- Umang Sagar

- Education, Recent article

Financial Education- A Necessity To Today’s Generation

Power Of Money - A Subject Not Taught In School

The Indian Education System (or maybe I should call it the English Education System) has always been an endless debate. From byhearting huge textbooks for months and months to the monotonous sessions of teaching, from prioritizing and bombarding unnecessary topics to avoiding important topics like time management, problem-solving, and decision making, the Indian education system has always proved to be a failure.

Now let’s get into the basic questions.

=> Why do we study?

We study to get employed with good pay.

But clearly, the Indian education system is not a bridge to employment.

The amusing part here is not even one person gets employment with the education they have. From today’s engineers and doctors to Chartered accountants and government officials, all of them are trained by coaching institutes for their jobs.

Does this mean that the education they have been getting for 20 years is of no use?

Here is an anecdote I would like to share. A friend of mine wanted to join civil services so he started his preparation by buying all the necessary books needed to crack the tests and interviews. Guess what? All of the books he bought were the 5th-10th history, economic, and civic books. This means that he did not learn anything from his 5th-10th.

Not just my friend but none of the students are learning anything in their prime age (12 years to 18 years).

It is pathetic that just 8 books are studied by the students for a whole year, 365 days, and they still fail to know any one of them. So what exactly did the Indian education system achieve?

If only the students had taken their education seriously. Or maybe the education system should have taught them things that were more important in life instead of making the students memorize the periodic table or some historic dates.

Here the point is not the elimination of the existing subjects. Math, Science, History, Grammar, all of these are important and every student should have a basic knowledge of all of them.

But the point here is the addition of some important subjects like crisis management, life skills, and so on.

One of the many topics that the Indian education system fails to teach the students is Financial literacy.

Irrespective of so much knowledge, why are we not able to make decisions and solve problems? Why are we caught up in the rat race of 9-5 jobs, savings, loans, repayment of credit, and pensions?

What we earn in 50 years, people like Kunal Shah, Riteish Agarwal, and Rakesh Jhunjhunwala are able to earn in just a short span of time.

What Is The Difference Between Them And Us?

Answer. Lack of early financial education.

They don’t spend hours on which atom has how many molecules or what war happened on 18 Dec 1649.

Our current educational system focuses on preparing today’s youth to get good jobs by developing scholastic skills. Their lives revolve around wages and salaries. Some will work further to become software engineers, doctors, managers, and chartered accountants. These professional skills allow them to enter the workforce and work for money. Either way, we are taught to work for money.

That itself is the first thing we should unlearn. We should never work for money, money should work for us.

What is missing from our education is not how to make money, but how to manage money.

The difference here is anyone can make money with the knowledge. But the management of money should be learned. It’s called financial aptitude- what you do with the money once you make it, how to keep people from taking it from you, how to keep it longer, and how to make that money work hard for you.

What Is Financial Literacy?

In simple words, financial literacy includes the skills and knowledge a person should possess in order to make smart financial choices.

It is the study of money.

It involves the understanding of money, control of money, and the working of money.

Everyone should learn how to use credit the right way and know the difference between good debt and bad debt.

Everyone should know the difference between asset and liability and buy assets.

An asset puts money in your pocket. A liability takes money out of your pocket.

Everyone should learn the difference between net worth and wealth.

Everyone should have a basic understanding of all the financial terms like balance sheet income statements, mutual funds, securities, market, stock exchange, assets, and liabilities.

Everyone should be updated with news related to the economy, business corporations, taxing, and stock prices because that’s how the economy is moving and our lives are dependent on that.

Why Financial Literacy?

Why do we need to be financially literate?

Think about it.

What is the primary aim of any human on this planet?

A pragmatic answer would be money and that is true.

Even if you want to do good for people by starting an NGO, or save lives by being a doctor or want to do anything which is characterized by “philanthropy”, your vehicle is not going to go ahead without petrol and you cannot sleep on an empty stomach.

Everyone has needs and wants and even luxuries.

Everyone needs money and everyone can earn money. But if you don’t learn to manage money then the money won’t stay with you for long.

A person should study medicine to become a doctor. A person should study engineering to become an engineer. A person should study time to manage it. In the same way, a person

should study money to earn, manage and control it.

