Introduction

Demonetization is the term used when the old currency of a country is changed, and a new currency is introduced. When demonetization occurs, it discontinues the use of a currency, and the new currency is adopted. The old currency becomes valueless, and it must be exchanged with the new currency in the bank. A time is always given to the public to exchange currency. Without time, it’s impossible to run the new currency, as all the money-related work will get stopped and for the public, it becomes a huge burden to exchange the currency, and it will pile up everything. The new currency includes new notes or coins. It is a tool to balance the Currency and is a solution to inflation, enhance trade and erase the black money from the economy. Sometimes, a country eliminates the old currency and introduces a new currency. Demonetization can cause a serious downturn in an economy if it goes wrong.

Removing a currency is a massive intervention in an economy because it directly affects the medium of exchange used in all economic transactions. It is done sometimes to modernize the economy by making it less cash-based, and also helps in the eradication of black money and corruption.

Some Motives For Demonetization

1. Elimination of black money:-

The term black money refers to unaccounted money. It is a household name in India. Black money holders don’t pay taxes on this money. The government wanted to erase the black money stock by demonetization.

2. Eradication of corruption:-

The government struck the root of the medium of bribery, high-value currency notes. High-value notes are mostly acceptable as bribes and other illegal activities.

3. Elimination of counterfeit currency:-

The counterfeit currency enhances the circulation of money and contributes to an inflationary spiral. Note ban can eliminate counterfeit currency. Counterfeit currency means the circulation of fake money. If a large amount of fake money is circulated means a large demand for the goods and services which will then raise the price of goods and services which will lead to the devaluation of money. So, it should be eliminated from the economy.

4. Money laundering:-

The main purpose of demonetization is to check money laundering. Money laundering refers to the hidden money transferred to different regions of the country. It creates crises in the economy. It slows down the progress of the economy and it promotes crime in the economy. Demonetization can eliminate it.

5. To control the circulation of fake money:-

Fake money leads to an imbalance in the economy. Printing of fake money is an illegal business. To stop the continuation of this demonetization can be done.

6. To run a cashless economy:-

To make an economy cashless, demonetization plays an important role. Through demonetization, the economy must use cashless methods for payments and other money-related transactions.

7. To reduce or eliminate tax evasion:-

By demonetization, people exchange their current currency which will ultimately reduce tax evasion as each, and every money of a person is accounted for. Demonetization gives a long-term benefit to the economy by banning the high currency notes.

Demonetization In India

In India demonetization has taken place three times, the first was in 1946, the next was in 1978, and the third time in the year 2016.

In 1946, demonetization occurred for the first time in India which banned notes of Rs 500, Rs 1000, and Rs 10000 from the Indian currency. Demonetization was declared by Sir Archibald Wavell. When India was out of jolt of British rule, it was at a peak and demonetization was declared, which was a very hard time for the citizens of India. Black marketing was evolving during the Second World War, so a decision was made to eliminate black money from the economy by demonetization. But it was not very impactful as the currency notes that were banned were not accessible to the common people. In 1954, both the notes were again reissued with an introduction of Rs 5000. The main aim of demonetization was to reduce tax evasion or cut off the circulation of black money in the economy. Many government officials became richer after this through bribery and corruption.

In 1978, the second demonetization took place. It was also aiming to reduce the circulation of black money in the economy. It was declared when the Janta Party coalition agreed to eliminate 10000, 1000, and 500 rupee notes. It was opposed by the RBI Governor, as it was thought the corrupt preceding government leaders. A week was given to exchange the currency notes.

In 2016, Prime minister Narendra Modi declared demonetization on Indian television. It was done for accomplishing four objectives: checking terror funding by Pakistan, Black money, Printing of counterfeit currency, and corruption.

