Atal Pension Yojana

The Atal Pension Yojana (APY) was launched on 09.05.2015 to create a universal social security system for all Indians, especially the poor, underprivileged unorganized workers in the unorganized sector. APY is administered by Pension Fund Regulatory and Development Authority (PFRDA).

APY is open to all bank account holders in the age group of 18 to 40 years and the contributions differ, based on the pension amount chosen.

Subscribers would receive the guaranteed minimum monthly pension of Rs. 1000 or Rs. 2000 or Rs. 3000 or Rs. 4000 or Rs. 5000 at the age of 60 years.

The monthly pension would be available to the subscriber, and after him to his spouse and after their death, the pension corpus, as accumulated at age 60 of the subscriber, would be returned to the nominee of the subscriber.

In case of premature death of Subscriber (death before 60 years of age e), spouse of the contributing to APY account of the subscriber, for the remaining vesting period, till the original subscriber would have attained the age of 60 years.

The minimum pension would be guaranteed by the Government, i.e., if the accumulated corpus based on contributions earns a lower than estimated return on investment and is inadequate to provide the minimum guaranteed pension, the Central Government would fund such inadequacy. Alternatively, if the returns on investment are higher, the subscribers would get enhanced pensionary benefits.

Subscribers can make contributions quarterly/half-yearly/half-yearly basis.

Subscribers can voluntarily exit from APY subject to certain conditions, on deduction of Government co-contribution and return/interest thereon.

- Atal Pension Yojana is the guaranteed pension scheme of the Government of India administered by FRDA launched on May 9, 2015, to provide old-age income security, particularly to citizens in unorganized sectors. Subscribers get a fixed amount of pension every month under this scheme after they turn 60, depending on their contributions made in the past. APY is managed by the Pension Funds Regulatory Authority of India (PFRDA).

About The Department

The mandate of the Department of Financial Services covers the functioning of Banks, Financial Institutions, Insurance Companies, and the National Pension System. The Department is headed by the Secretary (FS) who is assisted by three Additional Secretary (AS), seven Joint Secretaries (JS), one Economic Advisers (EA), and a Deputy Director General (DDG).

The Department of Financial Services (DFS) oversees several key programs/initiatives and reforms of the Government concerning the Banking Sector, the Insurance Sector, and the Pension Sector in India.

The Major Functions Of The Department Are As Follows

Administration of Acts-Export-Import Bank (EXIM Bank) Act, 1981, National Bank for Financing Infrastructure and Development Act, 2021, National Housing Bank Act, 1987, Small Industries Development Bank of India Act, 1989, Scheme for Financing Viable Infrastructure Projects (SIFTI), State Financial Corporation Act, 1951.

Administrative matters related to Public Sector Banks (PSB), Public Sector Insurance Companies (PSIC), Public Financial Institutes (PFIs), Regulator and matters related to appointments of Whole-time directors (WTDs) and Government Nominee Directors in PFIs

Implementation of Scheme- Emergency Credit Line Guarantee Scheme (ECLGS) which was launched in May 2020 as part of Aatmanirbhar Bharat Abhiyaan to support eligible Micro, Small, and Medium Enterprises (MSMEs) and business enterprises in meeting their operational liabilities and restarting their businesses in the context of the disruption caused by the COVID-19 pandemic, Schemes for financing viable infrastructure Projects (SIFTI) of IIFCL.

International Banking Relation- In addition to these, work related to the Office of custodian. Initiatives and reforms relating to Financial Inclusion, Social Security, and Insurance as a Risk Transfer mechanism; credit flow to the key sectors of the economy including Micro, Small, and Medium Enterprises (MSME)/ farmers/ common man are some of the key focus areas being dealt by the Department. The key flagship schemes being currently run/managed by the Department include the Pradhan Mantri Jan Dhan Yojana (PMJDY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Mudra Yojana (PMMY), Atal Pension Yojana (APY), Pradhan Mantri Vaya Vandana Yojana (PMVVY) and the Stand-Up India Scheme. Apart from these, Emergency Credit Line Guarantee Scheme (ECLGS) is also being implemented by the Department.

