Introduction

- Unified Payments Interface is an instant real-time payment system developed by the National Payments Corporation of India facilitating inter-bank peer-to-peer and person-to-merchant transactions.

How It Works?

- UPI has made the money transfer process a lot easier. You do not have to remember the receiver’s account details. you can do the money transfer only by knowing their Aadhaar number, mobile phone number registered with the bank account, or UPI ID.

You can set up a UPI ID on one of the apps that support UPI service.

The ID can be set up by providing the details of your bank account on the app.

The app will send an OTP to your registered mobile number to make sure that you are an authorized person. Once you enter the OTP, you will be prompted to create a PIN for the UPI ID.

After completing registration, you can choose any mobile number from your contacts and send money. You can also request money from anyone on your contacts list.

Development

Unified Payment Interface (UPI) was developed by the National Payments Corporation of India (NPCI) which was established by the Reserve Bank of India (RBI) and the Indian Banks Association (IBA).

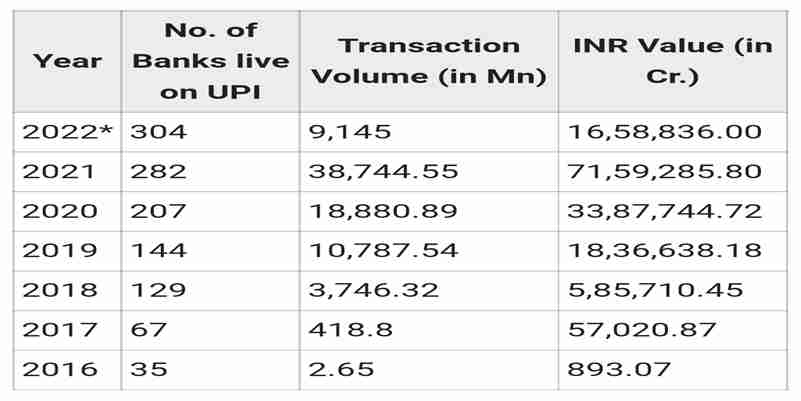

NPCI conducted a pilot launch with 21 member banks. The pilot launch was on 11th April 2016 by Dr. Raghuram G Rajan, Former Governor. Banks have started to upload their UPI-enabled Apps on the Google Play store from 25th August 2016 onwards.

What Makes UPI Different?

- With UPI, you can transfer funds without adding a beneficiary. Even if the recipient is not active on the UPI platform, you can make the fund transfer instantly using only their account number and IFSC code.

Market

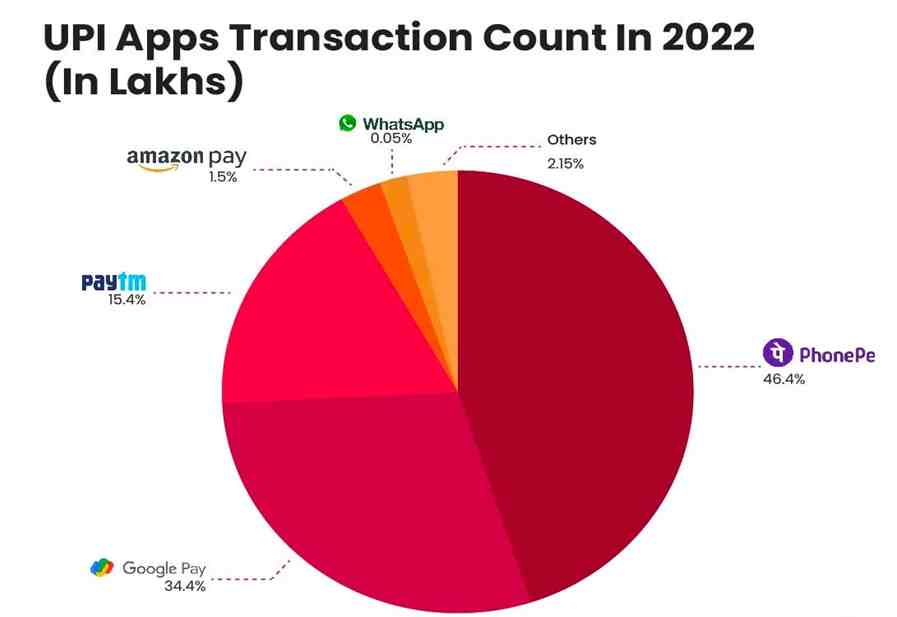

- PhonePe and Google Pay had the highest UPI app market share of about 43 percent as of the first half of the financial year 2022.

- According to the NPCI portal, the largest share of $2 trillion of annual digital payments in India comes from UPI.

History

By March 2011, RBI found out that in India only six non-cash transactions happen every year per individual citizen while 10 million retailers accept card-based payments. Around 145 million families have no access to any form of banking. There is also the problem to tackle black money and corruption that happens mostly in cash.

