- Umang Sagar

- Organisation, Recent article

Enforcement Directorate

Introduction

The Directorate of Enforcement is a multi-disciplinary organization mandated to investigate offences of money laundering and violations of foreign exchange laws. It is an agency which enforces laws related to the economy and fights the problems related to economic crimes in India. It is also an Economic intelligence agency which works the enforcement of the provisions of two main laws for the economic development of the country.

Two main laws are as follows:

- Foreign Exchange Management Act (FEMA), 1999,

- Prevention of Money Laundering Act (PMLA), 2002.

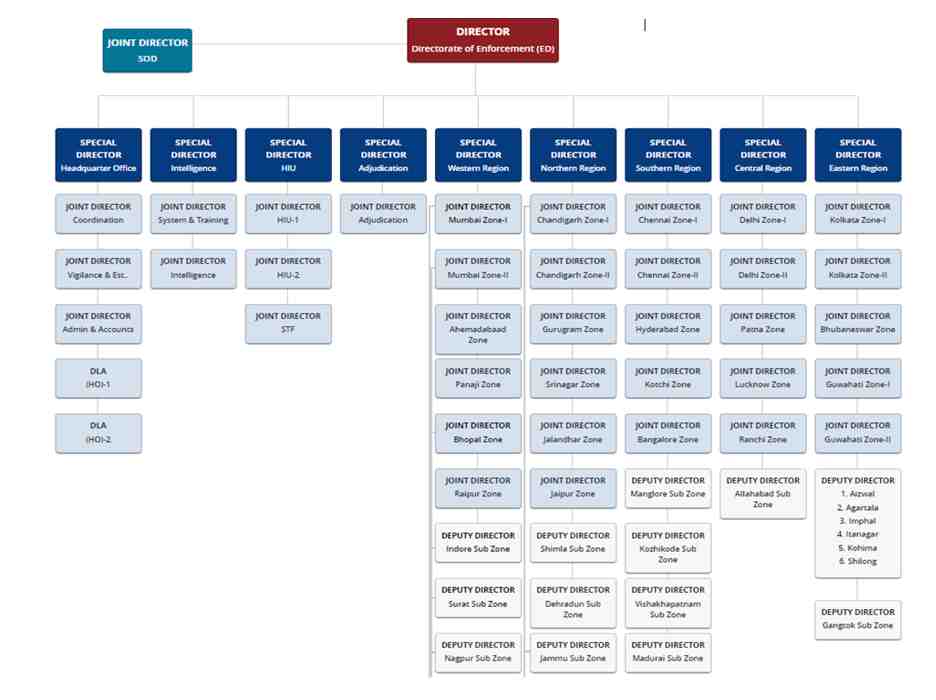

Headquarter: The Directorate of Enforcement (ED) is headquartered in New Delhi. The organization is headed by the Director of Enforcement.

Regional Offices: The Enforcement Directorate has five Regional Offices in Mumbai, Chennai, Chandigarh, Kolkata, and Delhi. The regional offices are headed by the Special Directors of Enforcement.

Zonal Offices: The Zonal Offices are in Ahmedabad, Bangalore, Chandigarh, Chennai, Kochi, Delhi, Panaji, Guwahati, Hyderabad, Jaipur, Jalandhar, Kolkata, Lucknow, Mumbai, Patna, and Srinagar. The Zonal Offices are headed by a Joint Director.

Sub-Zonal Offices: The Sub-Zonal Offices are in Bhubaneshwar, Kozhikode, Indore, Madurai, Nagpur, Allahabad, Raipur, Dehradun, Ranchi, Surat, Shimla, Vishakhapatnam, and Jammu. The Sub-Zonal Offices are headed by a Deputy Director.

Composition: It is composed of officers from the Indian Revenue Service, Indian Police Service and the Indian Administrative Service as well as promoted officers from its own cadre. In addition to directly hiring people, the Directorate also draws officers from different Investigating Agencies, viz., Customs & Central Excise, Income Tax, Police, etc. on deputation. The total strength of the department is less than 2000 officers out of which around 70% of officials came from deputation from other organizations while ED has its own cadre, too.

