- Umang Sagar

- Economy, Recent article

Mutual Funds

What Is Mutual Fund?

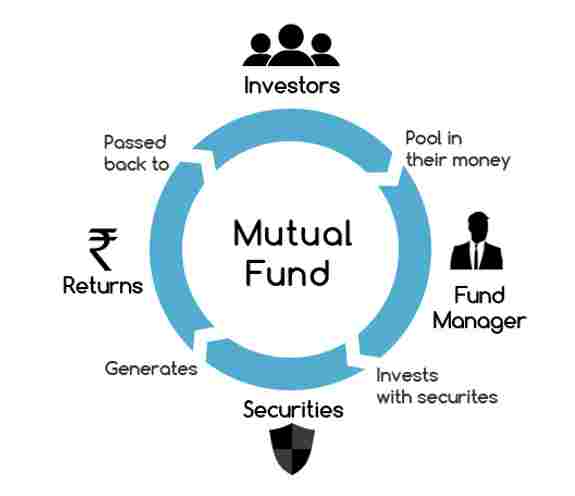

A mutual fund is an investment avenue that pools finance from various investors to invest it into financial securities like stocks, bonds, money market instruments, or other assets. Mutual funds are coordinated by portfolio managers, who allocate the funds in order to attain appreciation on the value of the invested funds of the investors. The investors are holding shares that represent a part of the total funds invested in the portfolio. The portfolio of a mutual fund is in accordance with the financial goals and objectives as per the prospectus.

Mutual funds in India are regulated by the Securities Exchange Board of India. The Securities and Exchange Board of India (Mutual Funds) Regulations, 1996 defines a mutual fund as a fund established in the form of a trust to raise money through the sale of units to the public or a section of the public under one or more schemes for investing in securities, including money market instruments. According to the above definition, a mutual fund in India can raise resources through the sale of units to the public. It can be set up in the form of a Trust under the Indian Trust Act.

Mutual Fund - An Overview

A mutual fund is equivalent to portfolio management services (PMS). Even though both are conceptually the same, they are quite completely different from one another other. Portfolio management services are rendered to high-net-worth individuals; taking into consideration their risk profile, their investments are managed separately. In the case of mutual funds, savings of small investors are pooled under a scheme, and the returns earned are dispersed in the same proportion in which the investments are made by the investors/unitholders.

Mutual funds are best for investors who do not have large sums for investment, or for those who do not end up having the inclination or the time to research the market for the best investment avenues and yet want to grow their wealth. The money pooled in mutual funds is invested by professional fund managers in line with the objective stated in the scheme. In exchange, the fund house charges a small fee that is directly deducted from the investment. The fees that are charged by the mutual funds are regulated and are subject to certain limits stated by the Securities and Exchange Board of India (SEBI).

Types Of Mutual Funds

1. Functional Classification:-

- Open-ended Schemes:

In the case of open-ended schemes, the mutual fund offers ongoing sell and repurchase of its units at net asset value (NAV) or NAV-related prices. There is no fixed or specific redemption period in open-ended schemes, which can be terminated whenever the need arises. The fund offers a redemption price which is the exit price that is different from time to time at which the holder can sell units to the fund and take an exit. Besides, an investor can enter the fund again by buying units from the fund at its offer price which is different from time to time. Thus, such funds announce sales and repurchase prices from time to time.

Liquidity is the key feature of open-ended funds. Open-ended schemes usually come as a family of schemes that enable the investors to switch over from one scheme to another of the same family when they deem fit.

- Close-ended Schemes:

- Close-ended schemes have a fixed corpus and a stated maturity period ranging between 2 to 5 years. Investors can invest in the scheme when it is introduced. The scheme remains open for subscription for a period not exceeding 45 days. Investors in close-ended schemes can buy units only from the market, once initial subscriptions are completed and thereafter the units are listed on the stock exchanges where they can be bought and sold. The fund has no interactivity with investors till redemption except for paying dividends/bonuses. The close-ended scheme can be converted into an open-ended scheme too.

