- While many out there stand critical of the Crypto world due to its unhealthy position for our climate, some even calling it a stupid course to tread on, the very latest craze for the NFT in the crypto land is ever thriving and picking up more and more steam as years are passing. Despite all the fault-finding and brickbats, NFT’s popularity boomed insane in the year 2021.

Introduction

In the year 2014, when a man named Kevin McCoy first minted his non-fungible token

“Quantum”, the crypto art category of NFT started surfacing everywhere. This first-ever artwork associated with NFT- type certificate of ownership was recently sold at Sotheby’s sale on a whopping amount of $1.47 million. The first NFT duo, Kevin McCoy and an Indian coder Anil dash felt the serious need of creating a unique platform to value and protect the real ownerships and authenticity of the artworks which were highly messed up on platforms like Tumblr, back then. They were bugged by the frequent instances of plagiarism and absence of attribution to the artworks. Hence together they prepared the first version of a blockchain-backed means of asserting ownership over an authentic digital work and went on naming it ironically as ‘Monetized graphics’.

‘Monetized graphics’ system which was mocked by the audience during its live demonstration at the New Museum in New York City, took the market by storm with a new version in itself, which came to be known as the NFT. NFT went on sweeping new records on its name and soon acquired the hot seat in the crypto market. Although the term ‘NFT’ gained currency only in the year 2017 with the introduction of CryptoPunks and later CryptoKitties in the market.

The NFT, which goes as Non-Fungible Token, is a one-of-a-kind’ cryptographic digital asset which represents real-world unique objects like in-game items, music, art, videos. Such digital contents are linked to the ‘blockchain’, which is a virtual database underpinning cryptocurrencies like Ethereum and Bitcoin. NFT is nonfungible in nature unlike the cryptocurrency, which can easily be replaced or exchanged with some other identical object of similar value. NFTs on the other hand, can’t be exchanged or replaced with their identical fellas. Each NFT has its own unique identification code and Metadata that differentiates one from another.

Since the origin of NFTs brought the crypto art category first in the scene, it was widely considered that all NFTs are necessarily in the form of artworks. Though this assumption is straight ignorance, as NFTs can exist to fulfill more other functions like –

A platform to provide people access to a digital, trackable, and traceable option.

They’re trusted as being promising collectibles, due to their ease of verification and authentication.

NFTs can be kept as coupons inside a single digital wallet.

They can also be used as memberships to attend some special events, win access to limited edition products and services.

As NFTs are going almost everywhere, they have now accessed virtual accessories. As we’ve already witnessed some of the top brands, such as Nike, D&G entering the NFT land, offering the collectors’ chances to own some of the very first released virtual goods in the market.

History And Changing Trends In NFT Before 2021

With the introduction of crypto art first, NFT initially welcomed ‘arts’ as, CryptoPunks, Rare Pepe, and CryptoKitties. As these came into the mainstream, NFT had a significant transition in its market standing and emerged as a new mania among crypto lovers. NFT’s wave blew minds as it hit the market and people were ready to pay crazy amounts of money for those digitized pieces of art.

Although the first NFT was minted in 2014 by Kevin McCoy, the very idea of NFT entered the scene in the year 2012 with the issuance of “colored coin” on the Bitcoin blockchain in the same year. Colored coins are basically tokens that represent the real-world assets on the blockchain ranging from, equities, bonds, and cars to precious metals, real estate. The time period of the emergence of colored coins is generally said to be, years 2012-13.

1. 2014 – Counterparty

Followed by the Colored Coins, a trio of Robert Dermody, Adam Krellenstein, and Evan Wagner founded Counterparty: a peer-to-peer financial platform and distributed, an open-source protocol built on top of the Bitcoin blockchain.

Essentially Counterparty is a protocol that enables anyone to issue tokens and set up contracts without permissions that pay dividends to holders. Counterparty has a fair launch but it has no blockchain of its own, and all of its transactions sit on the Bitcoin blockchain and pay transaction fees to the Bitcoin miners.