- Supreme Court has recently passed a judgment upholding the PMLA and jurisdiction of ED. While section 45 of the PMLA deals with the aspect of offenses to be cognizable and non-bailable, section 436A of the CrPC deals with the maximum period for which an undertrial prisoner can be detained. SC also said that Enforcement Case Information Report (ECIR) cannot be equated with an FIR and the supply of ECIR to the accused is not mandatory.

Historical Background

Its history can be traced from 1956 when on the 1st of May 1956, a unit (Enforcement unit) was formed in Economic Affairs Department. It was formed the control some issues relating to the violation of the provisions of FERA (Foreign Exchange Regulation Act),1947. This Enforcement unit was renamed “Enforcement Directorate” in 1957 and the administrative control was transferred to the Revenue department from Economic Department in 1960. Later the FERA Act was repealed after 1977 and a new Act was passed named FEMA (Foreign Exchange Management Act),1999 which came into effect on 1st June of 2000. Further the Prevention of Money Laundering Act, 2002 was passed by the parliament to prevent and control money laundering in India and to deal with such issues. Later the responsibility for the enforcement of provisions of both acts was given to the Enforcement Directorate on 1st July 2005 and since today it is working for the enforcement of the provisions of both acts.

In 1960, the administrative powers were transferred from the Department of Economic Affairs to the Department of Revenue. From 1973 to 1977, ED remained under the administrative jurisdiction of the Department of Personnel & Administrative Reforms. The Directorate of Enforcement functions under the aegis of the Department of Revenue, Ministry of Finance.

Functions Of Enforcement Directorate

The investigation agency works for the enforcement of provisions of the FEMA and PMLA. It is working to achieve the objectives of the acts and impose penalties on those who violate the provisions of these acts.

Some basic functions and powers are to investigate the matter, search any suspected place or person, confiscate any property purchased from laundered money, arrest any accused or person relates to such crime, file suit against the accused person, and some other function of its adjudication authorities and appellate authorities, such as to decide any case by taking evidence, power to penalize victim with imprisonment and fine.

The statutory functions of the Directorate include enforcement of the following Acts:-

- The Prevention of Money Laundering Act, 2002 (PMLA):It is a criminal law enacted to prevent money laundering and to provide for confiscation of property derived from, or involved in, money laundering and for matters connected therewith or incidental thereto. ED has been given the responsibility to enforce the provisions of the PMLA by investigating to trace the assets derived from proceeds of crime, provisionally attaching the property, and ensuring the prosecution of the offenders and confiscation of the property by the Special court.

- The Foreign Exchange Management Act, 1999 (FEMA): It is a civil law enacted to consolidate and amend the laws relating to facilitating external trade and payments and to promote the orderly development and maintenance of the foreign exchange market in India. ED has been given the responsibility to investigate suspected contraventions of foreign exchange laws and regulations and to adjudicate and impose penalties on those adjudged to have contravened the law.

- The Fugitive Economic Offenders Act, 2018 (FEOA):This law was enacted to deter economic offenders from evading the process of Indian law by remaining outside the jurisdiction of Indian courts. It is a law whereby the Directorate is mandated to attach the properties of the fugitive economic offenders who have escaped from India warranting arrest and provide for the confiscation of their properties to the Central Government.

- The Foreign Exchange Regulation Act, 1973 (FERA):The main functions under the repealed FERA are to adjudicate the Show Cause Notices issued under the said Act up to 31.5.2002 for the alleged contraventions of the Act which may result in the imposition of penalties and to pursue prosecutions launched under FERA in the concerned courts.

