- Umang Sagar

- Organisation, Recent article

Financial Action Task Force (FATF)

Formation

The G7 is an informal forum of leading industrialized nations, which include Canada, France, Germany, Italy, Japan, the United Kingdom and the United States. Representatives of the European Union are always present at the annual meeting of the heads of state and government of the G7. In recent years, the G7 has expanded to the G20 which includes the major 20 nations of the current world order.

In the 1980s, when there was the G7, there arose a need for the establishment of an organization that would look into money laundering cases and financial abuses at a global level. The Financial Action Task Force (FATF) was established by the G7 summit held in Paris in 1989.

The group’s initial purpose was to implement the necessary measures to prevent money laundering, which had only just been declared a crime in the US. Increased drug use among Europeans, as well as Americans, led to the establishment of the FATF in a bid to prioritize the end of money laundering in the drug trade. The FATF made a public statement in 1990 by creating a set of 40 recommendations.

Organization

The FATF has a well-organized secretariat that works towards achieving its goals and following the official FATF recommendations. The President of the FATF is the highest executive position in the FATF secretariat. The President is the official spokesperson of the FATF and addresses the media externally. The President represents the FATF in all major events, programs, and organizations.

There is a Vice-President too to assist the President in the work and fills in for the President whenever necessary. The current president of the FATF is T. Raja Kumar and the current vice president is Elisa de Anda Madrazo.

Apart from these two top positions, an exceptional secretariat monitors, analyses, and reports money laundering and financial fraud cases. The Executive Secretary is responsible for investigating financial crimes and developing safe practices and guidelines to combat the same. The secretary is a part of the FATF Plenary that elects the President and the Vice-President. He or she also works and coordinates with the jurisdiction of the global FATF organizations to report and blacklist fraudsters. The Executive Secretary is assisted by the Deputy Executive Secretary.

The FATF Secretariat consists of other support staff, officers, and analysts who work together to spot financial crimes. The Secretariat is guided by the principles of “passion, integrity, respect, and collaboration.” The Secretariat is located at the OECD Headquarters in Paris.

The FATF currently comprises 37 member jurisdictions and 2 regional organizations, representing most major financial centers in all parts of the globe. FATF has several associate members such as the Asia\Pacific Group on Money Laundering (APG). Nonetheless, it also has some observer organizations.

Policies

The FATF has identified jurisdictions with strategic deficiencies in their frameworks to combat money laundering and the financing of terrorism and proliferation: high-risk jurisdictions subject to a call for action and jurisdictions under increased monitoring.

The most crucial policies taken by the FATF to combat financial terrors are written and published in the report named ‘International Standards On Combating Money Laundering And The Financing Of Terrorism And Proliferation’ in the FATF Recommendations, 2012.

There are 40 precise recommendations made by the FATF to resolve and investigate any financial malpractices. The gist of the recommendations are as follows:-

Money laundering cases should be criminalized based on the Vienna Convention and the Palermo Convention.

Freeze lauded prosperities, instrumentalized properties, or assists received in any form.

Identifying and tracing money transfers and stopping any further transfers, disposal or attempts to remove transactional evidence and seize unsolicited properties.

Countries should criminalize terror financing on the basis of the Terrorist financing convention and also investigate even any link to terrorist outfits.

Countries should implement targeted financial sanctions regimes to comply with United Nations Security Council resolutions relating to the prevention and suppression of terrorism and terrorist financing.

Financial institutions should be prohibited from keeping anonymous accounts or accounts in obviously fictitious names.

Financial institutions should be required to maintain, for at least five years, all necessary records on transactions, both domestic and international, to enable them to comply swiftly with information requests from the competent authorities.

Financial institutions should be required, in relation to cross-border correspondent banking and other similar relationships.

Countries should take measures to ensure that natural or legal persons that provide money or value transfer services (MVTS) are licensed or registered, and subject to effective systems for monitoring and ensuring compliance with the relevant measures called for in the FATF Recommendations.

Countries and financial institutions should identify and assess the money laundering or terrorist financing risks that may arise in relation to (a) the development of new products and new business practices, including new delivery mechanisms, and (b) the use of new or developing technologies for both new and pre-existing products.

Countries should assess the risks of misuse of legal persons for money laundering or terrorist financing and take measures to prevent their misuse.

Countries should take measures to prevent the misuse of legal arrangements for money laundering or terrorist financing.

Countries should ensure that designated law enforcement authorities have responsibility for money laundering and terrorist financing investigations within the framework of national AML/CFT policies.

Countries should have measures in place to detect the physical cross-border transportation of currency and bearer negotiable instruments, including through a declaration system and/or disclosure system.

The convicted parties can be sanctioned for their actions.