How Demonetization Is Processed

The decision of demonetization was planned beforehand to curb the black money in the economy. It was a sudden announcement by the government

The notes of Rs 500 and Rs 1000 were banned from the Mahatma Gandhi series. These were legally stripped out from the economy and considered illegal. Then the new notes and coins were introduced into the economy. A time of 2 months was given to exchange the old currency with the new currency in the bank. Long queues were made, and old currencies were exchanged. After that time duration, the old currencies were declared officially illegal. And the medium of exchange only can be done with the new currencies.

2016 Demonetization Impact

The notes were banned from the Mahatma Gandhi series. The notes of Rs500 and Rs1000 were legally stripped out from the economy. It had a great bang on the Indian economy. Many got benefits while many sections suffered. There were long queues behind the banks for exchanging the currency that lasted for months. As it was a surprise for the whole nation. It was announced on 8 November 2016 at 8 pm. December was considered the last to exchange the currency, but it lasted beyond that also. As so many people, from poorer sections to the rich households with such a big population, it was very difficult to cooperate with the government. This situation became a disaster as many banks were out of new currency to be distributed to such a large group of people. ATMs were also out of money. It was really a very harsh situation, especially in the lower section of society.

It was a surprise announcement, in which the leaders’ said secrecy was needed to catch the holders of black money. And, to prevent them from getting rid of that money within 4 hours.

But still, there were many people who were seen as trying to convert their black money to white by purchasing jewelry, land, and traveling. They converted their black money into assets, and they will monetize it later.

GDP growth rate started to decline sharply in the post-demonetization years. India’s GDP growth rate increased persistently from 5.2% in 2011-12 to 8.3% in 2016-17. This trend reserved itself and the economy started to drop growth incentives with the GDP growth reaching just 4% in 2019-20.

Economic Impact

Cash is the most important thing in the economy. Its circulation is the heart of the economy, if it’s hurt, it affects the whole economy and all who are a part of that economy. In an economy there are both small and large firms and a large part of India is an unorganized sector. Small or micro-units use cash as the medium of exchange and don’t use the formal banking system. Unorganized sector, the organized sector was also affected by demonetization as many lost their incomes and they simply can’t work without cash.

The whole economy collapsed due to this. However, according to the data provided, 2016-17 had the best economic growth rate. It may be because the unorganized sector data is not collected. It only calculated the organized sector and made a result. Or it may be correct but before demonetization, it totally ruined the economic growth.

A very long period has been taken for this demonetization. And within that period, it was evident that the unemployment rate grew, and the inequalities also grew. It caused the economy to slow down. Demonetization was not positive at all and caused the economy to suffer and be damaged to a high level. Many farmers, women, and workers suffered a lot in demonetization.

The government, however, has stated that demonetization has had positive impacts on the economy. Several studies conducted by international researchers have shown the unfavorable impact of demonetization on the Indian economy.

Impact on automobiles Industry-

- It was a very tough situation for the automobile industry also, as its sales went extremely down. During 2015 and 2016 the growth in the automobile industry was seen but in the same year, after the announcement of demonetization suddenly it shows a fall in the industry. Demonetization hit the sales of automobiles in a drastic way. Passenger vehicles fell below double-digit. Demonetization didn’t hurt the luxury car makers in India. But now the industry is reviving itself gradually.

Political Impact-

The government promised to bring back black money of 15 lakhs from foreign and give it to each family in India, but it didn’t happen. No money was brought back from foreign, and no one knows where the money is.

The ruling party lost a lot of money in the election in Bihar, but to show seriousness it tried to check black money by setting up a supreme court-monitored special investigation team and imposition of tax act in 2015 and an income declaration scheme in 2016. But none of these worked. So, demonetization was declared.

- Demonetization also affected the GDP, before demonetization. After demonetization occurred it gradually decreased the GDP of the economy.

Advantages Of Demonetization

- There are some advantages of demonetization, also seen in the economy. India is now not fully based on cash.

After demonetization, India surged to be a cashless economy.