Intelligence solves problems and produces money. Money without financial intelligence is money soon gone.

It’s not about how much money you make. It’s about how much money you keep.

Robert Kiyosaki wrote this in his book, Rich Dad Poor Dad, “A fool and his money is one big party.” It is true. A person with money and no knowledge of it is very easy to trap.

We are living in Kaliyugam. The age of time in which the mistake is of the person who has been trapped, not the person who is trapped.

Most people spend the best years of their life working for money, not understanding what it is they are working for.

Why are people like Riteish Agarwal, and Nikhil Kamath earning so much at a young age?

What is the difference between us and them?

Simple. They want to earn money. So they study money. They learned how to manage it.

The rich learn how to make money work for them. The poor and middle-class learn how to work for money.

Other Skills Learned From Financial Literacy

Financial Literacy teaches a lot of other skills too.

For instance, it teaches you how to be a risk-taker.

There is a lot of difference between a prepared student and an unprepared student in the examination hall. That is confidence. When you are completely aware of a subject, you gain confidence in the subject. That increases your willingness to take risks. Because you have done your homework and you know the probabilities of the result.

Investment is not risky for financially literate people. It also gives you an open mind and acceptance of new financial instruments.

Financial Literacy also helps you to increase your EQ, emotional quotient, or emotional intelligence. High emotions tend to lower financial intelligence. So in order to be a very educated person in the subject of finance you have to balance your emotions. Emotional intelligence and financial intelligence are inversely proportional.

It also teaches us about investment.

Now when we talk about making smart financial choices, it means the mindset needed to know whether an investment is worthy or not.

Most of us assume investment as an investment in materialistic things like assets, companies, cryptocurrency, stocks, and so on.

A person who is actually financially literate would also have a good understanding of the investment in immaterial things. An investment in education, investment in healthcare, investment in courses, investment in workshops, investment in the right institutions, investment in the right books to read, and so on. These are actually the real investments that are the solution for deep-routed attitude problems. These will give long-term returns in the future.

Students should be exposed to real-life scenarios in the business world.

They should have knowledge of where to spend. For instance, they are ready to spend 4000 on clubbing but think twice to spend 400 on a workshop that teaches you a skill that can change your life.

They should learn about financial crises and their causes as our lives and the economy depend on them.

Objectives Achieved

It helps you strategically plan your finances. Planning is where any successful financial investment begins. And by acquiring financial education, you have the knowledge and skills on how to save successfully, the type of investments to make, and the kind of assets you would like to acquire. With financial literacy, you will also know the due diligence steps to take before investing your capital in a new project, which might be risky. It prepares you for your future by having a plan. Those who learn and plan their finances properly can experience less worrying and gain confidence.

It helps you set realistic goals. As you gain financial knowledge, you will be more inclined to set goals for yourself. Setting financial goals decreases the stress and anxiety you will experience when you face your financial reality head-on. You will have the skills to come up with a detailed budget that will accommodate all your financial needs.

It gives you financial security. Financial security refers to the peace of mind we feel when we aren’t worried about money. It also means you are in control of your money.

It improves the quality of life. Enjoying a quality of life means being able to take care of your most basic needs as well as a few luxuries while still having something left over to save for the future and any emergencies. It’s very similar to sustainable development. Having a financial education allows you to live debt-free and stay clear of gambling and investment traps that will inherently drain your accounts.

It helps you avoid scams and financial frauds because now you are financially educated. You know the difference between good debt and bad debt. It teaches you credit management. You have knowledge that gives you the confidence to question any kind of financial scams or frauds. You are not naive anymore and you will know what you are walking into.

It gives you control. With financial education, you have the power over your personal finances instead of letting money control you. This empowers you and makes you feel more confident and decisive with your money.

It teaches you risk management. Now that you know the subject well you know how to calculate the risk ratio. You will have the confidence to take a risk and you are not blind in the game anymore. Financial education prepares you to be confident in the subject of risk management.

Assumptions On Financial Literacy

The ironic part here is most of us want to earn money but we don’t study for money. Instead, we study medical or engineering or interior design or data science or pursue any course which leads us to earn “rich” jobs.

That allows me to introduce to you all the first myths people have, “rich” jobs.

