What Is Corporate Fraud?

- The term corporate fraud means mishappening or misconduct in any organisation. Mishappening or misconduct in the organisation can be done in various forms like embezzlement of cash, vendor fraud, fraud by employees and window dressing of accounts. In simple terms, window dressing of accounts is over/ understating of profit or under/overstating of expenses and reporting of fictitious assets or fictitious liabilities which may not even exist in the reality. Financials of an organisation can be window dressed either to present a rosy picture to attract more investors or sometimes they purposely depict loss to avoid paying government dues, dividends or any other obligations. Corporate Fraud or White Collar Crime, as it is often referred as, not only affects that particular organisation but has its far reaching effects on the sector in which that organisation operates and sometimes even on the economy at large. Following chart represents the top Scams in India along with its total revenue loss.

Sr. No. | Scam | Revenue Loss (Rs. in Crores) |

1 | Coalgate – This is a political scam highlighting the malpractices adopted b the then Government of India in allocation of coal deposits to the public and private companies | 1.86 lakh |

2 | 2G spectrum- Government officials were accused of favouring some of the telecom companies in allocation of 2G spectrum licenses for their own benefits. | 1.76 lakh |

3 | Commonwealth Games – The amount allotted for the Commonwealth Games was not utilised in the proper manner and affected country’s reputation internationally on the grounds of misappropriation of funds. | 70 thousand |

4 | Satyam – India’s biggest accounting fraud and classic example of window dressing of books of accounts. | 14 thousand |

5 | Nirav Modi PNB Bank- Punjab National Bank issued fake letter of undertakings to the tune of Rs. Ten thousand Crores | 11.4 thousand |

Satyam Fraud Case was one of its kind accounting fraud which in turn led to the introduction of more stringent rules and regulations in the various acts enacted to prevent such frauds.

Let’s understand how this fraud was committed and how was it disclosed.

Inception Of The Satyam

- Satyam Computer Services Limited primarily engaged in outsourcing of IT and a business process service was incorporated on 24th June, 1987 in Hyderabad. The idea of this company was conceived by Mr. Ramalingam Raju, the Chairman, and his brother Mr. Rama Raju, Chief executive Officer and managing Director of the company. The company which started its operations with 20 employees soon was the fourth largest exporter of IT software employing over 50,000 plus employees and with more than 150 Fortune 500 companies as their clients. Satyam got listed on the Bombay Stock Exchange in the year 1991 and was also listed on New York Stock Exchange. The company was operating in sixty six countries in five continents. In a short span of five years, i.e. from the year 2003 to 2008, the company’s Compounded Annual Growth Rate was 40% and with 300% increase in the stock price. SATYAM became a success model which every business aspired to follow and Mr. Ramalingam Raju an inspiration to every business owner.

Background Of Mr. Ramalingam Raju

- Mr. Raju was born in a family of farmers on 16th September 1954 in Bhimavaram village of Andhra Pradesh. He completed his graduation in commerce in the year 1975 from Andhra Loyola College in Andhra Pradesh and also had an MBA degree from Ohio University, the USA to his credit. He was never technically trained nor had any formal education in the field of IT, the empire in which he built and flourished. Mr. Raju’s father Mr. Satyanarayana was an inspiration for him to start Satyam Computer Services Limited.

How Did The Fraud Occur?