2. 2015 –‘Spells of Genesis' Team Joining The Counterparty

- The ‘Spells of Genesis‘ game creators partnered up with Counterparty in April 2015. The creators aided the Counterparty by funding its development by rolling their own in-game currency called, Bitcrystals. They were also among the first to launch an Initial Coin Offering (ICO).

3. August, 2016 – More Other Trading Cards On Counterparty

- In the year 2016, Counterparty ganged up with a famous trading card game, called ‘Force of Will’, to launch their cards on its platform. The ‘Force of will’ bagged the 4th rank in North America according to sales volume. It was only behind Pokemon, Yu-Gi-Oh, and Magic: the gathering. Their introduction at such a space where they didn’t have any blockchain or cryptocurrency experience highlighted the importance of delivering such assets on a blockchain.

4. October, 2016 –Introduction Of ‘Rare Pepes' On Counterparty

Soon after memes debuted on blockchain in 2016, they started to head on to the Counterparty platform. People were amazed and curious about this new trend and started to pour assets into a particular meme called, ‘Rare Pepes’.

Rare Pepes, which debuted as a comic frog character, acquired a crazy fan base over the years. It soon established itself as one of the most popular memes yet and took the meme world by storm. By early 2017, with Ethereum gaining unprecedented attention, Rare Pepes started to be traded there too.

5. 2017 – Entrance Of CryptoPunks

The work CryptoPunks was referenced to an experiment of Bitcoin in the 1990s and can be described as a hybrid of, ERC721 and ERC20. The creators of Larva labs created unique characters in the form of CryptoPunks on the blockchain. ERC20, the most common Ethereum Token Standard has rules that allow tokens to interact with each other.

The CryptoKitties NFTs came on the scene using ERC721. They are basically blockchain-based virtual games that provide players to adopt, breed, and trade virtual cats using Ethereum. Later

CryptoKitties gained much shine and granted features on popular news channels such as CNBC and Fox News.

6. 2018-2021 – The NFT Bang

The year 2018 stood as a treasure year for the NFTs as, those witnessed unprecedented growth in the same year, moving on further with increasing popularity towards next years. NFTs had their peak moment in early 2021 when they stood highest among all their fellas in crypto land. In the same year, NFTs swiftly migrated to mainstream art. This drastic transition touched the 7th sky on

Valentine’s Day in 2018, when artist Kevin Abosch ganged up with GIFTO for a charitable auction.

Their partnership led to a $1M transaction of an amazing piece of CryptoArt called, ‘The Forever Rose’.

Differences Between NFTs, Cryptocurrency And Digital Currency

The NFT being non-fungible in nature is not mutually interchangeable. Every NFT has a different setting, face to it which sets it apart from the fungible tokens as, Cryptocurrency and other digital currencies which can be exchanged with their other similar pals with zero loss of values.

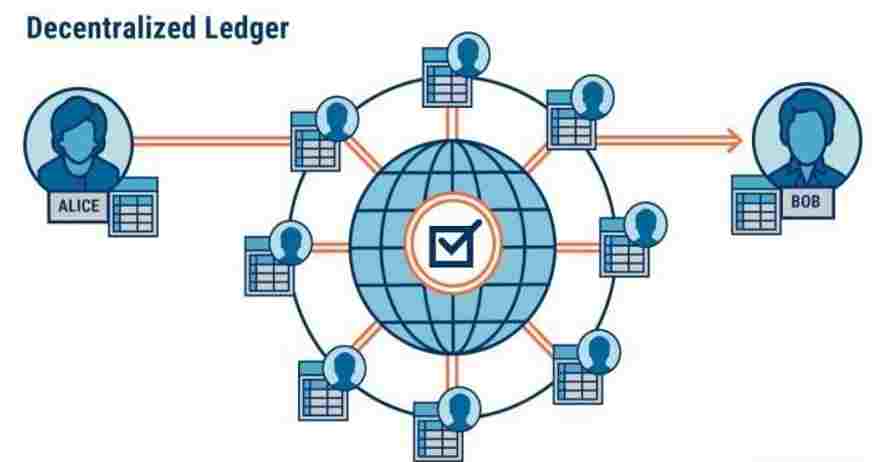

NFTs are similar to Cryptocurrencies on the feature of decentralization. They both are regulated by their own community people. On the other hand, Digital currencies are centralized; they’re handled by a certain group of people and computers that regulate the state of transactions in the network.

