- Indian Economic Service Exam is one of the most coveted exams conducted by the Union Public Service Commission every year. It is a group ‘A’ ministerial service, whose Cadre is allocated under the Ministry of Finance (Department of economic affairs), Government of India. Its main role is to cater to economic policy-making and specialized analysis of economic scenarios and give advice accordingly to the Government of India. After the LPG reforms of 1991, its importance has increased manifold.

Inception

Along with independence came the responsibility for India to become a thriving economy. But with the history of economic backwardness and extreme poverty, came its own challenges. So, the economic services were introduced by Jawahar Lal Nehru to give a strategic, balanced, and sustained push towards the aim of economic prosperity and development. In 1953 V.T. Krishnamachari committee was formed with the aim of the constitution of an economic advisory and statistical services. The service was constituted in 1961. It became operational in 1964 as a separate service from statistical services.

Chief Economic Advisor is the ex-officio Cadre controlling authority of Indian economic services, appointed by the appointments committee of the cabinet. V. Anantha Nageswaran is the present CEA (Chief Economic Advisor). Until 2009 CEA was appointed by UPSC. IES officers also help in the preparation of the Economic Survey of India, which is prepared by CEA and presented by the finance minister before the parliament of India. A specialized and distinguished feature of the service is its Cadre posts are spread across various ministries and departments of the union government.

Eligibility

1. Educational qualifications:-

- A person with a postgraduate degree in economics and allied services from a university incorporated by the act of central or state legislatures are eligible for various posts in IES.

2. Citizenship requirements:-

Person eligible for citizenship of India, Bhutan, or Nepal.

Tibetan refugee who moved to India before 1 January 1961, with the intention of permanently settling in India.

Person of Indian origin migrated from Burma, Pakistan, Sri Lanka, Vietnam, and East African countries.

- Except Indian citizens others would need a certificate of eligibility issued by the government of India.

3. Age limit:-

- The minimum age limit to be eligible for application is 21 years and the maximum age limit is 30 years on 1 August 2022.

2024 IES Exam Notification

Important dates regarding examinations are given below.

Release of notification | 10th April 2024 |

Start of the application process | 10th April 2024 |

Application fee | SC, ST, Women, Benchmark disability- nil OBCs, EWS Others- 200 |

Last date | 30th April 2024 |

Commencement of Examination | 21st June 2024 |

Admit card | Three weeks before the date of the Examination |

Allocation of center | First come First serve basis |

Results | To be announced |

Examination Details

The examination will be divided into 1 section and further into 2 parts.

SECTION-1:-

Part-1: written examination carrying 1000 marks in the following subjects.

Subject | Maximum marks | Time allotted |

General English | 100 | 3 hrs. |

General Studies | 100 | 3 hrs. |

General Economics1 | 200 | 3 hrs. |

General Economics2 | 200 | 3 hrs. |

General Economics3 | 200 | 3 hrs. |

Indian Economics | 200 | 3 hrs. |

Part-2: viva voce of 200 marks.

How To Apply?

Fill out the application form available on the official website of UPSC i.e., upsc.gov.in.

Look for instructions

Fill out personal details and other requirements.

Scan the recent photograph and signature.

Submit the application form after payment of the application fee of 200 INR. for general and OBC categories. Women, SC, ST, and PH are exempted from payment of fees.

Payment can be done via online (credit card, debit card, internet banking)/ offline mode (e-challan in any branch of SBI).

Results Declaration And Final Selection

UPSC will release results on its website on a stipulated date. Candidates selected for written examination will be called for a personality test.

Results will be based on a written test and personality test combined; a merit list will be prepared. Save the results for future reference.

Syllabus

General English:-

Candidates will be required to write an essay in English. Other questions will be designed to test their understanding of English and workmanlike use of words. Passages will usually be set for summary or precise.

General Studies:-

General knowledge including knowledge of current events and of such matters of everyday observation and experience in their scientific aspects as may be expected of an educated person who has not made a special study of any scientific subject. The paper will also include questions on Indian Polity including the political system and the Constitution of India, the History of India, and the geography of a nature which a candidate should be able to answer without special study.

