Biography Of Rakesh Jhunjhunwala

Introduction

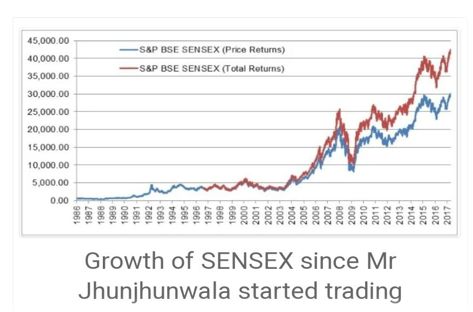

- Rakesh Jhunjhunwala was an Indian billionaire, business magnate, stock trader, and investor who began investing in 1985 with a capital of Rs. 5,000 with his first major profit in 1986. At the time of his death, Jhunjhunwala had an estimated net worth of $5.8 billion which made him the 438th richest person in the world.

Early life

Jhunjhunwala was born on 5 July 1960 and grew up in a Rajasthani Marwari family, in Mumbai, where his father worked as a Commissioner of Income Tax. His surname indicates that his ancestors belonged to Jhunjhunu in Rajasthan.

Rakesh Jhunjhunwala consistently used to hear his father discussing the stock market with his friends. As he was very curious about stocks, he once asked his father why the stock price fluctuated daily. His father suggested he read newspapers as it’s the news that makes the price of stocks fluctuate.

Rakesh Jhunjhunwala also expressed his wish to pursue a career in the stock market. However, his father suggested he first to get a graduate degree from a college. Rakesh Jhunjhunwala graduated from Sydenham College in 1985 as a chartered accountant.

Career

Jhunjhunwala had an interest in the stock market since he had first observed his father talking about it with his friends. Although his father guided him in the field of stock markets, he never offered him any money to invest there. But Rakesh did not stop there and started investing in stock markets just when he started going to college. He invested his savings of 5000 rupees in 1985, which has given him a whopping return of INR 11,000 crores today.

Jhunjhunwala’s first big profit came in the form of ₹5 lakh in 19861986. Between 1986 and 1989, he earned almost ₹20–25 lakh profit. By 2022, his investment had grown to ₹11,000 crores. As of 2021, his biggest investment was in Titan Company which is worth ₹7,294.8 crores. Jhunjhunwala did not just stop there.

Achievements

He managed his own portfolio as a partner in his asset management firm, Rare Enterprises. Besides being an active investor Jhunjhunwala was the chairman of Aptech Limited and Hungama Digital Media Entertainment Pvt. Ltd. and sat on the board of directors of Prime Focus Limited, Geojit Financial Services, Bilcare Limited, Praj Industries Limited, Provogue India Limited, Concord Biotech Limited, Innovasynth Technologies (I) Limited, Mid-Day Multimedia Limited, Nagarjuna Construction Company Limited, Viceroy Hotels Limited, and Tops Security Limited.[citation needed] He was also a member of the Board of Advisors of India’s International Movement to Unite Nations (I.I.M.U.N.).

In 2013, Jhunjhunwala bought 6 of the 12 units of Ridgeway apartments at Malabar Hill from Standard Chartered bank for ₹176 crore. Later in 2017, he bought the other 6 apartments in the building from HSBC for ₹195 crore. In 2021, he commenced the construction of his new 70,000 square feet 13-storey home after the demolition of the old building. In 2021, he co-founded Akasa Air, a low-cost airline in India,with former Jet Airways CEO Vinay Dubey. The new airline has 2 aircraft, with additional order for 70 more aircraft, and as of August 2022, flies to 3 cities.

Rakesh Jhunjhunwala Net Worth

Rakesh Jhunjhunwala was a business magnate who was known for his business skills and talent of identifying profitable investments. He began investing in the year 1985 with a capital of Rs. 5,000, with his first major profit coming in 1986.

At the time of his death, Rakesh Jhunjhunwala had an estimated net worth of $5.8 billion, making him the 438th richest person in the world.

At one time, Rakesh Jhunjhunwala was also investigated for insider trading. As of July 2021, the Security Exchange Board of India (SEBI) had settled the issue after the total payment of Rs. 35 crores from Jhunjhunwala and his associates. At the time, Rakesh Jhunjhunwala paid Rs. 18.5 crores and his wife paid Rs. 3.5 crores.

Multi-Baggers Stocks In Rakesh Jhunjhunwala’s Portfolio

Rakesh Jhunjhunwala manages a privately owned stock trading firm called ‘RARE Enterprises’. The name is derived from the first two initials of his name and his wife Mrs. Rekha Jhunjhunwala.