NFTs and Cryptocurrencies stand transparent as all of the transaction-related data of all the users is available on the public blockchain network. Whereas, digital currencies aren’t transparent as, under this, no one can have access to the information of each money transfer on the portal, as all of that information is highly confidential here.

NFTs are traded in collaboration with auction houses or in NFT marketplaces. Such as Super Rare, Rarible, Known Origin, Arkane Market, OpenSea, etc. Examples of popular Cryptocurrencies are – Bitcoin, Ethereum, Litecoin, and Tether.

Types of Digital currencies systems are – Central bank-backed digital currency system, Price stabilized Cryptocurrencies, Eg. Stablecoins and Non-stabilized Cryptocurrencies, Eg. Bitcoin.

The Central Bank-backed digital currency system (CBDC) currency is electronic cash. Similar to cryptocurrency such as Bitcoin, a CBDC is data-based and non-existent in the real world. The CBDCs are backed by governments, which makes them more likely to be recognized as money that people can use to do their purchases of goods and services.

Ethereum Blockchain As A Plinth To The NFT

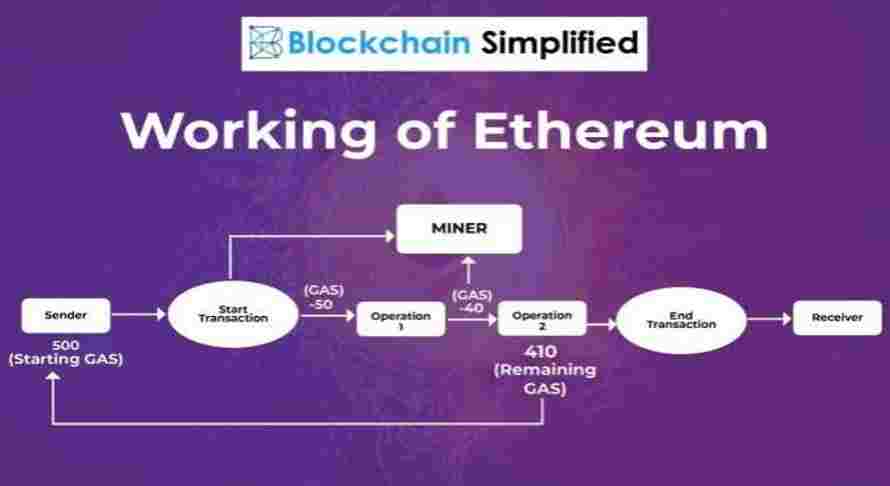

As the NFTs debuted in 2014 through Kevin McCoy, they found a decent base on Ethereum blockchain which started in the same year and later went live in the year 2015. Ethereum blockchain is widely considered as a plinth to the NFT as it has a good history of not only starting off with functioning on Ethereum but also being carried along further on the same blockchain and gaining much attention and crowd towards it due to that.

Ethereum is a decentralized, open-source blockchain with smart contract features attracting much of the NFT crowd towards it. It has a record of keeping 2nd rank among the largest blockchain networks. As it serves a wide range of use cases other than just acting as a platform for cryptocurrency transactions, it automatically grabs a lot of interest and passion of the investors. Apart from performing well in the crypto market, Ethereum is constantly evolving, proving to be the constant solution to blockchain projects.

The most common standard for NFTs on the Ethereum is, ERC-721. It serves as an interface that allows auction applications, brokers, wallets to work with any NFTs on the Ethereum blockchain. Other prominent standards are, ERC-20 for fungible tokens and ERC-1155 for semi-fungible tokens. On Ethereum, tokens are smart contracts that are written in ‘Solidity’. NFT developers can customize the smart contracts that allow the owners of the tokens to establish a proper interaction with the contract in varied ways.