General Economics– I

PART A:

Theory of Consumer’s Demand—Cardinal utility Analysis, Marginal utility and demand, Consumer’s surplus, Indifference curve, Analysis and utility function, Price income and substitution effects, Slutsky theorem and derivation of the demand curve, Revealed preference theory. Duality, indirect utility, and expenditure, Choice under risk and uncertainty. Simple games of complete information, Concept of Nash equilibrium.

Theory of Production: Factors of production and production function. Forms of Production Functions: Cobb Douglas, CES, and Fixed coefficient type, Translog production function. Laws of return to scale and returns to factors of production. Duality and cost function, Measures of productive efficiency of firms, technical and allocative efficiency. Partial Equilibrium versus General Equilibrium approach. Equilibrium of the firm and industry.

Theory of Value: Pricing under different market structures, public sector pricing, marginal cost pricing, peak-load pricing, cross-subsidy free pricing, and average cost pricing. Marshallian and Walrasian stability analysis. Pricing with incomplete information and moral hazard problems.

Theory of Distribution: Neo classical distribution theories; Marginal productivity theory of the determination of factor prices, Factor shares, and adding up problems. Euler’s theorem, Pricing of factors under imperfect competition, monopoly, and bilateral monopoly. Macro-distribution theories of Ricardo, Marx, Kaldor, and Kalecki.

Welfare Economics: Inter-personal comparison and aggression problem, public goods and externalities, Divergence between social and private welfare, compensation principle. Pareto optimality. Social choice and other recent schools, including Coase and Sen.

PART B

Quantitative Methods in Economics

Mathematical Methods in Economics: Differentiation and Integration and their application in economics. Optimization techniques, Sets, Matrices, and their application in economics. Linear algebra and Linear programming in economics and Input-output model of Leontief.

Statistical and Econometric Methods: Measures of central tendency and dispersions, Correlation and Regression. Time series. Index numbers. A sampling of curves based on various linear and non-linear functions. Least square methods and other multivariate analyses (only concepts and interpretation of results). Analysis of Variance, Factor analysis, Principal component analysis, Discriminant analysis. Income distribution: Pareto law of Distribution, lognormal distribution, measurement of income inequality. Lorenz curve and Gini coefficient. Univariate and multivariate regression analysis. Problems and remedies of Heteroscedasticity, Autocorrelation, and Multicollinearity.

General Economics– II

Economic Thought: Mercantilism Physiocrats, Classical, Marxist, Neo-classical, Keynesian and Monetarist schools of thought.

Concept of National Income and Social Accounting: Measurement of National Income, Inter relationship between three measures of national income in the presence of Government sector and international transactions. Environmental considerations, Green national income.

Theory of employment, Output, Inflation, Money and Finance: The Classical theory of Employment and Output and Neo-classical approaches. Equilibrium, analysis under classical and neo classical analysis. Keynesian theory of Employment and output. Post Keynesian developments. The inflationary gap: Demand pull versus cost push inflation, Philip’s curve, and its policy implication. Classical theory of Money, Quantity theory of Money. Friedman’s restatement of the quantity theory, the neutrality of money. The supply and demand for loanable funds and equilibrium in financial markets, Keynes’ theory on demand for money. IS-LM Model and AD-AS Model in Keynesian Theory.

Financial and Capital Market: Finance and economic development, financial markets, stock market, gift market, banking, and insurance. Equity markets, Role of primary and secondary markets and efficiency, Derivatives markets; Future and options.

Economic Growth and Development: concepts of Economic Growth and Development and their measurement: characteristics of less developed countries and obstacles to their development – growth, poverty, and income distribution. Theories of growth: Classical Approach: Adam Smith, Marx, and Schumpeter- Neo classical approach; Robinson, Solow, Kaldor and Harrod Domar. Theories of Economic Development, Rostow, Rosenstein-Roden, Nurske, Hirschman, Leibenstien and Arthur Lewis, Amin and Frank (Dependency school) respective role of state and the market. Utilitarian and Welfarist approach to social development and A.K. Sen’s critique. Sen’s capability approach to economic development. The Human Development Index. Physical quality of Life Index and Human Poverty Index. Basics of Endogenous Growth Theory.