The Department provides policy support to the Public Sector banks (PSBs), Public Sector Insurance Companies (PSICs), and Financial Institutions (FIs) the like National Bank for Agriculture and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI), National Housing Bank (NHB), Export-Import Bank of India (EXIM Bank), National Bank for Financing Infrastructure and Development, India Infrastructure Finance Company Ltd. (IIFCL), Industrial Finance Corporation of India (IFCI), National Credit Guarantee Trustee Company Ltd. (NCGTC), etc. It also monitors the performance of, these PSBs, PSICs and DFIs and undertakes policy formulation in respect of the Banking and Insurance Sector in India. This Department deals with legislative sues pertaining to the concerned regulatory bodies i.e., the Reserve Bank of India (RBI), the Insurance Regulatory and Development Authority of India (IRDAI), and the Pension Fund Regulatory and Development Authority (PFRDA). DFS also deals with the legislative framework relating to debt recovery.

Matters Relating To International Banking Relations Are Al With So Dealt By The Department

1. Vision:-

- To foster a well-regulated growth of the banking and insurance sector to serve all citizens by developing a financially inclusive, insured, and pensioned society.

2. Mission:-

The Department of Financial Services was created on 28th June 2007 by merging the erstwhile Banking and Insurance Divisions of the Department of Economic Affairs.

The Department of Financial Services (DFS) oversees several critical programs/initiatives and reforms of the Government concerning the Banking Sector, the Insurance Sector, and the Pension Sector in India. The key flagship schemes Brun/managed run/managed by the Department include the Pradhan Mantri Jan Dhan Yojana (PMJDY), Stand Up India, Pradhan Mantri Suraksha BimaYojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri EMMY Yojana (PMMY), Atal Pension Yojana (APY) and the pradhan Mantri Vaya Vandana Yojana (PMVVY). Department of Financial Services (DFS) is also implementing Emergency Credit Line Guarantee Scheme (ECLGS) under Aatma Nirbhar Bharat Abhiyan.

We Fulfill The Vision Through

Policy support to the Public Sector Banks (PSBs), Public Sector Insurance Companies and Financial Institutions (FIs) i.e National Bank for Agriculture and Rural Development (NABARD), Small Industries Development Bank of India (SIDBI), National Housing Bank (NHB), EXIM Bank, National Bank of Financing Infrastructure and Development (IIFCL), IFCI Ltd, National Credit Guarantee Trustee Company Ltd (NCGTC) and Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) through policy guidelines, legislative and other administrative changes.

Monitoring the performance of the PSBs, Public Sector Insurance Companies, and Public Sector Financial institutions.

Support to regulatory authorities i.e., Reserve Bank of India (RBI), Insurance Regulatory and Development Authority (IRDA), Pension Fund Regulatory and Development Authority (PFRDA), and NABARD.

National Mission of Financial Inclusion through PMJDY. Entities having Client interface:

- Public Sector Banks – 12

- Public Sector Insurance Companies – 6

- Public Sector Financial Institutions – 9

- Non-banking Financial Companies

- Regional Rural Banks

- DRATs/DRTs

- Regulators – 3

- NABARD

Services

1. Appointment Matters:-

Appointment of Chief Executives and Government nominee Directors / non-official Directors on the Boards of Public Sector Banks (PSBs), Public Sector InsurPICCsCompanies (PSICs), and Public Sectors Financial Institutions (FIs); Chief Vigilance Officers (, CVOs) in PSBs, PSICs, and PSFIs.

Chairpersons and Members of IRDAI & PFRDA, and Workmen employee directors in PSBs.

2. Administration of Acts:-

The Regional Rural Banks Act, 1976 and all Acts on Banks, PSFIs Acts on The National Bank for Agriculture and Rural Development Act, 1981, SIDBI Act, 1989, The National Housing Bank Act, 1987, The Export-Import Bank of India Act, 1981, National Bank for Financing Infrastructure and Development Act, 2021, The Industrial Finance Corporation (Transfer of Undertakings and Repeal) Act, 1993 and Insurance Companies.

Framing of rules and regulations in respect of service conditions of employees of Public Sector Financial Institutes, Public Sector insurance companies and Chairperson and Members of IRDAI.