RBI in 2012 released a vision statement for a period of four years that indicated commitment toward building a safe, efficient, accessible, inclusive, interoperable, and authorized payment and settlement system in India. It is part of the Green Initiative to decrease the usage of paper in the domestic payments market. UPI was officially launched in 2016 for public use.

UPI works on four pillar push-pull interoperable model where there will be a remitter/beneficiary front-end PSP (payment service provider) and remitter/beneficiary back-end bank that settles the monetary transaction for the users. As per the CEO of Net magic Solutions, UPI became one of the most successful deep-tech innovations coming out of India.

With the exponential growth of UPI, India became the world’s largest real-time payment market with 25.50 billion (25.5 billion) annual transactions in 2020 as per data from ACI Worldwide and Global Data leaving behind China and United States.

From January 1, 2019, UPI became a popular payment option for Initial public offerings (IPOs). The transaction limit was enhanced from ₹100,000 to ₹200,000 in March 2020. From December 2021, RBI again increased the limit to ₹500,000 for Retail Direct Scheme and IPO applications. To make UPI economically feasible for payment companies, RBI is considering merchant discount rates (MDR) on future UPI transactions. RBI in its first monetary policy for the financial year 2022-23 proposed a cardless cash withdrawal facility from ATMs using a UPI-based QR code.

Can UPI Be Hacked?

- However, in some cases, a hacker might get access to your UPI account and transfer money illegally from your bank account. If you take the necessary precautions, you’ll be able to protect your UPI account from being hacked. Do not disclose your UPI credentials to anyone. Before making transactions with a second party, make sure the merchant or seller is safe and authentic. Secure your smartphone by installing antivirus or malware, which will ensure your phone from being hacked. Make sure you keep changing your password on your phone over regular intervals.

UPI - Advantages

One of the major advantages of UPI is that it is fast, hassle-free, and the cheapest way of money transfer.

UPI is also very fast and a safe medium, while you only need a UPI ID for carrying out a transaction.

It is easy to use as it only requires a single click authentication that involves only two factors.

You also have an option of scanning with a QR code to make online and offline purchases.

While making payments on UPI, the user does not have to pay any charges as it is free by the Government.

UPI - Disadvantages

Sometimes, there can be delays in payments, it takes up to 48 hours for the money to get back to your bank account.

The UPI money transfer limit is currently Rs 100,000, which you can send to anyone through the mobile app.

The UPI pin only consists of four to six digits, which should be elongated for more security.

Another major disadvantage of UPI is that it is very slow in making payments sometimes, but that can be avoided by using faster internet services.

Is UPI Safe?

- UPI payments are absolutely safe. UPI payments are regulated by the Reserve Bank of India & NPCI and mobile payment applications like Paytm follow all the guidelines as laid down by these regulators.

The Third-party Apps Using UPI Is Reliable Or Not?

And the third-party apps using the UPI feature are reliable BUT I’d like to advise you that stay away from duplicate/fake apps. A lot of fake money transfer apps even fake banking apps are also circulating around the web Don’t download apps from any website, Use the Play store always.

And most importantly Don’t go for the apps which are not popular. Trust only dominating apps such as Paytm, Phone pe, and some others like these.

Service

1. Mobile Apps

- Any UPI app can use payment and transfer funds from and to UPI-enabled banks. Apart from various third-party apps such as Google Pay (previously Tez), PhonePe, Paytm, MobiKwik, Amazon Pay, Samsung Pay, and WhatsApp Pay, NPCI manages its own app called BHIM.

2. On-Device Wallet

- Since 50% of UPI transactions are below ₹200 creates a large backlog of volume which increases the failure rate and affects the stability of the entire payment network. To save electricity consumption and computing power of banks, UPI mobile apps will have to support on-device wallet features as per the RBI directive from December 2021. The in-built wallet will help in low-value instant payment by using the infrastructure of the mobile app developer, thus decreasing the load on banks through the decentralization of back-end infrastructure and resources.

3. Supported Banks

- The website of the National Payments Corporation of India (NPCI) lists the banks that facilitate UPI. Banks here are termed as Payment Service Providers (PSP) – listed with their UPI application and handle – and issuers. PSP includes those banks which have their own mobile application to facilitate transactions and issuers include banks that don’t have their payments interface and rely on third-party software for transactions using UPI.

4. e-RUPI

e-RUPI or e-RUPI (portmanteau of electronic Rupee and UPI) was developed in collaboration with the Department of Financial Services, Ministry of Health and Family Welfare, and National Health Authority.

e-RUPI is basically an e-voucher based on a QR code or SMS string that can be delivered through a mobile phone. e-RUPI will act as a precursor for future Central bank digital currency (CBDC) that will be launched by RBI as it will help in highlighting the gaps within the national digital payment infrastructure.

The government of Karnataka partnered with NPCI to provide student scholarships through e-RUPI which can even be received on feature phones.