International Economics: Gains from International Trade, Terms of Trade, policy, international trade, and economic development- Theories of International Trade; Ricardo, Haberler, Heckscher- Ohlin and Stopler- Samuelson- Theory of Tariffs- Regional Trade Arrangements. Asian Financial Crisis of 1997, Global Financial Crisis of 2008, and Euro Zone Crisis- Causes and Impact.

Balance of Payments: Disequilibrium in Balance of Payments, Mechanism of Adjustments, Foreign Trade Multiplier, Exchange Rates, Import and Exchange Controls and Multiple Exchange Rates. IS-LM Model and Mundell- Fleming Model of Balance of Payments.

Global Institutions: UN agencies dealing with economic aspects, the role of Multilateral Development Bodies (MDBs), such as the World Bank, IMF, and WTO, and Multinational Corporations, G-20 summits.

General Economics– III

Public Finance—Theories of taxation: Optimal taxes and tax reforms, the incidence of taxation. Theories of public expenditure: objectives and effects of public expenditure, public expenditure policy, and social cost-benefit analysis, criteria of public investment decisions, social rate of discount, shadow prices of investment, unskilled labor, and foreign exchange. Budgetary deficits. Theory of public debt management.

Environmental Economics—Environmentally sustainable development, Rio process 1992 to 2012, Green GDP, UN Methodology of Integrated Environmental and Economic Accounting. Environmental Values: Users and non-users values, option value. Valuation Methods: Stated and revealed preference methods. Design of Environmental Policy Instruments: Pollution taxes and pollution permits, collective action and informal regulation by local communities. Theories of exhaustible and renewable resources. International environmental agreements, RIO Conventions. Climatic change problems. Kyoto Protocol, UNFCC, Bali Action Plan, Agreements up to 2017, tradable permits and carbon taxes. Carbon Markets and Market Mechanisms. Climate Change Finance and Green Climate Fund.

Industrial Economics—Market structure, conduct and performance of firms, product differentiation and market concentration, monopolistic price theory and oligopolistic interdependence and pricing, entry preventing pricing, micro level investment decisions and the behaviour of firms, research and development and innovation, market structure and profitability, public policy, and development of firms.

- State, Market and Planning—Planning in a developing economy. Planning regulation and market. Indicative planning. Decentralized planning.

Indian Economics:-

History of development and planning— Alternative development strategies—the goal of self-reliance based on import substitution and protection, the post-1991 globalization strategies based on stabilization and structural adjustment packages: fiscal reforms, financial sector reforms and trade reforms.

Federal Finance—Constitutional provisions relating to fiscal and financial powers of the States, Finance Commissions, and their formulae for sharing taxes, the financial aspect of Sarkaria Commission Report, financial aspects of 73rd and 74th Constitutional Amendments.

Budgeting and Fiscal Policy—Tax, expenditure, budgetary deficits, pension, and fiscal reforms, public debt management and reforms, Fiscal Responsibility and Budget Management (FRBM) Act, Black money and Parallel economy in India—definition, estimates, genesis, consequences and remedies.

Poverty, Unemployment and Human Development—Estimates of inequality and poverty measures for India, appraisal of Government measures, India’s human development record in a global perspective. India’s population policy and development.

Agriculture and Rural Development Strategies— Technologies and institutions, land relations and land reforms, rural credit, modern farm inputs and marketing— price policy and subsidies; commercialisation and diversification. Rural development programmes include poverty alleviation programmes, development of economic and social infrastructure and the New Rural Employment Guarantee Scheme.

India’s experience with Urbanisation and Migration—Different types of migratory flows and their impact on the economies of their origin and destination, the process of growth of urban settlements; urban development strategies.

Industry: Strategy of industrial development— Industrial Policy Reform; Reservation Policy relating to small-scale industries. Competition policy, Sources of industrial finances. Bank, share market, insurance companies, pension funds, non-banking sources and foreign direct investment, the role of foreign capital for direct investment and portfolio investment, public sector reform, privatisation and disinvestment.