- Sponsoring agency under COFEPOSA:Under the Conservation of Foreign Exchange and Prevention of Smuggling Activities Act, 1974 (COFEPOSA), this Directorate is empowered to sponsor cases of preventive detention about contraventions of FEMA. Agency act as sponsors to cases of preventive detention under COFEPOSA in regard to a contravention of the provisions of the Foreign Exchange Management Act, 1999.

Powers Of Enforcement Directorate

- Sections 48 & 49 of the PMLA empower the ED officers to investigate cases of Money Laundering.

Case 1: Suman Sehgal vs Union of India

- Section 37(3) does not refer to any express provision of the Income Tax Act. The only conclusion which can be therefore logically read is that there is no pre-condition that any ‘proceeding’ ought to be pending against a particular or specified individual nor is the pre-requisite for the exercise of such power dependent upon existing judicial proceedings. If there are certain matters under the investigation of the concerned authority, it can invoke the power under Section 37(3).

- Summon an individual whose attendance is essential, whether to give evidence or to produce any records, during investigation or proceedings.

Case 2: T.T.V. Dinakaran vs. Enforcement Officer of Enforcement Directorate

- When there is suspicion about the involvement of the petitioner in any of the transactions which are prohibited under the FERA Act, it is open to the authorities to summon the individual for inquiry. Since the documents are about the individual, it cannot be said that the investigation has no nexus with the documents called for from the petitioner. When an investigation is commenced, the authorities cannot conclude about the involvement or the non-involvement of any person until the enquiry is completed. During the enquiry, if the authorities get any information concerning the involvement of any other individual, those individuals can also be summoned by the concerned officer to complete the enquiry. When Section 40(4) of the FERA Act specifically mentions that the proceedings taken by the authorities are judicial, it is not open to the petitioner to challenge the summons issued under the said proceedings as ab initio void. The petitioner cannot claim any right under Article 21 of the Constitution of India and Section 24 of the Evidence Act, as he is not an accused.

- Power to Seize assets

The ED has the authority to undertake “search and seizure” against any individual based on information in the officer’s possession and by establishing in writing exact “reasons to suspect” that money laundering has occurred.

About Section 157 CrPC, the proviso to Sections 17(1) and 18(1) was repealed by the Finance Act, 2019, thus authorizing ED to enter any property for search and seizure even without registering a scheduled crime with a Magistrate or any other competent body. This change significantly enlarged the ED’s current powers by placing Sections 17 and 18 at the same level as Section 19, where there is no prerequisite to forwarding a report under Section 157 CrPC to a Magistrate – thus removing judicial scrutiny at this point.

The use of the terms “any offense” and “any property” allows a police officer to confiscate any property under suspicious circumstances under any act. As the Finance Act of 2019 emphasized, the crimes under the Act have always been cognizable and non-bailable, giving the ED unrestricted authority to investigate, arrest, and harass anybody under the guise of “reasonable suspicion”.

Case 3: In Abdullah Ali Balsharaf v. Directorate of Enforcement the Delhi High Court held that:

Powers of seizure of properties is a draconian power. Grant of such authoritarian and drastic powers, without commensurate checks and balances, would militate against the principle of rule of law engrafted in the Constitution of India.

The ED seizes a property first for purposes other than those intended and then chooses whether to apply provisions of the PMLA or Section 102 CrPC, as it has been done in Circuit. In this judgment, the Court dismissed the ED’s argument that the power of seizure is available under Section 102 CrPC, which was exercised, and therefore the freezing of the account would stay lawful. The Court concluded that the power must be exercised in the way described, or it will violate the necessity of adhering to due process under the law.

- Power to attach property

If an individual is in possession of “proceeds of crime,” the ED has the authority to temporarily attach a property under Section 5(1) of the PMLA. The Adjudicating Authority confirms the attachment under Section 8(3) of the PMLA, and the Government would finally confiscate it under Section 9 of the PMLA. The existence of “proceeds of crime” is thus essential in establishing a money laundering or property attachment offence under the PMLA.