- Interval Scheme:

- An interval scheme is a combination of the features of open-ended and close-ended schemes. They are open for sale or redemption during predetermined intervals at NAV and related prices.

2. Portfolio Classification:-

- Income Funds:-

- The main objective of income funds is to provide investors with the safety of investments and regular income. Such schemes invest largely in income-bearing instruments like bonds, debentures, government securities, and commercial paper. The return, as well as the risk, are low in income funds as compared to growth funds.

- Growth Funds:-

- The aim of growth funds is capital appreciation over the medium-to-long- term. They invest most of the funds in equity shares with remarkable growth potential and they offer higher returns to investors in the long term. There is no guarantee or assurance of the returns. These types of schemes are usually closed-ended and listed on stock exchanges.

- Balanced Funds:-

- The objective of a balanced scheme is to provide both capital appreciation and regular income. They proportionate their investment between equity shares and fixed income bearing instruments in such a proportion that, the portfolio is balanced. The portfolio of balanced funds usually comprises companies with good profit and dividend track records. Their exposure to risk is moderate and they offer a decent rate of return.

- Money Market Mutual Funds:-

- The money market mutual fund specializes in investing in short-term money market instruments like treasury bills, and certificates of deposits. The main aim of such funds is high liquidity with a low rate of return.

3. Geographical Classification:-

- Domestic Funds:-

- Funds that incorporate resources from a particular geographical locality like a country or region are domestic funds. The market is limited and confined to the boundaries of a particular nation in which the fund operates. They can invest only in the securities or stocks which are issued and traded in the domestic financial markets.

- Offshore Funds:-

- Offshore funds invite foreign capital for investment in the country of the issuing company. They facilitate cross-border fund flow that results in an increase in foreign currency and foreign exchange reserves. They open the domestic capital market for international investors.

4. Other

- Sectoral:-

- The objective of these funds is to invest in specific core sectors like energy, telecommunications, IT, construction, transportation, and financial services.

- Tax saving schemes:-

- Tax-saving schemes are structured based on tax policy with special tax incentives to investors. Mutual funds have introduced many tax-saving schemes. These schemes are close-ended schemes and investments are made for ten years, although investors can avail of encashment facilities after completion of 3 years.

- Equity-linked savings scheme (ELSS):-

- In order to motivate investors to invest in the equity market. Investment in these schemes enables the investor to claim an income tax rebate. These schemes carry a lock-in period before the end of which funds cannot be withdrawn and thus are blocked for the time period.

- Special schemes:-

- Mutual funds have introduced special schemes to cater to the special requirements of investors. Special schemes introduced by UTI are the Children’s Gift Growth Fund, 1986, Housing Unit Scheme, 1992, and Venture Capital Funds.

- Gilt funds:-

- Mutual funds that deal solely in gilts are called gilt funds. With a view to creating a vast investor base for government securities, the Reserve Bank of India encouraged and recommended the setting up of gilt funds. Reserve Bank provides liquidity support to these funds.

- Index funds:-

- An index fund is a mutual fund that invests in securities of companies in the index on which it is based BSE Sensex or S&P CNX Nifty. An index fund adopts a passive investment strategy as no effort is made by the fund manager for identifying stocks for investment/disinvestment. The fund manager must simply track the index on which it is based. The portfolio will require an adjustment in case there is a revision in the underlying index. In simple words, the fund manager is required to buy stocks that are added to the index and sell stocks that are deleted from the index.

- P|E ratio fund:-

- P|E ratio fund is another mutual fund variant that is offered by Pioneer IT! Mutual Fund. The P|E (Price-Earnings) ratio is the ratio of the price of the stock of a company to its earnings per share (EPS). The P|E ratio fund invests in equities and debt securities wherein the distribution of the investment is determined by the ongoing price-earnings multiple of the market. The main aim of this scheme is to provide superior risk-adjusted returns through a balanced portfolio of equity and debt instruments.