Labour—Employment, unemployment and underemployment, industrial relations and labour welfare— strategies for employment generation—The urban labour market and informal sector employment, Report of National Commission on Labour, Social issues relating to labour e.g. Child Labour, Bonded Labour International Labour Standard and its impact.

Foreign trade—Salient features of India’s foreign trade, composition, direction and organisation of trade, recent changes in trade, the balance of payments, tariff policy, exchange rate, India and WTO requirements. Bilateral Trade Agreements and their implications.

Money and Banking—Financial sector reforms, Organisation of India’s money market, changing roles of the Reserve Bank of India, commercial banks, development finance institutions, foreign banks and non-banking financial institutions, Indian capital market and SEBI, Development in Global Financial Market, and its relationship with Indian Financial Sector. Commodity Market in India-Spot and Futures Market, Role of FMC.

Inflation—Definition, trends, estimates, consequences, and remedies (control): Wholesale Price Index. Consumer Price Index: components and trends.

The Standard of paper of General English and General Studies will be of graduate level. Other papers will be of master’s level of an Indian University recognized by statute.

Books To Refer

Books For General Economics – I

- Micro-Economics: Ahuja

- Micro-Economics: Koutsoyiannis

- Macro-Economics: Shapiro

- Macro-Economics: Ahuja

- Macro-Economics: Dornbusch and Fischer

- Mathematical Methods: Class 11th and 12th NCERT Math books are sufficient.

- National Income Accounting: Class 12th book of NCERT

Books For General Economics – II

- Monetary Economics: SB Gupta (For both) M L Jhingan and RBI Report.

- International Economics: Soderston and Mannur.

- Growth and Development: M L Jhingan, Meir, and Baldwin.

- Statistics: Class 11th and 12th NCERT books along with some chapters of any graduate-level statistics book and Econometrics book.

- Latest Books by Amartya Sen.

Books For General Economics – III

- Public Finance:

- Indian Economy: Planning chapter of Uma Kapila.

- Environmental Economics: Any good books-only topic-wise coverage.

- The Economic Times Newspaper

- Yojana Magazine

Indian Economics

- Indian Economy by Dutt and Sundaram.

- Indian Economy: Mishra & Puri

- Indian Economy:A N Agrawala

- Indian Economy: Uma Kapila

- Indian Economy: Economic Survey –Last two years

- Indian Economy: Budget-3 years, very important

- Indian Economy: latest two Monetary & Credit Policy (mid-term and annual). The latest data about CRR, SLR, and Repos rate should be known.,

- Different reports like Human Development Report, World Development Reports, and papers by United Nations Environment Programme.

- Economy newspaper: The Economic Times

Salary, Grade Pay And Promotions

| Grade/ Scale (Level on pay Matrix) | Position in the Government of India | Pay Scale |

| Junior time scale (Pay level 10) | Assistant Director/ Research Officer | ₹56,100 (US$740)—₹132,000 (US$1,700) |

| Senior time scale (Pay level 11) | Deputy Director/ Assistant Economic Adviser/ Senior Research Officer | ₹67,700 (US$890)—₹160,000 (US$2,100) |

| Junior administrative grade (Pay level 12) | Joint Director/ Deputy Economic Adviser | ₹78,800 (US$1,000)—₹191,500 (US$2,500) |

| Selection grade (Pay level 13) | Director/ Additional Economic Adviser | ₹118,500 (US$1,600)—₹214,100 (US$2,800) |

| Senior administrative grade (above super time scale) (Pay level 14) | Economic Adviser/ Adviser | ₹144,200 (US$1,900)—₹218,200 (US$2,900) |

| Higher administrative grade (above super time scale) (Pay level 15) | Senior Economic Adviser/ Senior Adviser | ₹182,200 (US$2,400)—₹224,100 (US$2,900) |

| Apex scale (Pay level 17) | Principal Adviser (Apex) | ₹225,000 (US$3,000) |

Posting And Career Growth

- Place of Posting is usually the state capital or national capital New Delhi. A person appointed at early age can expect to go as high as secretary to the Government of India, in any ministry concerned with economic matters.