Proceeds of crime

Section 2(i)(u) of the PMLA divides proceeds of crime into three categories:

(1) property derived or obtained because of criminal activity.

(2) the value of such property; or

(3) if the property has been “taken or held” abroad, any other property “equivalent in value” whether held in India or abroad.

Case 4: Seema Garg vs. Deputy Director,

Directorate of Enforcement holding that the ED cannot attach tainted properties and the “deemed tainted properties” as defined in the Axis Bank case, if they don’t have a direct or indirect link, with the property derived or obtained from the commission of a scheduled offense.

Case 5: State Bank of India vs. The Joint Director

the ED continued to seize property without giving a thought to the financial consequences for the banks that used the property as collateral for their loans. The appellate tribunal, on the other hand, held that the ED cannot attach any such property mortgaged to banks per se, especially if the transaction with the bank occurred before the alleged crime, indicating that the property is not proceeds of crime and has appropriate documentation and a clear title in the borrower’s name.

- Power to penalize

- Section 13 of the FEMA Act imposes penalties on anyone who violates the Act’s provisions, or any order or regulation issued in the exercise of the Act’s functions. When the contraventions are quantifiable, the penalty can be up to three times the total amount involved. In this aspect, the ED has vast authority in its hands to collect such payment arrears. The ED has the same powers as the authorized agencies under the ITA when it comes to income tax collection.

Case 6: Suborno Bose vs Enforcement Directorate,

the High Court has observed that men’s rea is essential for imposing a penalty for breach of civil obligations. It also noted that the penalty is remedial and coercive in its nature thus it emphasizes the fact of loss of revenue.

- Power during adjudication proceedings

- During the adjudication of such a case, the Adjudicating Authority may decide to recommend to the ED the initiation of criminal proceedings in the same case. The ED may file a criminal complaint under Section 13(1B) after recording the Adjudicating Authority’s findings in writing. The court will only take notice of the case if ED files a written complaint with the court. If the security, exchange, or property is held in violation of FEMA or more than the government’s limit, the owner of the property will be found guilty and subject to penalties under FEMA Section 13.

Case 7: Arun K. Maitra & Ors vs Enforcement Directorate

the Company was liable for compliance for payments exceeding US$5000. The petitioners submitted that the complaint filed by ED was opposed to findings in the CBI investigation report. It was contended by the petitioners that the complaint and impugned order deserve to be quashed as the facts of the case were concealed in the complaint and the respondents failed to establish the nexus between alleged facts and the findings. The Court quashing the complaints held that the respondents, ED have deliberately ignored the investigation conducted by CBI.

- Power to compound contraventions

- Compounding is a settlement mechanism under section 13 in which a person willingly acknowledges to violating FEMA requirements, pleads guilty, and seeks redress. It is a procedure that allows a defendant to pay a monetary penalty rather than face prosecution and lengthy legal battles. The ED and the Reserve Bank of India (RBI) have the ability under Sec 15 of FEMA to compound contraventions listed in Sec 13 of the Act.

Case 8: Brentfield Travels Co. Pvt. Ltd v. Reserve Bank of India & Anr,

The power to compound must be exercised judiciously having regard to the considerations which have been set out in the statute and in the circular issued by the Reserve Bank of India. There is no absolute right to claim a compounding of contraventions. It is for the Competent Authority to decide whether the contravention is of a technical nature or whether it is of a sensitive nature involving broader issues of national security or money laundering or serious infringement of the regulatory framework in which case a compounding cannot be allowed.

Jurisdiction

Both FEMA and PMLA apply to the whole of India including Jammu and Kashmir. So, the Enforcement Directorate can act against any person to which this act applies. Cases under FEMA may lie in civil courts whereas PMLA cases will lie in criminal courts.

The agency has jurisdiction over a person or any other legal entity who commits a crime whether he is a politician or a businessman. All public servants come under the jurisdiction of the agency if they are involved in any offense related to money laundering.