Here are some of the earliest NFTs that made their way on the Ethereum blockchain:-

1. Terra Nullius:-

It is the first-ever NFT introduced on an Ethereum blockchain with a mint date of, August 7, 2015.

2. Etheria v1.1 (Blockplots):-

This was the first NFT on Ethereum with a transfer function. This transfer feature was a significant move towards the NFTs which is rocking the Crypto market these days.

=> A few others are,

- Ethereum Name Service

- Curio Cards

- CryptoPunks (Original contract)

- CryptoPunks

- MoonCatRescue

- CryptoCats

- CryptoKitties

- Ethermon

- EtherRock

Top Most NFTs Sold Yet

- As the immense craze of NFTs kicked years 2020 and 2021, digital assets worth millions of dollars earned a great appeal among collectors, investors and NFTs saw a craziest trend of people investing religiously and setting records through their investments. In recent times, we’ve seen quite a number of celebrities and influencers joining the crazy race on the NFT route and making hefty amounts of money, adding more appeal to the NFTs among the common masses.

Here Are Some Of The Top Most Expensive NFTs Yet

1. Pak’s ‘The Merge’– $91.8m

It officially became the most expensive NFT ever sold in the year 2021, with approximately 30,000 collectors pitching together for a whopping sum of $91.8m. This NFT had multiple owners unlike many other NFTs out there.

2. Every Days: The First 5000 days - $69.3m

- This was the next in Beeple’s project, also the most expensive NFT ever sold to a single owner. Beeple’s this piece is essentially a collage of 5000 pieces of his work. He initiated putting together an art each and every day and assembled all of them, giving life to his ‘Everyday: the First 5000 days.

3. Beeple’s Human One – $28.985m

- Beeple’s assets being one of the most sold assets anytime, stay regular in the toppers list. The ‘HUMAN ONE’ which was sold in the year 2021, for a whopping fee of around $30m, was closely attached to his previous piece naming, ‘Everyday – the First 5000 days.

4. CryptoPunk #7523 - $11.75m

#7523 stands as the 3rd rarest CryptoPunk among all its fellow punks.

5. CryptoPunk #7804 - $7.6m

- This one is one of just nine ‘Alien’ CryptoPunks with a cool and fancy look, carrying a greyish cap, pipe, and shades to boot.

6. CryptoPunk #3100 - $7.67m

- On March 11, 2021, just a day after the selling of #7804, #3100 crossed the dollars count, beating its fellow mate #7804 with a minor but significant difference. This Alien punk came out sporting just a headband.

Experts Take On The Nature Of NFT

As NFTs continue to rule the Crypto market with millions of dollars adding to their fortune with every progressing year, they are attracting major attention and all sorts of opinions from stakeholders and experts all around the world. “We’re opening a Pandora Box”, says one expert named, Morgan. According to him, there are certain security problems that can still

arise even with the best of intentions. Someone anonymous naming themselves, Monsieur Personne, claimed to have found a way to force a prominent artist to authorize an NFT

without being aware of the entire process. “It’s like any immature technology’, says Doug Schwenk, Chairman of Digital Asset Research.

“If a platform mints the token, do you really have clear-cut provenance back to the artist?” says Snider.

“This may well be the apotheosis, the peak in the paradigm of everything bubbles,” says Michael Every, Rabobank’s head of financial markets research for Asia pacific. He further goes on with, “It worries me intensely even if I fully understand the dynamic that drives younger people in particular”

Experts majorly recommend investing in the NFTs only if one wants to own it, not because he wants to get it on the hype.

“Don’t buy it because it’s an NFT, buy it because you like the art or buy it because you think the collectible is cool or the community is cool. You want to participate for the asset, not the underlying technology that powers this.”