The Wage settlement in the banking and insurance industry.

Framing of rules under IRDA Act 1999 and appointment of Chairperson and Members of IRDAI.

Credit Flow Monitoring and Coordination between industry, banks, financial institutions, Insurance c, companies, Regulators, and concerned line Ministries.

Administration of PFRDA Act, 2013.

Further ramming of rules under PFRDA Act, 2013 and processing appointments on the board of PFRDA; CVO in PFRDA.

Legislative and policy prescriptions to PFRDA.

Administration of DRATs/DRTs through Recovery of Debts Due to Banks and Financial Institutions (RDDBFI Act), 1993 and Securitisation & Reconstruction of Financial Assets & Enforcement of Security Interest (SARFAESI)Act, 2002.

Schemes Implementation.

Monitoring Performance: of Public Sector Banks, Public Sector Insurance Companies, Public Sector Financial Institutes.

Grievances Mechanism

To further strengthen the grievance redressal mechanism in Public Sector Banks Insurance Companies, and Financial Institutes this Department has been using extensively the CPGRAMS portal (Centralised Public Grievances Redressal and Monitoring System) developed by the Department of Administrative Reforms and Public Grievances.

The system facilitates the citionline to lodge their grievances online directly on the website.

The grievances received from individuals on theisGRAM portal of DARPG, DOPT is transmitted online to the Public Sector Banks, Public Sector Insurance Companies, Public Sector Financial Institutes concerned, RBI, PFRDA, IRDAI, Banking Ombudsman offices, Insurance, e Ombudsman offices, DRTs/DRATs, etc.

For Necessary Action Responses to the grievances can also be submitted by agencies online.

The system helps the complainant to monitor the status of the complaints online and generate action-taken reports.

The progress of Grievances Redressal is monitored regularly at different levels.

Right To Information Act 2005

- In the department of Financial Services, Centre Public Information Officers (CPIO) and Appellate Authorities have been nominated to deal with applications received under RTI Act. Information is provided to the applicants within the prescribed time limit. The applicants, who are not satisfied with the information provided, or have not gotten the information in time, can prefer an appeal before the Appellate Authorities w the prescribed time schedule. The names and other requisite details regarding the CPIOs and Appellate Authorities are posted on the website of the Department and updated as and when changes are made.

Conclusion

- Atal Pension Yojana is a good investment option provided by the government for the working people of the unorganized sector of India. This scheme was launched to provide financial protection to the people working in the unorganized sector of India.

Top 13 Interesting Facts About Atal Pension Yojana

The Atal Pension Yojana can be subscribed to by all citizens between the ages of 18 to 40 and they can avail the pension amount after they attain the age of 60.

The scheme is backed by the Pension Fund Regulatory and Development Authority (PFRDA) and subscription is being offered by banks within the country.

People can get a fixed pension ranging from Rs. 1000 to a maximum of Rs. 5000/month by investing through this scheme.

Any Citizen of India can join the APY scheme.

The following are the eligibility criteria: – (i) The age of the subscriber should be between 18 – 40 years. (ii) He / She should have a savings bank account/ post office savings bank account.

ICICI Bank is registered with PFRDA to provide APY-related services.

APY? irrespective of his/her employment status with Govt./Public Sector, for availing benefits guaranteed by the Government of India under the scheme.

APY refers to the amount of money or interest, you earn on a bank account over one year.

Upon the subscriber’s death, his or her spouse is entitled to the same pension as the subscriber.

The department will inform subscribers about PRAN activation, account balances, contribution credits, and other topics that will be communicated to APY subscribers via SMS alerts.

A subscriber can open only one APY account and it is unique. Multiple accounts are not permitted.

The age of the subscriber should be between 18 – 40 years.

He / She should have a savings bank account/ post office savings bank account.

Frequently Asked Questions (FAQs)

A Pension provides people with a monthly income when they are no longer earning.

Need for Pension:

- Decreased income earning potential with age.

- The rise of nuclear family-Migration of earning members.

- Rise in cost of living.

- Increased longevity.