The first thing we all need to clear in our head is that there is nothing called a “rich” job.

No profession is rich or poor. A profession is just a paid occupation given to you according to your formal qualification and education.

Of course, we all have just judged a profession by the majority of high-paying jobs in that particular field. But those are called high-earning jobs and not high-paying jobs. They are paid well because the employees are doing well, not because the company is paying well.

Deloitte is just not going to pay 2 lakhs to an employee who lazes in the office from morning 9 am to evening 5 pm.

There are many engineers and data scientists who earn less and many artists and photographers who earn a lot.

Your dedication to your work decides your pay.

So a rich job is a myth. It all depends on your qualifications and performance.

You can choose to study whatever you want and earn a job in whatever field you like. But one qualification that everyone should possess is financial education. Be it an actor in Bollywood or a farmer in Haryana, be it a 9-5 software employee in Bangalore or a family business owner in Gujarat, we all should be financially literate in order to have the ability to make better financial decisions.

The second assumption we have, according to the studies of Rich Dad Poor Dad, is that we need to earn a high income to become rich.

That is definitely a myth. Especially in a world where technology, robots, and a global economy are changing the rules.

I would definitely agree with the other side of the argument too which says that there will definitely be new jobs as AI takes over the existing jobs. There will definitely also be some jobs that can never be replaced by AI. Well, that is a totally different debate that will never end.

So the primary focus here is that in the upcoming world, where Artificial Intelligence is going to replace human labor, it is tough to take employment as the only source of income. People whose primary source of money is their job are on a very risky path. Because once the jobs are gone they will have a hard time surviving and fulfilling their necessities and wants.

A person should always have many different sources of income. This means everybody needs to have an understanding of investment, credit, and financial management. This is taught in Financial Literacy. Being financially literate gives you financial security and financial smartness. Financial literacy is more than just making smart financial choices. It teaches you crisis management, decision making, and how to deal with and handle failure.

The future depends on financial literacy. Because employment, salaries, all these are unpredictable. A job is really a short-term solution to a long-term problem. A strong financial foundation is a solution for the long-term problem.

The Rat Race

What exactly is the rat race?

It is the vicious cycle of lifestyle creep.

Now let’s just get into the timeline of a normal human in India.

He/she studies until the 10th following the English education system.

Then thrown into some strict intermediate college for 2 years which destroys their creativity and makes the students completely focus on their entrance exams for a good rank and college.

Then comes college which is another story. For students, college is all about fun, and by the time they graduate they realize they need to get serious and start going to coaching institutes to get a mediocre job or probably do an MBA (the goldmine in your resume which leads you to a well-paying job in an MNC or some top company).

Once they get a job with mediocre pay they start aiming for promotions and rises and savings and end up in the rat race.

An employee with a safe secure job and without financial aptitude has no escape.

They are stuck between responsibilities and commitments and repayment of loans that they won’t even have time to learn about some new investment and put that learning into practice cause they don’t know and have the guts to take a financial decision and bet their savings on it.

You work for the company because you sit in the workplace for 9 hours and the profits are received by the CEO and your other top superiors.

You work for the government because before you even see your paycheck the government already taxed your income.

You work for the bank because you spend half of your life paying interest on your loans and repaying your credit.

So you are basically not even able to completely enjoy your hard-earned money for which you worked your ass off. If only you had knowledge about the working of corporations and taxing and banks because your money revolves around these 3 sectors and hence your life revolves around these 3 sectors.

Slowly they enter the middle class of the economy and this even affects their way of living, their spending and then this is passed on to the next generation.

All these point back to our roots.

We are forced to read science textbooks, math, graphs, chemistry, physics problems, etc.

But we are not forced to read financial literacy books like Rich Dad Poor Dad, The Psychology of Money, Think & Grow Rich, and so on. Some of us may not even have heard of these books. This epiphany happens at age 30 or maybe even late for most people like 40 or 50. And we won’t be able to dedicate time because we have responsibilities and commitments.

All such important things are to be taught in prime time, i.e. 19-30 (even earlier if possible)

Because the input that goes in this age is remembered lifelong and believed lifelong.