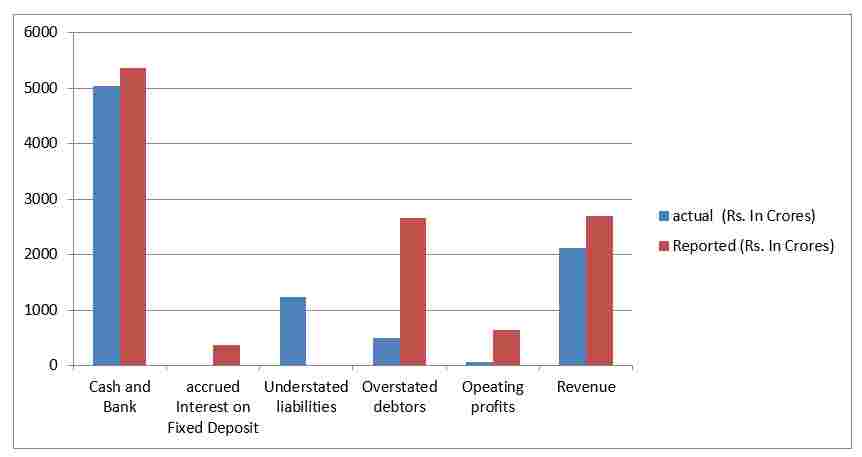

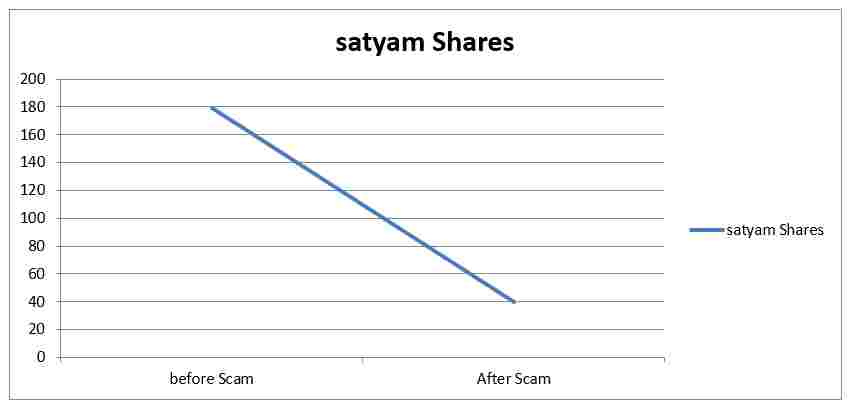

- Satyam started overstating its profit every quarter by creating fake invoices and reporting fake customer identities to generate revenue. Salaries where paid to dummy employees who never existed and once this money was deposited in the bank it was then siphoned off in the personal accounts of Mr. Raju and his family members. Mr. Raju generated falsified bank statements from his personal computers to show the bank balances which were not there in reality. Internal audit system of the company was not in place and Mr. V S Prabhakar Gupta, the then, Global Head of Internal Audit Committee accommodated all the loopholes in the system by falsifying the accounts. Even, the external auditors of the company Pwc who were its auditor for nine years were not able to detect the malpractices happening in the company. It is also believed that, Pwc had deliberately turned a blind eye and was party to these fraudulent practices as the firm was paid audit fees three times more than what was prevalent in the market at that time. The auditing firm also did not take any efforts to verify the bank balances independently with the banks and totally relied on the fake bank statements generated. The other major point was that the huge reserves of cash were lying idle and not invested in any income generating source which is very illogical for any prudent and rational man. No attention was paid on ban imposed by World Bank on Satyam Computers on account of failure to maintain proper documentation of sub contractors. The graphical representation will help us better understand as to what extent where the accounts falsified and misreported:

Now the question that arises is what did Mr. Raju do with this siphoned-off money?

Mr. Raju used this siphoned-off money to acquire a controlling interest in the Maytas Infrastructure and Maytas Properties which were also founded by him and this firms dealt in the acquisition of land properties in Hyderabad. Mr. Raju, it is rumored, had the idea of an upcoming metro project and wanted to cash in on this opportunity.

Disclosure Of Fraud To The World

- On 7th January 2009, Mr. Raju wrote a letter to his Board of Directors, wherein he confessed to having siphoned off the funds. In his letter, he wrote that what started as a marginal gap between the actual revenue and reported revenue in the books grew with time and came to a point where they became unmanageable. At this time, it became necessary to introduce fictitious assets in the books of accounts to justify the increase. He stated that “It was like riding a tiger, not knowing how to get off without being eaten”. Every attempt was made to revive the company and bring it back to its position but all in vain.

What triggered Mr. Raju to confess the crime?

- In December 2008, Mr. Raju announced his plans to acquire of Maytas Infra and Maytas Properties wherein he and his family members had a vested interest. This decision was not received well by the foreign as well as domestic investors in addition to it what irked them more was the fact that it was a hush–hush decision and no prior approval of any of the Board members was sought. In order to save the reputation of the company in the foreign and domestic market, the decision of acquiring was taken back and the buyback of shares of Satyam Computer Services Ltd was announced, but the damage was already being done. After a few days, World Bank alleged Satyam for not maintaining proper documentation of the contracts carried on by them and also bribing its staff members for inappropriate benefits. This led to the imposition of a ban for 8 years on Satyam and was not asked to deal with any of the World Bank’s references. In the meanwhile, whistleblowers also had been activated and rumors of something might be amiss in the company started doing rounds. Mr. Raju came out in open with the hope that the government would take stock of the situation and help the company to revive and survive the market turmoil. Such was the impact of this fraud that Satyam shares crashed to Rs. 40 which was earlier trading at Rs. 179 also BSE’s Sensex plunged over 7 percent.

Reformatory Measures Undertaken

After the shocking disclosure of fraud by Mr. Raju to the world, Board wanted to sell off the company at the earliest. Different regulating government bodies came forward to analyse the situation and do corrective measures. Merrill Lynch was appointed to do the due diligence. New Board of members were appointed and many experts from various fields were involved to give suggestions and create a path to take hold of the situation. Some of the stalwarts that helped Satyam include T N Manoharan, Deepak Parekh, Kiran Karnik and C Achutan. It was decided to sell of the company through auction and bids were placed in order to buy the company by many players in the IT sector. Tech Mahindra, subsidiary of Mahindra Group placed the highest bid and acquired Satyam at almost one third of its value.

Punishment

Mr. Ramalingam Raju was accused on the charges of manipulating books of accounts, creating false invoices, generation of fake bank account statements and also siphoning off money from the accounts to his own personal accounts. During the search and survey operations conducted by CBI, 425 properties were attached by it, which is in addition to 444 properties that were earlier attached by the Enforcement Directorate in the money laundering case.