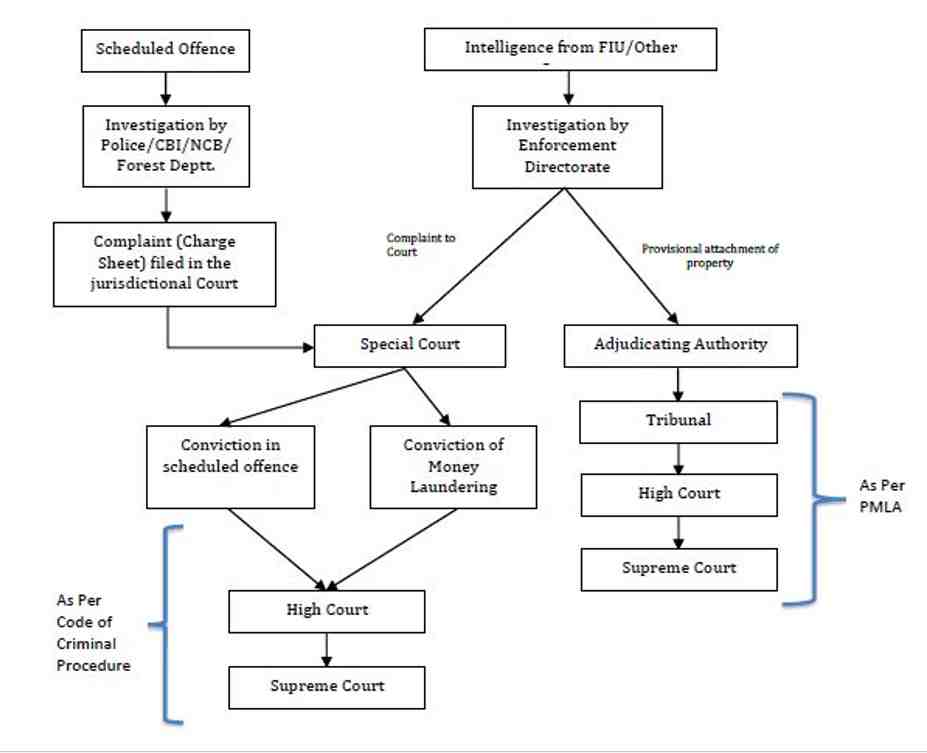

Prevention Of Money Laundering Act, 2002: Appellate Jurisdiction

The Act provides for separate provisions pertaining to attachment and confiscation of property; and a separate procedure for adjudging an offence under the Act. Though the Act provides for a well-laid appellate remedy against the attachment of the property, it also lays down the aspect of a Special Court for the trial of the scheduled offence along with the offence under the Act. However, the procedure regarding any appeal against the order of the Special Court is prescribed to be governed by the Criminal Procedure Code.

With the backdrop of the above provisions, it is pertinent to note that the aggrieved party can proceed with an appeal to the Tribunal, High Court, and Supreme Court, only with respect to attachment or confiscation of tainted property, proceeding from crime. The Act does not specifically prescribe any recourse against the order of the Special Courts and refers to the provisions of the Code of Criminal Procure, 1973 for any appeal and revision of the order of the Special Court.

the Act empowers the Director to attach and confiscate the tainted property suo-moto, for a maximum period of 180 days, if he has reasons to believe that the property has been acquired out of criminal proceeds of a scheduled offence.

Although the very purpose of the provisions of provisional attachment is to curb concealment, transfer or dealing of the proceeds of crime to frustrate proceedings under the Act, appellate remedies are also provided under the Act to keep a check against such severe powers of the enforcement directorate.

As already discussed earlier, the Director or any other officer who provisionally attaches the property under the provisions of the proposed Act is mandatorily required to file a complaint before the adjudicating authority within a period of 30 days from such attachment. Going further, the Adjudicating authority shall serve a notice of a minimum of thirty days under section 8 of the Act, on the affected person requiring him to indicate the sources of his income, earnings, or assets by which he has acquired such attached property and to show cause as to why such seized properties do not reflect criminal proceeds and hence shall not be confiscated by the Central Government. The Adjudicating Authority considering the reply of the person aggrieved, the Director, or any other officer, and taking into consideration all the relevant materials, documentation and evidence placed on record, shall decide whether the property is involved in money laundering or not.