Conclusion

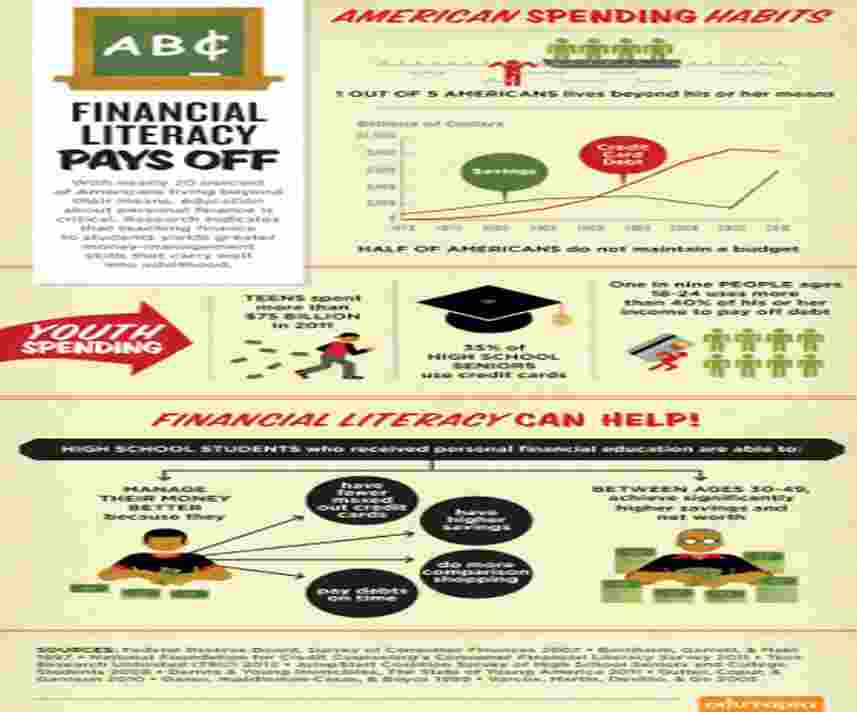

Financial literacy is low even in advanced economies with well-developed financial markets. On average, about one-third of the global population has familiarity with the basic concepts that underlie everyday financial decisions. The average hide gaping vulnerabilities of certain population subgroups and even lower knowledge of specific financial topics. Furthermore, there is evidence of a lack of confidence and this has implications for how people approach and make financial decisions.

The lack of financial literacy, even in some of the world’s most well-developed financial markets, is of acute concern and needs immediate attention.

An essential indicator of people’s ability to make financial decisions is their level of financial literacy. Financial literacy is not only the knowledge and understanding of financial concepts and risks but also the skills, motivation, and confidence to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life. Thus, financial literacy refers to both knowledge and financial behavior.

Financial literacy is like a global passport that allows individuals to make the most of the plethora of financial products available in the market and to make sound financial decisions. Financial literacy should be seen as a fundamental and universal need, rather than the privilege of the relatively few consumers who have special access to financial knowledge or financial advice. In today’s world, financial literacy should be considered as important as basic literacy, that is, the ability to read and write. Without it, individuals and societies cannot reach their full potential.

Top 13 Books One Should Read To Be Financially Educated

Top 13 Facts About Financial Education

The avoidance of money is just as psychotic as being attached to money.

Schools focus only on teaching people to work for money, not how to harness money’s power.

Money without financial intelligence is money soon gone.

According to the 2008 wave of the National Longitudinal Survey of Youth, only 27 percent of youth knew what inflation was and could do simple interest rate calculations.

India is home to almost one-fifth of the world’s population and has a literacy rate of nearly 80 percent. Unfortunately, only 24 percent of people in the country are financially literate

India is a status-driven society and not a wealth-driven society. – Kunal Shah

The participation of the common people in the Indian share market is below a satisfactory level. Less than 2.5% of the population of India invests in the market.

Have you ever wondered why a book is always best-selling and not best-written? – This tells the importance of the skill of selling.

Understanding how to read a company’s financial statements is a key skill for any investor wanting to make smart investment choices.

The joy that money brings is often short-lived.

Emotional Intelligence and Financial Intelligence are inversely proportional.

Corporations are the biggest secret of the rich.

In reality, the rich are never taxed. It is the middle class, especially the upper-middle class, who are being taxed.