Mr. Raju along with his two brothers was awarded to seven years of rigorous imprisonment by CBI. They were also directed to pay Rs. Five Crores each and other eight accused involved in the fraud had to pay Rs. Twenty Five Lakhs each. SEBI imposed a two year ban on the accounting firm Pwc and it was not allowed to involve in engaging any of the auditing services to listed companies. Institute of Chartered Accountants of India cancelled the membership of six independent auditors who were involved in this fraud.

Current Status Of The Company And Its Personnel

- Mr. Ramalingam Raju is still involved in the business though he is away from the limelight. He advises the younger generation on the tricks and gives them hindsight on the way business should be conducted. According to some sources, it is believed that Mr. Raju’s family is one of the richest families in Hyderabad. His son and daughter-in-law run successful businesses in the agriculture and healthcare sector. After the acquisition of Satyam Computer Services Limited by Tech Mahindra, the company was rebranded and named Mahindra Satyam. This acquisition led to the formation of the fifth largest software services company. In the financial year of 2013, the newly formed company had reported a turnover of US $2.7 billion and also declared a dividend of 30% to its shareholders.

Documentaries

In the year 2009, winner of the Prem Bhatia Award, Kingshuk Nag has authored a book titled “The Double Life of Ramalinga Raju” which gives insight into the rise and fall of Mr. Raju.

As per the news article featured in India Today on 11th February 2021, National award-winning Director Nagesh Kukunoor is all set to direct a bilingual (Hindu- Telugu) web series on Sony LIV based on the book “The Double Life of Ramalinga Raju” written by Kingshuk Nag.

Netflix also had documented Satyam Fraud in its web series “Bad Boy Billionaires: India”. Currently, Mr. Raju had moved to Supreme Court to stop the telecast of this web series alleging that it will cause reputation loss to him and his consent was not taken to make the documentary.

“The Resurgence of Satyam” written by Zafar Anjum gives a thrilling narrative of how the company was revived and made into a profitable venture by Tech Mahindra Group. The book starts with an engaging quote by Mirza Faizan one of Satyam’s employees “when one man creates Satyam as an organization of 53,000 people, why can’t 53,000 committed people rebuild one Satyam?”

Changes Brought In The Regulations After Satyam Fraud

1. Companies Act:-

- Earlier Companies Act, 1956 has been repealed and the Companies Act, 2013 was implemented. As per the provisions of the new act, corporate fraud is termed a criminal offence. The act clearly states and distinguishes the responsibility of disclosure of fraud lies in the hands of auditors, cost accountants, and company secretaries. Also, a new provision of rotation of auditors was introduced, wherein the auditors after a period of five years and audit firm after a period of ten years need to be changed. It also provides that Director’s Responsibility Statement should form part of the Board of Directors’ Report.

2. SEBI:-

- SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR”) was framed in the year 2015, wherein guidelines on reporting of actual and suspected frauds and also disclosure of material events occurring that affect the decision-making capacity of the investors are provided.

3. ICAI- The Institute of Chartered Accountants of India:-

- The accounting body emphasized on the detailed reporting of fictitious assets and contingent liabilities in the audit report by the auditors.

4. Serious Fraud Investigation Office (SFIO):-

- The Companies Act, 2013 accorded the status of a statutory body to this regulatory authority formed under the control of the Ministry of Corporate Affairs. It investigates corporate and accounting frauds in India.

- Best practices of Corporate Governance became the need of an hour.

Top 13 Interesting Facts About The Satyam Scam

Satyam had received The Golden Peacock award for Corporate Accountability in 2008 some five months before the scam was disclosed.

In the same year 2008, Mr. Ramlinga Raju was bestowed with the Young Entrepreneur Award by Ernst and Young.

SATYAM when read in reverse is MAYTAS, the real estate firm that Mr. Raju intended to acquire.

World Bank had banned Satyam from doing business with its contacts for a period of 8 years.

Pwc, the external audit firm was banned from providing audit and assurance services to listed companies for over a period of two years.

After Infosys, TATA, and Wipro, Satyam was the fourth largest exporter of IT and business software.

The first Fortune 500 client of Satyam Computers was John Deere in 1991.

Sify (Satyam Infoway) was the first entrant in the Internet service provider market in 1999.

The early failed business ventures of Mr. Raju were Dhanunjaya Hotels and Sri Satyam Spinning.

Ramalingam Raju got married to Nandini at the early age of twenty-two years.

CallHealth, a supermarket of healthcare services is being promoted by Sandhya Raju, daughter-in-law of Mr. Ramalingam Raju.

T N Manoharan and Mr. C Achutan, former presiding officers of the Securities and Appellate Tribunal, were on the board of Mahindra Satyam the newly formed company.

Satyam is termed as Enron Scandal of Indian History. Enron was the biggest accounting and corporate fraud in the US which led to the downfall of Wall Street.

For deep details, you can read the full article. & Editorial Click the link below :