On affirmation by the Adjudication Authority, the property shall be attached and the possession of the same shall be taken over by the Enforcement Directorate, till the conclusion of the trial of an offence. However, if the Adjudicating Authority decides otherwise, the attachment order shall be revoked, subject to the decision of the Appellate Tribunal.

- Section 26 of the Act allows the Director or any person aggrieved in respect of an order passed by the Adjudicating Authority to prefer an appeal before the Appellate Tribunal within a period of 45 days or otherwise from the receipt of such order of the Adjudicating Authority. Since my fellow colleague in his Article has already discussed in detail the appellate remedy before the Hon’ble Money Laundering Appellate Tribunal, I shall throw some light on the provisions pertaining to the remedy from the Hon’ble High Court and Supreme Court in this regard.

What Actions Are Taken On The Report Prepared By The Enforcement Directorate Officer

After the investigation of the matter, officers make a report of the matter which includes the detail of the report, investigation done by the officer, places, and persons investigated, attachment report of the attached property, and report of an arrested person.

After the preparation of the report matter may be adjudicated by ED’s own adjudicating authority or the case may be referred to CBI court or Apex court also. The aggrieved party of the case may go to the higher court for an appeal. The agency has its own appellate tribunal for the purpose to take an appeal.

The court on the decision of the matter may impose a fine thrice of the sum involved in case of contravention of the provisions of the FEMA and may punish with rigorous imprisonment not exceeding seven years.

How To Report The Matter To Enforcement Directorate

Can a person directly approach the Enforcement Directorate?

A person cannot directly approach Enforcement Directorate. But complaints relating to illegalities in foreign exchange and money laundering may be sent to the Enforcement Directorate at the following address:

- Director,

- Enforcement Directorate,

- 6th Floor, Lok Nayak Bhawan,

- Khan Market,

- New Delhi- 110003

- Website: http://finmin.nic.in

An application can also be filed with the court to refer the matter to Enforcement Directorate and to investigate the matter by the Enforcement Directorate agency.

Complaint to any other agency: If someone wants to report a matter related to the violation of FEMA or PMLA act, he must register a complaint with any other agency or Police than ED. PMLA contains 157 sections regarding the offences related to money laundering. These offences are called schedules or predicate offences. If such a registered offence is one of any schedules or predicate offences, then Enforcement Directorate can act against such person. Officers can investigate, search, and confiscate the property of a such person.

Organisational Structure

How To Join Enforcement Directorate (ED)

- There are two ways to join the Enforcement directorate and they are as follows:

1. Through UPSC: On A Deputation Basis

Eligibility for Assistant Director:-

- The candidate should be an Officer working under the Central Services or State Police Organizations or Central Bureau of Investigation (CBI) or Reserve Bank of India (RBI) or Public Banks etc.

- Holding the analogous posts or equivalent on a regular basis in the parent cadre or department; or

- With 02 (two) years of relevant experience of the regular service in the immediate lower pay scale or equivalent; and

- Possessing 03 (three) years of experience in the respective discipline of Legal Works etc. and 03 years of experience in Banking/ Accounts/ Audit.

Age Limit:-

- Candidate should be appointed on deputation (including short-term contract) shall not be exceeding 56 years as on the closing date of receipt of the application, relaxation is provided for candidates belonging to reserved category (if applicable).

Selection Procedure:-

- Candidates would be tested based on a Written Test/ Personal Interview.

2. Through SSC-CGL: For Assistant Enforcement Officer Posts

Assistant Enforcement Officer

How to become an Assistant Enforcement Officer?