- Assured monthly income ensures dignified life in old age.

Atal Pension Yojana (APY), a pension scheme for citizens of India, is focused on organized sector workers. Under ta the APY, a guaranteed minimum pension of Rs.1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given at the age of 60 years depending on the contributions by the subscribers.

- Any Citizen of India can join the APY scheme. The following are the eligibility criteria: –

- The age of the subscriber should be between 18 – 40 years.

- He / She should have a savings bank account/ post office savings bank account.

The prospective applicant may provide Aadhaar and mobile number to the bank during registration to facilitate receipt of periodic update ates on the APY account. However, Aadhaar is not mandatory for enrolment.

The co-contribution of the Government of India is available for 5 years, i.e., from the Financial Year 2015-16 to 2019-20 for the subscribers, who join the scheme during the period from st June 2015 to 31s March 2016 and who are not covered by any Statutory Social Security Scheme and are not income taxpayers. The Governor-contribution button is payable to eligible Permanent Retirement Account Number (PRANs) by the Pension Regulatory and Development Authority (PFRDA) after receiving the confirmation from Central Record Keeping Agency to the effect that the subscriber has paid all the installments for the year Government co-contribution will be credited in subscriber’s savings bank account/ post office savings bank account 50% of the total contribution subject to a maximum of Rs 1000/- at the end of the financial year.

- The beneficiaries, who are covered under statutory social security schemes, are not eligible to receive Government co-contribution under APY. For example, members of the Social Security Schemes under the following enactments would not be eligible to receive Government co-contribution under APY:-

- Employees’ Provident Fund and Miscellaneous Provision Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948.

- Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

- Seamans’ Provident Fund Act, 1966.

- Jammu Kashmir Employees’ Provident Fund and Miscellaneous Provision Act,1961.

- Any other statutory social security scheme.

A Minimum guaranteed monthly pension of Rs 1,000/- or 2,000/- or 3,000/- or 4,000 or 5,000/- per month will be given from the age of 60 years onwards depending on the contributions by the subscribers.

The benefit of minimum pension under Atal Pension Yojana would be guaranteed by the Government in the sense that the actual realized returns on the pension contributions are less than the assumed returns for minimum guaranteed pension throughout the contribution. Such shortfall shall be funded by the Government. On the other hand, if the actual returns on the pension contributions are higher than the assumed returns for a minimum guaranteed pension, such excess shall be credited to the subscriber’s account, resulting in enhanced scheme benefits to the subscribers. The Government would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber, who joins the scheme during the period 1st June 2015 to 31s March 2016 and is not a beneficiary of any social security scheme and is not an income taxpayer. The government co-contribution will be given for 5 years from the Financial Year 2015-16 to 2019-20. At present, a subscriber under the National Pension System (NPS) is eligible to get tax benefits for the contribution, up to a ceiling, and even for the investment returns on such contributions. Further, the purchase price of the annuity on exit from NPS is also not taxed and only the pension income of the subscribers is part of normal income and taxed at the appropriate marginal rate of tax, applicable to the subscriber. It is proposed that similar tax treatment may be given to the subscribers of APY. However, presently, a similar tax dispensation, on par with that available under NPS, is yet to be accorded to subscribers under APY.

The contributions under APY are invested as per the investment guidelines prescribed by PFRDA for the Central Government / State Government / NPS-Lite / Swavalamban Scheme / APY.

Approach the bank branch/post office where the individual’s savings bank account is held or open a savings account if the subscriber doesn’t have one.

Provide the Bank A/c number/ Post office savings bank account number and with the help of the Bank staff, fill up the APY registration form.

Provide Aadhaar / Mobile Number. This is not mandatory but may be provided to facilitate communication regarding contribution.

Ensure keeping the required balance in the savings bank account/ post office savings bank account for the transfer monthly/quarter Lyerly / half yearly contribution.

It is not mandatory to provide an Aadhaar number to open an APY account. It is however desirable to provide an Aadhaar Number for proper identification of the subscriber.

The savings bank account/ post office savings bank account is mandatory for joining APY.

The contributions can be made at monthly/quarterly/half-yearly intervals through the auto debit facility in the savings bank account/ post office savings bank account of the subscriber.