Blacklisting: Pakistan’s Case

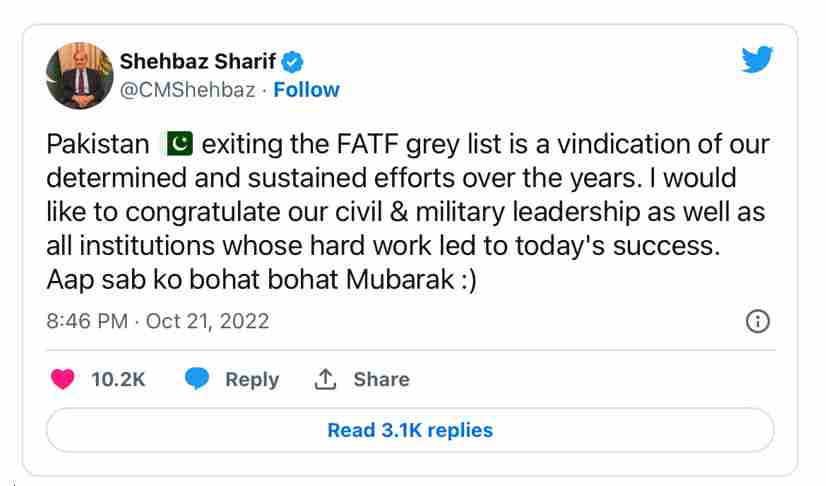

Pakistan has appeared on the FATF greylist multiple times since 2008, signaling the organization’s heightened scrutiny of money laundering and terrorism financing in the country. This greylist designation has had a significant impact on Pakistan’s economy, particularly its financial services industry. FATF concerns had also impacted the country’s IMF program: one of the conditions in the recent $6 billion bailout was the requirement that Pakistan complies with FATF guidelines.

The removal decision was announced by FATF President T Raja Kumar at the end of a two-day meeting in Paris, France. At the last FATF meeting in June, the organization said Pakistan would be kept on the list until a visit to the country took place to verify progress.

Subsequently, a FATF technical team traveled to Pakistan in late August and the visit was declared a “success” by Pakistan’s foreign office, which said it expected a “logical conclusion” at the next evaluation meeting in October.

After placing the country on the grey list in 2018, FATF gave Pakistan a 27-point action agenda, which was later increased to 34 points, related to money laundering, terrorist financing, and action against armed groups and individuals.

Being on the list can severely restrict a country’s international borrowing capabilities.

The decision comes at a time when Pakistan’s credibility on the global market has taken a pounding because of its precarious economic situation.

- The FATF said the decision to remove Pakistan from the grey list came as Pakistan has made significant and consistent efforts to adhere to the policies of the terror financing rules of the FATF. The worsening situation of the economic condition together with the devastating floods in recent times has even turned the eyes of several humanitarian and health aid groups to donate and carry out volunteering activities in the affected areas.

FATF’s Efforts Against Terror Financing

Fighting against terror financing has been the top priority of FATF since 2001. However, in 2015, the scope and nature of terrorist threats globally intensified considerably, with terrorist attacks in many cities across the world, and the terrorist threat posed by the so-called Islamic State of Iraq, and by Al-Qaeda and their affiliated terrorist organizations. Terrorists need money and other assets, for weapons but also training, travel, and accommodation to plan and execute their attacks and develop as an organization. Disrupting and preventing these terrorism-related financial flows and transactions is one of the most effective ways to fight terrorism. Not only can it prevent future attacks by disrupting their material support, but the footprints of their purchases, withdrawals, and other financial transactions can also provide valuable information for ongoing investigations.

The FATF plays a central role in global efforts in combatting terrorist financing, through its role in setting global standards to combat terrorist financing, assisting jurisdictions in implementing financial provisions of the United Nations Security Council resolutions on terrorism, and evaluating countries’ ability to prevent, detect, investigate and prosecute the financing of terrorism. Yet many countries have not yet implemented the FATF Standards effectively. They do not understand the nature of TF risks they face, nor have effective means to combat them.

The FATF has a detailed report on the steps to combat terror financing titled ‘CONSOLIDATED FATF STRATEGY ON COMBATING TERROR FINANCING’. This consolidated report talks about three steps:-

- The framework, mechanisms, and actions already in place

- The current threats that are faced

- The key policy objectives and the global network will take in this fight against terrorism and terrorist financing.

- The FATF has steps to freeze terrorist assets, equip law and investigations mechanisms and locate the source of funding. Additionally, FATF has a Fact-Finding Committee to verify the sources of the funding and check the authenticity of the information.

Shortcomings

After Pakistan was taken off the grey list, the Indian defense system and many diplomats got wary as Pakistan has taken multiple occasions to harm the sovereignty and security of India. According to a brief of the Manohar Parrikar Institute of Defense Studies and Analyses, the three lists of black, grey, and white are oversimplified. The low economic conditions of many countries like Pakistan and many Western African countries cannot be a reason for its removal from the grey list. The terrorist outfits continue to fund their terror activities through many other unverified and untraceable sources. Many independent institutions have raised the question if Pakistan has complied with the FATF recommendations or whether it is being sympathized by its high inflation rates, worsening economic conditions, and natural calamities. In the United Nations General Assembly sessions, India’s security needs have always been overlooked and criticized by Pakistani representatives.

Moreover, if the FATF has such strict recommendations strategy, then it should be able to verify and lock the terror funding sources to the US as well. The US has provided fighter planes to Pakistan and other aid several times. This comes under the category of terror assets.

Top 13 Interesting Facts About FATF

The FATF is also known by its French name, Groupe d’action financiere.

Apart from money laundering, the FATF has extended its mandate to human trafficking and drug trafficking.

The mandate to include terror financing was included in 2001.

The FATF holds at least three plenary meetings every year.

Mali is the latest member to join the FATF in 2021.

The FATF recommendations are not legally binding to any nation or party.

Even though it is not legally bound, many countries have taken this commitment to adhere to the recommendations of the FATF.

The FATF does not have any investigating bodies; it is only a law-making body.

The FATF has many observing and associate members who take a deliberate part in the proceedings.

The Economic Declaration of Group-7 has announced the birth of the FATF.

The FATF has been functional for many years and crossed 30 years in 2019.

The 9/11 attack compelled the FATF to include terror financing in its mandate.

The FATF has 9 regional bodies spread across the globe to cover all areas under its jurisdiction.