UPI - Charges

- Yes, the UPI is free of charge at present but there is no in-principal decision to keep it so forever. The UPI is free because of its simple and low-cost design. The NPCI has made UPI bring mobile payments to the masses. It makes UPI a preferred mode of payment even for a small sum. The NPCI would try to keep the cost very low and have indicated that they would keep the range of UPI charges from 0 to 50 paisa per transaction. These are the proposed UPI charges for your reference!

Apps With UPI Feature In India

1. PhonePe

2. Paytm

3. BHIM app

4. MobiKwik

5. Google pay

6. Uber

7. Chillr

8. Paytm Payments Bank

9. SBI Pay

10. iMobile

11. Axis Pay

12. Bank of Baroda (BOB) UPI

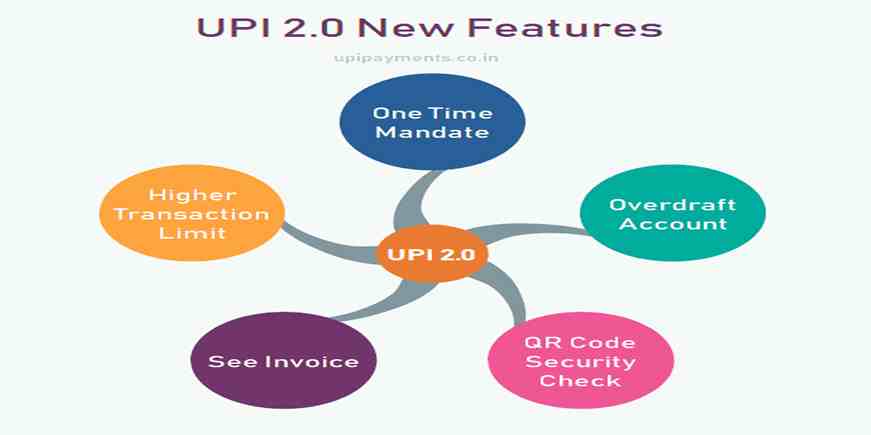

UPI 2.0 & It's Upcoming Features

With this feature, you can pre-authorize (Mandate) a transaction, for debit from your bank account later. UPI mandate is to be used in scenarios where money is to be transferred later, however, the commitment towards that is to be done now.

UPI 2.0 is the second version of the fund transfer platform. It supersedes the former version which was structured mainly to facilitate peer-to-peer transactions with a platform that also accommodates merchant payments.

Key Features Of UPI 2.0

. Linking of overdraft account: In addition to current and savings accounts, customers can link their overdraft account to UPI. Customers will be able to transact instantly and all benefits associated with an overdraft account shall be made available to the users. UPI 2.0 will serve as an additional digital channel to access the overdraft account.

One-time mandate: UPI mandate could be used in a scenario where money is to be transferred later by providing commitment at present. UPI 2.0 mandates are created with one-time block functionality for transactions. Customers can pre-authorize a transaction and pay at a later date. It works seamlessly for merchants as well as for individual users. Mandates can be created and executed instantly. On the date of actual purchase, the amount will be deducted and received by the merchant/individual user.

Invoice in the inbox: According to NPCI, this feature is designed for customers to check the invoice sent by the merchant prior to making payment. It will help customers to view and verify the credentials and check whether it has come from the right merchant or not. Customers can pay after verifying the amount and other important details mentioned in the invoice.

Signed intent and QR: This feature is designed for customers to check the authenticity of merchants while scanning QR or a quick response codes. It notifies the user with information to ascertain whether the merchant is a verified UPI merchant or not. This provides additional security.

Top 13 Interesting Facts Of UPI

UPI is a payment system that allows money to be transferred between any two bank accounts using a smartphone.

Users need to create a Virtual Payment Address and link it to a bank account, which then acts as their financial address.

Sending money using the UPI app is as easy as sending a message since users don’t need to remember the beneficiary’s account details or their own net banking ID and password.

The service is instant and available round the clock, even on public and bank holidays.

Currently, the per transaction cap is Rs 1,00,000. But this may change from time to time, as it is subject to the UPI guidelines.

You need not carry even a single rupee.

The transaction through UPI is a minimum of 1 rupee and maximum bounds of 20,000 per day. And forever 10,000 single transactions there’s a cap.

One does not need to share, store, or remember any sensitive information related to the account

With the UPI app, you need not carry cash. Even use of ATMs is not required to leave aside getting cheques encashed. Simply use the QR code scan to make online and offline purchases

You can easily link all your accounts to this one ID on the UPI app

The largest share of $2 trillion of annual digital payments in India comes from UPI.

It requires only the UPI ID for carrying out a transaction.

UPI works on Immediate Payment Service; available 24×7. The current cap of transactions on this app is ₹ 1,00,000 subject to terms and conditions. This is under revision currently and soon the cap might be increased. Also, many of the banks have their internal caps also.