The monthly/quarterly/half-yearly contribution depends upon the pension and the age of shuttered subscribers. The details may be referred to in Annex I.

The contribution may be paid to APY through a savings bank account/ post office savings bank account on any date of the month, in case of monthly contributions or any day of the first month of the quarter, in case of quarterly contributions, or any day of the first month of the half year, in case of half-yearly contributions.

The subscribers should keep the required balance in their savings bank accounts/ post office savings bank account on the stipulated due dates to avoid any overdue interest for delayed contributions. The monthly/quarterly/half-yearly contribution may be deposited on the first date of the month after a half year in the savings bank account/post office savings bank account. However there Indian quate balance in the savings bank account/ post office savings bank account of the subscriber till the last date of the month / last date of the first month in a quarter / last day of the first month in a half year, it will be treated as a default and contribution will have to be paid in the subsequent month along with overdue interest for delayed contributions. Banks are required to collect Rs. 1 per month for the contribution of every Rs. 100, or part thereof, for each delayed money contribution.

Overdue interest for delayed contribution for quarterly/half yearly mode of contribution shall be recovered accordingly. The overdue interest amount collected will remain as part of the pension corpus of the subscriber.

More than one monthly/quarterly/half-yearly contribution can be recovered subject to the availability of the funds. In all cases, the contribution is to be recovered along with the overdue charges if any. This will be e bank’s internal process. The due amount will be recovered as and when funds are available in the account.

The deduction would be made in the subscriber’s account for account maintenance charges and other related charges periodically. Once the account balance in the subscriber’s account becomes zero due to deductive account maintenance charges, fees, d overdue interest, the account would be closed immediately. For those subscribers, who have availed of Government co-contribution, the account would be treated as becoming zero when the subscriber corpus minus the Government-contribution would be equal to the account maintenance charges, fees, and overdue internet and hence the net corpus becomes zero. In this case, the Government contribution would be given back to the Government.

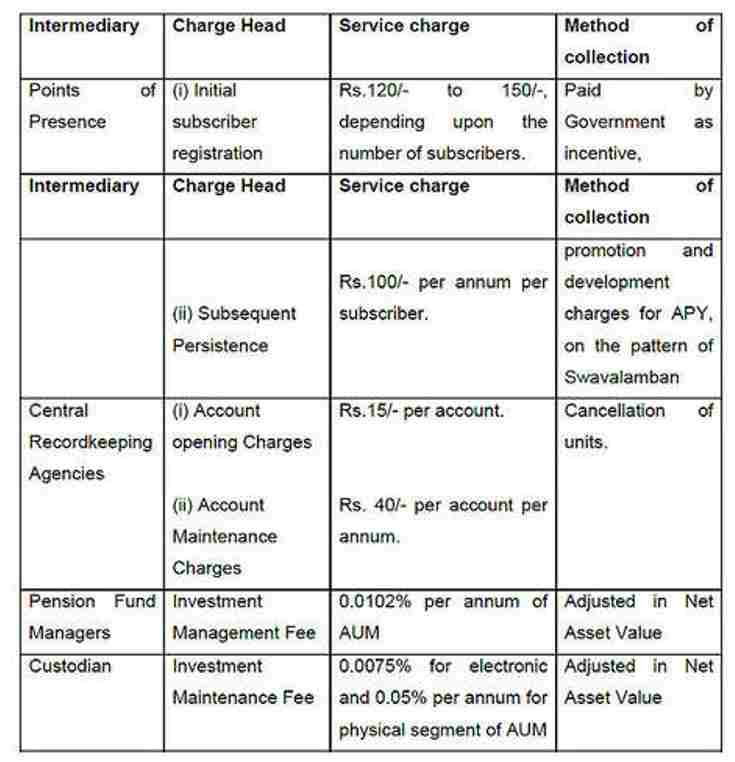

Table of all charges of APY

Yes. It is mandatory to provide nominee details in the APY account. If the subscriber is married, the spouse will be the default nominee. Unmarried subscribers can nominate any other persona as a nominee & they have to provide spouse details after marriage. The Aadhaar details of spouses and nominees may be provided.