Apart from the top-notch investment records, NFTs with the entire Crypto team has long been the talk of the town for the environmental concerns they raise. In the process of mining cryptos, an exorbitant amount of computing power and energy is used to solve complex puzzles. These ‘complex’ puzzles get more perplexing to solve, as the price of Crypto inflates and more computers get in the race of solving them. This results in the spending of greater computer power and large warehouses and stronger cooling units just to keep up – also an exponentially increasing carbon footprint.

“NFTs are using blockchain platforms, so you could associate their use of the blockchain with the share of the blockchain’s environmental impacts,” Susanne Kohler, a blockchain sustainability researcher at Aalborg University in Denmark, told CBS News.

“The environmental issue with NFTs isn’t the NFTs themselves, but the way the network they are built on is secured,” another expert Shirley said.

“This kind of gleeful wastefulness is, and I am not being hyperbolic, a crime against humanity,” digital artist Everest Pipkin wrote in a blog post.

Controversies Surrounding NFTs For Being A ‘foe’ To The Environment

In the rush to gain millions of dollars on Cryptocurrencies and NFTs, those throwing their artworks and other collectibles into the harrowing crypto mining operations are clearly losing sight of the bigger picture behind all the surface shine of the Crypto world. While these digital objects don’t call for manual labor needs, they do demand nasty amounts of energy to keep running or born into the cyber landscape. Many Cryptocurrencies are mined in Power-hungry farms where owners of those farms exploit private or municipal power grids as long as the mining operation stays beneficial.

It is estimated that crypto mining operations all over the world are consuming as much as 91 terawatt-hours of electricity annually. And that accounts for even more electricity than the entire nation of Finland uses in a year and seven times the annual consumption of Google’s global footprint. This can make anyone deeply concerned, terrified, and question, ‘What’s the point of making trillions of dollars at the cost of our most essential environment’s healthy life?’

In the year 2021, Art Station, an online marketplace for virtual artists, called off its plans to launch a platform for NFTs within a few hours after gathering a lot of heat from people who stood against such unethical dealing with the environment. Artists collectively called NFTs an “ecological nightmare pyramid scheme”.

While NFTS seem a little less hungry than massive crypto farms, they also demand lots of computing power to properly deal with encryptions and validations on the blockchain ledger. One random digital artist estimated that producing six works of crypto-art used more electricity than her whole studio consumed over a two-year time period. Attempts to calculate the overall environmental impact of mining and NFTs have fetched a variety of results. But experts can collectively agree about the overall carbon footprint of the blockchain being alarmingly colossal. A digital artist named, Memo Akten, analyzed a total of 18,000 NFTs, found out that the average NFT has a carbon footprint equivalent to even more than a month of electricity consumption for the average person living in the European Union. The large carbon footprint can partially be attributed to the many transactions under NFTs, involving, minting, canceling, sales, and transfer of ownership.

Possible Future Directions To The NFT

- Above all future possibilities towards the direction of NFTs, there lie many doubts regarding the long-term implications of NFT. And on such a scenario, questions arise as, “Is the NFT craze indeed a Bubble?” And, if so, is it starting to pop?”

- On this, Samson Mow, Chief Strategy Officer at Blockstream, stated, “There has been a lot of hype surrounding NFTs, and that hype is slowly dying down.”

- “Many NFTs that were issued were highly experimental and did not actually fulfill any particular purpose as NFTs that they could not have fulfilled as a simple data entry in a spreadsheet.”

- “When you have high-profile brands enter into this experimentation phase, what you get is FOMO,” Mow went on stating.

- Some out there have to say that, NFTs are still in their initial stage, they’re yet to see their full potential. If we see, the tech giants like Twitter, Meta, and Reddit are on the NFT projects currently, Investors are betting huge on NFTs, and new NFT Startups are running with their full potential. NFTs seem to hold a decent future in various aspects, and that definitely goes beyond the cliched elements to it, such as gaming and art. Some of the not so mainstream fields where NFTs might bring significant impacts are :–

- Managing licensing for photography

- Managing licensing and royalties for Music

- Transferring ownership of real estate and unlocking equity

- Transferring the ownership pf textbooks and other works.