- Exchange-traded funds:-

- Exchange-Traded Funds (ETFs) are a combination of open-ended mutual funds and listed individual stocks. These are listed on stock exchanges and are traded like individual stocks on the stock exchange. ETFs do not sell their shares directly to investors for cash but are offered to investors over the stock exchange. ETFs are primarily passively managed funds that track a particular index such as S&P CNX Nifty.

Valuation Of Mutual Fund

The value of the mutual fund company is solely dependent on the performance of the securities it has invested in. So, when an individual buys a unit or share of a mutual fund, he or she is buying the performance of its portfolio or, more particularly, a part of the value of the portfolio. Investing in a share of a mutual fund is quite different from investing in shares of stock.

The net asset value (NAV) of a fund is the market value of the assets less the liabilities on the day of valuation. In simple words, it is the amount that the shareholders will receive collectively if the fund is dissolved or liquidated. The net asset value of a unit is the net asset value of the fund divided by the number of outstanding units.

NAV of a fund is affected by four sets of factors:

- Purchase and sale of investment securities

- Valuation of all investment securities held

- Other assets and liabilities

- Units sold or redeemed.

Regulators Of Mutual Fund

Mutual funds are mainly regulated by the Securities and Exchange Board of India (SEBI).

A mutual fund should have the approval of RBI in order to provide a guaranteed returns scheme.

The Ministry of Finance acts as a supervisor of RBI and SEBI and appellate authority under SEBI regulations.

The Association of Mutual Funds in India (AMFI) has been made to develop this Mutual Fund Industry of India on professional and ethical lines and to enhance.

Charges With Respect To The Mutual Fund

- Entry Load:-

Entry load is the fee imposed on investors when they invest in a mutual fund scheme for the first

time. This fee covers the distribution costs incurred by the asset management company for promoting an MF scheme.

Before the year 2009, this fee was levied differently by each fund house in India. However, as per the current SEBI regulations, fund houses cannot charge an entry load from their investors.

- Exit Load:-

When an investor takes an exit from a mutual fund scheme within a specific period from the date of purchase, an exit load is levied on the individual. AMCs charge an exit load on investors to discourage them from opting out of a mutual fund scheme before maturity. Moreover, this fee allows fund houses to minimize the volume of withdrawals.

Usually, fund houses charge an exit load of around 1% on redemption value. It is common for the fund houses to impose an exit load if an investor redeems the units within a year. Whereas there is no exit load charge post one year of investment in the same scheme.

- Transaction Charges:-

This charge is imposed on an investor only once during his/her investment. A transaction fee of

Rs. 100 to Rs. 150 may be charged for investments worth Rs. 10,000 and above. Likewise, this

fee is also charged on SIP investments worth over Rs. 10,000. Thus, investments worth less than Rs. 10,000 do not involve a transaction fee.

Advantages Of Investment In Mutual Funds

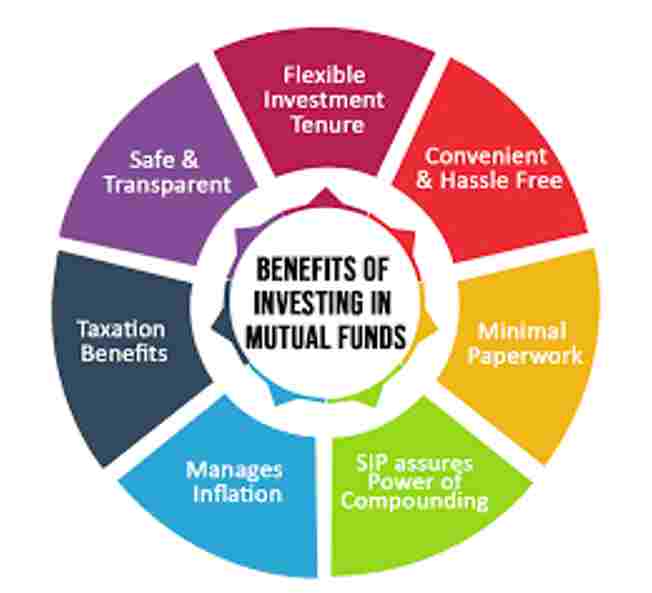

- Professional management:

- An average investor is having poor knowledge with respect to capital market operations and does not have large resources to obtain the benefits of investment. Hence, he prefers to take help from an expert. It is costly to hire the services of an expert, but it is even more difficult to identify a real expert. Mutual funds are managed by professional managers who have the required skills and experience to analyze the performance and prospects of companies. They make possible an organized investment strategy, which is hardly possible for an individual investor to even think about.

- Portfolio diversification:

- An investor undertakes high risk if he invests all his funds in a single stock i.e., in one basket. Mutual funds invest in several companies across various industries and sectors i.e., not in one basket. This diversification reduces the level of risk of the investments as it is distributed among various companies.

- Reduction in transaction costs:

- Compared to direct investment in the capital market, investment through the Mutual Funds is comparatively less expensive as the benefit of economies of scale is passed on to the investors.

- Liquidity:

- It is seen that investors cannot sell the securities held easily, whereas, in the case of mutual funds, they can easily encash their investment by selling their units to the fund case it is an open-ended scheme or by selling them on a stock exchange in case it is a close-ended scheme.

- Convenience:

- Investing in a mutual fund is quite convenient as it reduces paperwork, saves time, and makes investment easy.

- Flexibility:

- Mutual funds offer a family of schemes, i.e., a variety of schemes and investors have the option of transferring their holdings from one scheme to the other.

- Tax benefits:

- Mutual fund investors can enjoy income-tax benefits. Dividends that are received from mutual funds’ debt schemes are exempted from taxes to the overall limit of Rs 9,000 allowed under section 80L of the Income Tax Act.

- Transparency:

- Mutual funds transparently announce their portfolio every month. Thus, an investor knows where his/her money is being deployed and in case they are not satisfied with the portfolio they can withdraw at a short notice.

- Stability in the stock market:

- Mutual funds have many funds that provide them economies of scale by which they can absorb any losses in the stock market and continue investing in the stock market. Other than that, mutual funds increase liquidity in the money and capital market.

- Equity research:

- Mutual funds can afford research of information and data required for investments as they have many funds and equity research teams available with them.

- Protection from inflation:

- Mutual funds have diversified portfolios and hence even in case of losses, an investor would earn enough returns that cover inflation and capital gains over a period.

Disadvantages Of Investment In Mutual Funds

- Unavailability of choice of stock:-

- An investor doesn’t have a choice of stock selection in a portfolio as the choice is available in portfolio management services. Various schemes are available for selection with different risk and return rates.

- Exit load:-

- Exit load must be borne by the investors. This is a reduction in the returns in case of low returns bearing funds and sometimes an increment in the loss in case of loss-making fund for an investor.

Top 13 Companies Of Mutual Fund

- SBI Mutual Fund

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- Reliance Mutual Fund

- Aditya Birla Sun Life Mutual Fund

- DSP BlackRock Mutual Fund

- Franklin Templeton Mutual Fund

- Kotak Mutual Fund

- IDFC Mutual Fund

- Tata Mutual Fund

- Invesco Mutual Fund

- Sundaram Mutual Fund

- L&T Mutual Fund

Top 13 Interesting Facts About Mutual Funds

- Professional management

- Portfolio diversification

- Reduction in transaction costs

- Liquidity

- Convenience

- Flexibility

- Tax benefits

- Transparency

- Stability to the stock market

- Equity research

- Protection from inflation

- Unavailability of choice of stock

- Exit load