A subscriber can open only one APY account and it is unique. Multiple accounts are not permitted.

The subscribers can opt to decrease or increase the pension amount during the accumulation phase, once a year. However, the switching option shall be available once a year during April.

1. On attaining the age of 60 years:

Upon completion of 60 years, the subscribers will submit the request to the associated bank for drawing the guaranteed minimum monthly pension or higher monthly pension, if investment returns are higher than the guaranteed returns embedded in APY. The same amount of monthly pension is payable to the spouse (default nominee) upon death the subsite nominee will be eligible for return of pension wealth accumulated till age 60 of the subs cribber upon the death of both the subscriber and spouse.

2. In case of death of the subscriber due to any cause after the age of 60 years:

In case of death of the subscriber, a pension would be available to the spouse and on the death of both (subscriber and spouse), the pension wealth accumulated till age 60 of the subscriber would be returned to the nominee.

3. Exit before the age of 60 Years:

Exit before 60 years of age is generally not permitted, it may be permitted by PFRDA only in exceptional circumstances, i.e., in the event of the death of a beneficiary or terminal disease, etc in line with the provisions for pre-mature exit under NPS.

In case a subscriber, who has availed off ed Government co-contribution under APY, chooses to voluntarily exit APY at a future date, he shall only be refunded the contributions made by him to APY, along with the net actual accrued income earned on his contributions (after deducting the account maintenance charges). The Government co-contribution, and the accrued income earned on the Government co-contribution, shall not be returned to such subscribers.

4. Death of the subscriber before 60 years:

The entire accumulated corpus under APY will be returned to the spouse/nominee.

However, the pension shall not be payable to the spouse/nominee.

The periodical information to the subscribers regarding activation of PRAN, balance in the account, contribution credits, etc. will be intimated to APY subscribers by way of SMS alerts. The subscriber will also be receiving a physical Statement of Account once a year.

The physical statement of the APY account will be provided to the subscribers annually.

The contributions may be remitted through auto debit uninterruptedly even in case of a change of residence/location.

The scheme is open to Indian citizens only. Hence, in that event, the APY account will be closed and the contribution will be returned to the subscriber as mentioned above in the case of voluntary exit before the age of 60 years.

1. Subscriber between the age group of 18 and 40:-

The subscriber would be automatically migrated to APY with an option to opt-out. The associated aggregator will facilitate those subscribers for completing the process of migration. The subscribers may also approach the nearest authorized bank branch/post office for shifting their Swavalamban account into APY with PRAN details.

The benefit of co-contribution of the Government of India for those subscribers of the Swavalamban Scheme who have migrated to APY would not exceed 5 years under both the Schemes. For example, if a Swavalamban beneficiary has received the benefit of Government co-contribution for 1 year, then the Government co-contribution to that subscriber under APY, after migration from the Swavalamban Scheme, would be available only for 4 years, and so on.

The existing Swavalamban beneficiary opting out of the proposed automatic migration to APY will be given Government co-contribution up to 2016-17, if he is eligible, and the NPS Swavalamban would continue till such people attain the age of exit under that scheme.

The accumulated corpus of existing Swavalamban subscribers between the age group of 18 and 40 years, who get migrated to APY will be kept under the same PRAN and remain as an additional wealth of the subscriber till the time of exit. This additional amount may be given to the subscriber as an enhanced pension benefit or as a lump-sum withdrawal. The contribution of such subscribers under APY, after migration from the Swavalamban Scheme to APY, would be as per the amount mentioned in Annex –I, depending on the pension amount selected and the age of the subscriber.

2. Subscriber above 40 years of age:-

The subscribers under the Swavalamban Scheme, who are beyond the age of 40 and who do not wish to continue under the Scheme, may opt-out by complete withdrawal of the entire amount in a lump sum or may prefer to continue till the age of 60 years, to be eligible for annuities there under.

Yes, the subscriber can change the mode (monthly/ quarterly/half yearly) of the auto-debit facility once a year during April.

No, a person who is in the age group of 18 years to 39 years 364 days can join Atal Pension Yojana.