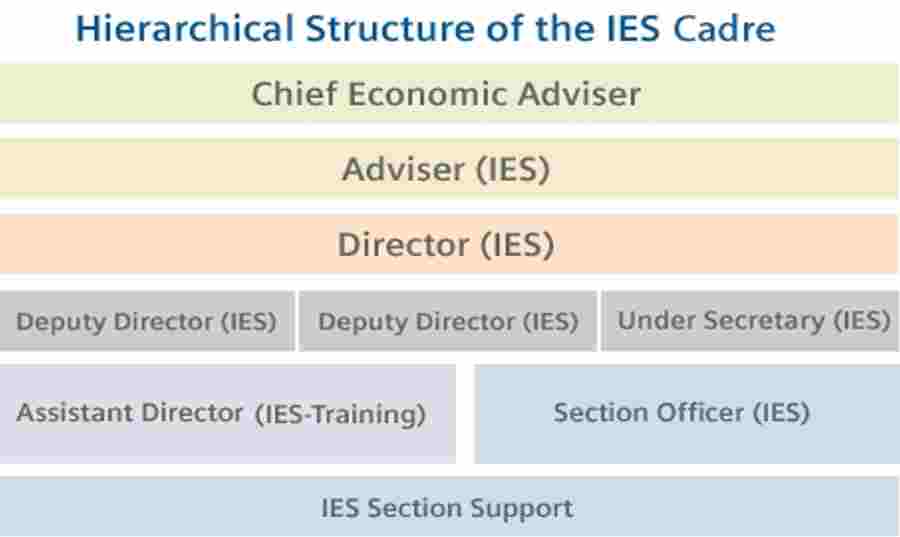

Organizational Hierarchy

Responsibilities After Selection

IES is the gateway to central services as group A officers. Candidates after successfully passing the exam will be provided various Cadre posts in central government departments like the department of economic affairs, the National sample survey organization (NSSO), and other allied offices which specialize in economics.

IES officers also go on deputation to various domestic departments and economic sections of ministries and various international organizations like IMF, World Bank, and WTO, and act as economic representatives of the government of India and work with global organizations.

Disparity With Other Administrative Services

Even after so many years of its inception, the service continues to be not that much remunerative in terms of the power structure. Seldom do any IES officers get promoted to the post of secretory to the department of economic affairs and take part in policy making. Mostly IAS officers are preferred for this post. IES officers are mostly confined to giving inputs. But there are some efforts by the government to make this service at par with administrative services Government has created 5 posts of principal advisor, equivalent to secretory, and 15 posts of senior advisor only for IES Cadre.

Economic decision-making must be complemented by analytical ability and economic specialization. The aim with which IES services were created must not be forgotten.

Top 13 Interesting Facts About IES

The history of service goes back to around 61 years.

A high-level IES board that advises Cadre controlling authority about matters pertaining to policy is headed by the cabinet secretary.

The sanctioned strength of the IES Cadre is 511 out of which 40 are for leave reserves.

Direct recruiters after being appointed undergo probationary training in economics at the Indian Institute of Economic growth, New Delhi.

Apart from purely economic services IES officers also crucially contribute to social sectors.

Officers could be required to monitor and evaluate policy parameters from the economic angle laid down in the Fiscal Responsibility and Budget Management Act, 2003.

Officers assist the Ministry of Finance in the preparation of annual or any other financial statements.

IES officers participate in exchange programs of the Government of India with other countries like Australia, the USA, the UK, etc. u/d Government Economic Service (GES) exchange programs.

The government provides financial assistance to IES officers for pursuing higher education from reputed global Institutes and universities.

14th governor of RBI – I.G. Patel, former Prime Minister- Manmohan Singh, and many notable personalities are members of the reputed service.

Post and rank of economic advisor is only present in IES services.

IES service completed the celebration of its golden jubilee on 24th January 2012.

Arthapedia- a portal for understanding the Indian Economy is managed by IES officers.