Many apps launched for digital transactions of money, which don’t require the use of cash. Anyone can use who has a bank account from anywhere. And it is also safe and secure. Almost every person from a lower or rich household uses the online mode of payment, as it eliminates the use of cash and the physical presence of the person. It helped India a lot through demonetization. And it’s growing since 2017. It’s convenient to use and online mode doesn’t need to carry money all the time in the pockets or purse.

Through online banking, each money has a record of its own, whether the person is purchasing anything from the shop or transferring a certain amount to someone. A small to big amount has a history. Other than this the government also can evaluate the money in the economy.

- The rate of inflation goes down after demonetization. As the necessary consumed goods like vegetables, pulses, fruits went down, which allowed the poorer section to purchase those items easily.

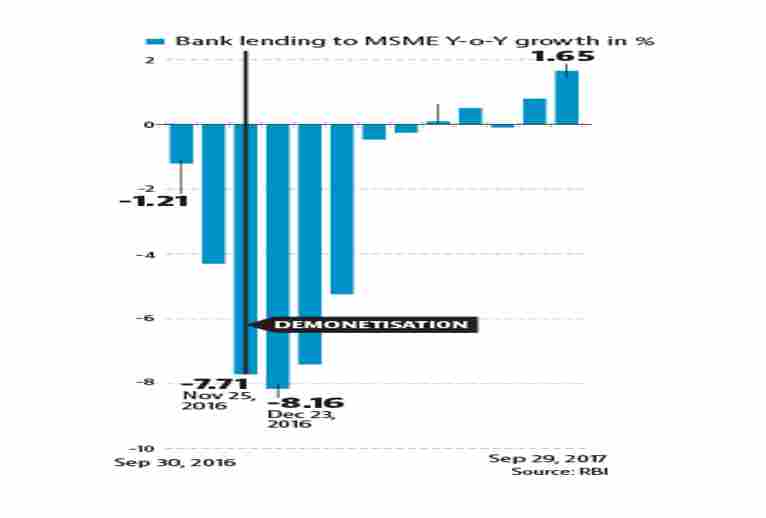

- Bank lending increased for small businesses. It was going on a negative side before demonetization, but after it was seen as positive growth of bank lending.

Through demonetization, new currency notes were introduced. New notes were issued of Rs 100, Rs 500, and Rs 2000. New currency notes were introduced with different colors, designs, and sizes. It can be easily identified the number of notes by seeing its color. The highest note that is in circulation is Rs2000, which is in pink color.

Disadvantages Of Demonetization

Halt in the economic growth- Demonetization paused the growth of the economy for a certain period. It reduced around 2-3 percent of jobs in India. Growth of India can be facilitated when the economy is stable, but economy came to a halt.

Difficulties in paying bills and exchanging money- Before demonetization was announced, if anyone has sent money to someone and it is delayed, the value of that money will diminish. This happened with many traders and sellers as they used to send and receive money in their day-to-day life.

Remodification of ATM- After demonetization, new currency notes were introduced for which the ATMs were to be re-modified as per new notes. Which incurs a lot of money and time. This had been very difficult for the customer as well as the users.

Short-term economic crises for the needy- As demonetization harshened the life of small and medium businesses, it affected the life of poorer section or the person who is in need. It became a problem for those people.

Reactions Of Media, Opposition, And Citizens

1. The Media:-

The media reported the demonetization on TV and in the print media. There were many rumors spread that new notes were having GPS chips that can be traceable. Lots of articles were published on print media about the ‘long queues’ and ‘out of cash in the bank’. There were lots of talks in the media all around.

Media also sometimes talked about the crises and difficulties in the public and bankers and sometimes about the benefits of the economy. They heartily welcomed the demonetization as they thought it can bring something new to the economy and will curb the black money.

But in the news, it was also mentioned that no black money was refunded.

The media totally mixed up the positive and negative aspects of demonetization.