- The future use cases of NFTs are digitally unexhausted.

Top 13 Interesting Facts About The NFT

NFTs are indissoluble. As all of the information is stored in a blockchain with every piece of NFT data, the information can’t be tampered with or be lost. In all, NFT tokens are the most secure on a blockchain, and from there; they can’t be destroyed, copied, or removed.

The most expensive NFT ever sold yet is, an art piece named, ‘The merge’ by a digital creator named, Pak. A record number of over 28,000 collectors bought into the release, spending a huge amount of $91.8 million on the art piece.

CryptoPunks are the first non-fungible digital art ever created. They came into life in the year 2017, powering Ethereum’s ERC721 standard that is responsible for much of the NFT craze today.

The original creators of any digital asset can choose to automatically collect royalty from every transaction by the owners in the process.

The total volume of all traded NFTs is around $431m.

The first privately owned NFT meme is said to be the meme of Animated Flying Rainbow Cat with a PopTart body, which sold for around $600,000.

A single minted NFT produces almost 211 Kg of CO2, equivalent to a return flight from London to Rome or month-long energy consumption by a European household.

Minting NFTs is free at the Opensea marketplace; though listing them for sale costs a significant amount of money.

The NFT market grew around 18000% in 12 months. The impressive growth started to surface in the early 6 months in the year 2020, collecting a hefty amount of $13.7m in sales. Later, the first six months of 2021 saw a whopping $2.5 billion in sales.

The very first CryptoPunks were given away without any costs, to those with an Ethereum wallet.

Beeple’s ‘Crossroad’ is the most expensive NFT video yet. This art piece involves Donald Trump- a type figure lying static in an idyllic setting with slogans punched all across his entire body. The video is only 10 seconds long.

CEO, Jack Dorsey, sold an NFT of his first tweet for $2.9 million in the year 2021. Dorsey later donated the received amount of money to charities fighting poverty.

Beeple’s ‘Everyday: the First 5000 days’ is the most valuable NFT yet, earning the artist a crazy amount of $69.3 million.

Some FAQs Or Also Ask Question

Is NFT a good Investment?

Before anything, NFT is a safe investment given the involvement of the Blockchain technology which is fully secure and is decentralized and distributed, which nearly zeroes the possibilities of corruption or any malpractices with the digital assets. So we can consider NFTs as a good investment as its not only safe but a popular, trending idea too in the market which is minting a good amount of money in exchange of just the ‘Ownerships’ of some unique assets.

What are NFTs used for?

The NFT, which goes as ‘Non-Fungible Token’ is one-of-a-kind cryptographic digital asset which represents real world unique objects like, in-game items, music, art, videos. NFTs are basically used as, ‘Authentication certificates’ to the ownerships of unique digital assets and exist on a blockchain and can’t be copied or tampered with.

What is NFT market?

An NFT marketplace is simply a digital platform where this trade of digital assets ranging from art to music to whole virtual worlds happen.

How do I buy NFTs?

Buying an NFT is a simple process given its all digital and quick. NFTs are mostly dealt on the Ethereum Blockchain, so as NFTs are registered on Ethereum or any other blockchains they require payment. It involves just a few steps –

- Make a purchase of Ethereum on a Crypto exchange

- Transfer your crypto to a crypto wallet.

- Connect your wallet to some NFT marketplace and here you are ready to purchase your favorite NFT pieces.

What is the Full form of NFT?

NFT simply goes as, Non- Fungible Token.

How to make NFT?

To mint, an NFT is a quick process involving just a few steps –

- One is supposed to first pick his item (any digital asset)

- Choose your blockchain, people mostly go for Ethereum as it’s most commonly used everywhere.

- Setting up of digital wallet

- Make a selection of your NFT marketplace

- Upload your file (can be anything digital, even a meme or a tweet)

- Set up the sales process and boom! you’re good to go.