Job Profile:-

Assistant Enforcement Officers are responsible for inspecting the employees working in various departments under the central government. They ensure whether the employees are working under the rules and regulations specified by the government. It is their duty to give a report to the department heads if they find any violation in the specified rules or regulations.

It’s a Group B post and deals with managing financial frauds and scams in India. The post of Assistant Enforcement Officer is mostly a desk/office posting job in which you will deal with files or clerical work such as making reports and presentations/brochures. Sometimes you may also be ordered by a senior officer to join the raid team that comes under the field job. The fieldwork also entails intelligence on money laundering or other economic crime.

Qualifying Exam:-

To become an assistant enforcement officer, one should qualify for the assistant enforcement officer exam conducted by Staff Selection Commission (SSC).

Notification of this examination will be published in the newspaper or the official website which contains the details of the application procedure and eligibility. Candidates should forward their applications to the concerned authority in the manner specified in the notification. There will be an interview for the candidates who have scored well in the written examination. Those who perform well in the interview will be appointed as assistant enforcement officers.

Eligibility Criteria:-

1. Educational Qualification

- To be eligible for becoming an Assistant Enforcement Officer Inspector one should hold a Bachelor’s of any stream.

2. Age

- The candidate must have attained the age of 18 years on 1st July of the year of examination and must not have attained 27 years of age on that date.

- The upper age limit will be relaxed by 3 years for OBC candidates and 5 years for SC/ST candidates.

- The upper age limit is also relaxed in favor of certain categories of employees working under the Government of India and Défense Services Personnel.

How to become an Assistant Enforcement Officer?

- To be an Assistant Enforcement Officer one must follow the below-given steps:

Step 1:-

- As a first step, the aspirant must procure the “Application Form” along with required information from the employment newspaper generally published in the month of April. sent the filled Application form to the regional centers as mentioned.

Note: The notification for the examination with relevant details regarding rules and syllabus is published in the month of April in the ‘Employment News / ‘Rozgar Samachar’, ‘Gazette of India’, and in some leading newspapers of the country.

Step 2:-

Preliminary Examination

In the month of May or June, the aspirants have to take the “Preliminary Examinations” consisting of two papers. The papers are on:

Subject | No. Of Question | Marks | Time |

Part A | 100 | 100 | 2 Hrs. |

Part B | 100 | 100 | 2 Hr. |

Note: This exam is just a qualifying exam for the Final exam and scores obtained in this exam are not added to make the result.

Step 3:-

Main Examination

- Those candidates who are declared qualified in the “Preliminary Examination” are supposed to take the final exam.

- The final exam consists of two parts. Part A will be of written exam and second Part B will be of Personality Test.

Subject | Max. Marks | Duration |

General Studies | 200 Marks | 3Hr. |

English | 200 Marks | 2Hr. 20 Min. |

Arithmetic | 100 Marks | 4Hr. |

Language | 100 Marks | 2Hr. 20 Min. |

Communication Skills and writing | 200 Marks | 2Hr. 20 Min. |

Step 4:-

Personality Test

- Once you are through the final stage is the interview. The aspirants are grilled in the interview to test their personality and mental ability.

Assistant Enforcement Job Description

- The job of an Assistant Enforcement Officer is full of pressure and responsibilities, sometimes they must deal strictly with their own colleagues and even seniors when they themselves are not working according to the laid down policies. Therefore, this job is considered a tough one. But to discharge his duties one must be very dedicated towards his work responsibilities, brave, hardworking, honest as well as tactful as he must deal with so many high profiles people that may use their influence in high echelons to save themselves and in turn prove the officer wrong or impartial.

Syllabus:-

Tier I

General Intelligence & Reasoning – Problem-Solving, Coding-Decoding, Arithmetic Reasoning, Semantic Analogy, Number Classification, Critical Thinking, Word Building, Number Series, Emotional Intelligence, Venn Diagrams, Social Intelligence.