2. The Opposition:-

- The opposition party tried their best to put dirt on the demonetization planning. They were spilling lots of things in the media and all over the rally. Some said they wanted debates on the issue, and some were saying the government was playing with the world and experimenting. Some said it was a plan to disturb the economy and be harsh with the people. Communist party Sitaram Yechuri also said that demonetization was an abnormal condition where the people can’t use their own money, it was a total violation of the fundamental rights of the property. They also challenged PM Modi that if he is really an honest man then dissolve the Parliament and hold fresh elections.

3. The Citizens:-

- The citizens were in the favor of demonetization. No were in the media it Was mentioned that people were protesting the government. They were suffering and were doing hardships to exchange their money. But still, they were cooperating with the government. They were in hope of changes in the economy.

Summary

Demonetization was declared three times but still, those were not as impactful as it was promised. Black money still circulates, but this timeless black money is in circulation in the economy. Many things changed after demonetization, some lost their incomes, and some lost their money. But the ones who were not involved in the circulation of black money welcomed demonetization happily. But still, they suffered a lot in front of banks. Long queues were seen in every bank. ATMs were out of money, and many had to see the harsh situation at that time. Demonetization was a nightmare for many. Despite that people cooperated with the government, to see an economy with no black money and corruption-free. But the dream of the people remains incomplete.

Demonetization had a severe economic impact. The currency notes that were demonetized amounted to approx. 85% of the economy’s total cash. And 85% of total cash had sudden effects that were crippling both the short and long term.

A very little amount of black money in the economy was collected.

Either the black money was very low in the economy, or the government failed to implement the demonetization in an effective way. And this is the reason why black money is still in circulation in the economy. It must be governed properly and effectively. So that if any such action will be implemented further, it should not create trouble like the 2016 demonetization or any other previous demonetization.

But recently RBI said in the subsequent year black money amounting to 15.31 lakh crore was returned out of Rs 15.41 lakh crores that were invalidated.

Demonetization is needed in an economy for eliminating the corruption, flow of black money, tax evasion, and fighting with terrorism funds. But for applying demonetization there should be a proper way and rules and management. To eliminate problems there should not be problems. Proper management in the economy will gradually remove the black money and a lot more problems in the economy. It should be properly studied and implemented.

When the demonetization was announced, there was an insufficiency of cash across the country, as people mixed up to exchange their existing banknotes. It led to disturbance to the economy, reducing India’s industrial production and hampering its GDP growth rate.

Demonetization was done on high currency notes as a surplus amount of higher denomination fake currency notes were in circulation in the economy which seems to cause a rise in the crime rate too. The Rs.1000 and Rs.500 notes made up 86% of the monetary base of India and stripping these currency units will bring down cases of money laundering and tax evasion.

However, the promise was not fulfilled completely by the government. Still, there are fake currencies that must be removed from the economy.

Top 13 Interesting Facts On Demonetization

On November 8, 2016, demonetization was declared in India. Some Indians observe its anniversary as a boon, while others celebrate it as ‘black day’.

Government is still unable to measure the demonetized notes, black money, defaulters, etc.

The highest denomination note ever printed by RBI is Rs 10000.

The government said demonetization will eliminate black money, but it harmed the small and medium units.

After demonetization, India became a less cash-based economy.

Many people who were having black money, throw it in the river or dustbins. It was the daily news about how people get rid of their unaccounted money.

Opposite of demonetization is Remonetization, which means restoring the currency.

In 1980, ‘truth alone shall prevail’ was a quote by the legend Satyamev Jayate that was embedded for the first time.

The highest denomination note in India is Rs2000.

Portrait of Mahatma Gandhi and Ashoka Pillar watermark on Rs 500 note was introduced in October 1987.

In August 2005, Rs 50 and Rs 100 were introduced.

In October 2005 Ra Rs 1000 and Rs 500 in April 2006 were introduced.

Rs 10 and Rs 20 in April 2006 and August 2006, respectively were introduced.

For deep details, you can read the full article. Click the link below :