General Awareness – Questions related to India and its neighbouring countries pertaining to General Policy, History, Geography, Culture, Economic Scene, and Scientific Research.

Quantitative Aptitude – Numbers, Percentage, Average, Mixture and Allegations, Interest, Discount, Profit and Loss, Circles, Triangles, Time and Distance, Histogram, Bar and Pie Chart.

- English Comprehension – Read the comprehension and related questions.

Tier II

Quantitative Abilities – Whole numbers, Ratio, Profit and Loss, Triangle, Circles, Basic Algebraic Identities, Heights and Distances, Time and Distance, Circle and its Chords, Graphs of Linear Equations, Bar & Pie chart.

English Language and Comprehension – Comprehension, Spelling/ Misspelled words, Synonyms, Antonyms, Idioms & Phrases, One Word Substitution, Cloze Test, Spot the Error.

Statistics – Presentation of Statistical Data, Measure of Dispersion, Measures of Central Tendency, Sampling Theory, Moments, Skewness and Kurtosis, Time Series Analysis, Correlation and Regression, Index Numbers.

General Studies (Finance and Economics)

Finance – Financial accounting and Basic Concepts of Accounting.

Economics – Finance Commission – Role and Functions, Indian Economy, Theory of Demand and Supply, Economic Reforms in India, Indian Economy, Money, and Banking.

- Candidates can check out the detailed syllabus for the CGL exam in the official notification.

Assistant Enforcement Officer– Salary, Pay Scale, And Allowances

Basic + Allowances | X Category | Y Category |

BASIC | 44900 | 44900 |

DA (5%) | 2245 | 2245 |

HRA | 10776 | 7184 |

TA | 3600 | 1800 |

SIA (20%) | 8980 | 8980 |

GROSS SALARY | 70501 | 65109 |

NPS | 4490 | 4490 |

CGHS | 325 | 325 |

CGEGIS | 2500 | 2500 |

DEDUCTIONS | 7315 | 7315 |

SALARY IN HAND | 63186 | 57794 |

- After the 7th Pay Commission, the Assistant Enforcement officer post comes under 4600 grades pay. Based on this Basic Salary, the Estimated Salary after the 7th pay commission is as follows:

Note: Special Incentive Allowances are only for CBI & Enforcement Directorate (ED).

Assistant Enforcement Officer – Career Growth

As an Assistant Enforcement Officer, you will have the following career path

- Enforcement Officer (Group B Gazetted post in 4-6 years)

- The Assistant Director of the Enforcement Directorate

- Deputy Director of Enforcement Directorate

- Joint Director

- Additional Director

- Special Director in Enforcement Directorate

Top 13 Interesting Facts About Enforcement Directorate

It was formed with the purpose of handling Exchange Control Law violations under the Foreign Exchange Regulation Act,1947.

Initially established under the Department of Economic Affairs in 1956 as an ‘Enforcement Unit’, it was later shifted to the Department of Revenue for administration in 1960.

It was renamed the Enforcement Directorate (ED) in 1957.

Now, the Enforcement Directorate (ED) is administered by the Department of Revenue under the Ministry of Finance.

The ED has its headquarters in New Delhi and has many regional offices all over the country.

It is headed by the Director of Enforcement, who is an IRS officer (Indian Revenue Service).

It mainly deals with two laws which are, FEMA (Foreign Exchange Management Act), and PMLA (Prevention of Money Laundering Act).

It has its own courts for trial and its own appellate tribunals.

It investigates and files suits in courts against those who violate the rules of FEMA and PMLA.

It resolves the matters or issues by adjudication and has provision for appeal in both acts.

the Act PMLA 2002, empowers the Director to attach and confiscate the tainted property suo-moto, for a maximum period of 180 days, if he has reasons to believe that the property has been acquired out of criminal proceeds of a scheduled offence.

Work with upgraded systems and methods to improve work performance and remove outdated systems and methods.

The team is responsible for the consequences of their actions and answerable for an outcome.