During his long career in the stock market, Rakesh Jhunjhunwala invested in a number of multi-bagger stocks.

In 2002-03, Rakesh Jhunjhunwala bought ‘Titan Company Limited’ at an average price of Rs 3, and currently, it is trading at a price of Rs 2140. He is holding over 4.4 crore shares of titan company. He has an ‘overall’ holding of 5.1% in the company as of March 2022

In 2006, he invested in LUPIN and his average purchase price was Rs 150. Today, LUPIN is trading at Rs 635. A few other multi-baggers in Rakesh Jhunjhunwala’s portfolio are CRISIL, PRAJ IND, Aurobindo Pharma, NCC, etc.

In a recent turn of events, Rakesh Jhunjhunwala once again made headlines for making 50 crores in just 8 days.

Apart from being on the board of directors of big companies like Prime Focus Ltd, Geojit BNP Paribas financial services, Praj Industries, Concord Biotech, etc, Rakesh Jhunjhunwala is also a movie producer. He has produced movies like ‘English-Vinglish’, ‘Shamitabh’, ‘Ki and Ka’. He is the chairman of Hungama Digital media entertainment Pvt Ltd.

Latest Stock Portfolio Of Rakesh Jhunjhunwala

Here are the latest stocks with the most weightage in Rakesh Jhunjhunwala’s Portfolio:

| Sl No | Company Name | Quarter | No of Shares | Current Price | Percent | Total Value |

| 1. | Bilcare Ltd | March 2022 | 1997925.00 | 65.55 | 8.48 | ₹ 130,564,398.75 |

| 2. | Canara Bank | March 2022 | 35597400.00 | 208.00 | 1.96 | ₹ 7,423,837,770 |

| 3. | Geojit Financial Services Ltd. | March 2022 | 18037500.00 | 51.55 | 7.55 | ₹ 909,991,875 |

| 4. | Jubilant Ingrevia Ltd | March 2022 | 5020000.00 | 493.00 | 3.15 | ₹ 2,504,729,000 |

| 5. | Prozone Intu Properties Ltd. | March 2022 | 3150000.00 | 21.35 | 2.06 | ₹ 66,937,500 |

| 6. | Indiabulls Real Estate Ltd. | March 2022 | 5000000.00 | 62.10 | 1.10 | ₹ 318,750,000 |

| 7. | Titan Company Ltd. | March 2022 | 44850970.00 | 2138.70 | 5.05 | ₹ 95,442,864,160 |

| 8. | Man InfraConstruction Ltd. | March 2022 | 4500000.00 | 80.30 | 1.21 | ₹ 368,550,000 |

| 9. | NCC Ltd. | March 2022 | 78333266.00 | 56.50 | 12.84 | ₹ 4,457,162,835.4 |

| 10. | Fortis Healthcare Ltd. | March 2022 | 31950000.00 | 252.75 | 4.23 | ₹ 8,083,350,000 |

Controversy

Jhunjhunwala was investigated for insider trading. As of July 2021, the SEBI had settled the issue after a total payment of ₹35 crores from Jhunjhunwala and his associates. Jhunjhunwala paid ₹18.5 crores and his wife paid ₹3.2 crores.

Rakesh Jhunjhunwala, his wife Rekha, and eight others linked with an insider trading probe involving the stock of Aptech have settled the nearly five-year-old case by collectively paying the market regulator Rs 37 crore. A lawyer for the investor said the move was aimed at preventing further litigation and didn’t amount to an admission of guilt.

Jhunjhunwala’s brother Rajeshkumar, sister Sudha Gupta and mother-in-law Sushiladevi Gupta are the other members of the billionaire’s family opting to settle the case with the Securities and Exchange Board of India (SEBI).

on 6 February 2021 Rakesh Jhunjhunwala, some other members of his family, and several board-level executives at Aptech filed a settlement application with the markets regulator in the case.

Rakesh Jhunjhunwala and his wife Rekha paid Rs 18.5 crore and Rs 3.2 crore, respectively. The Rs 37-crore settlement amount includes disgorgement of gains and interest charges.

Utpal Sheth, CEO of Jhunjhunwala’s asset management firm Rare Enterprises, and his sister Ushma Sheth Sule have also settled the insider trading complaint. Utpal Sheth is a director of Aptech. The probe relates to an Aptech filing with stock exchanges on September 7, 2016, announcing the company’s entry into the preschool segment.

“The said information was considered Unpublished Price Sensitive Information (UPSI) and the period of UPSI was March 14, 2016, to September 7, 2016,” Sebi said in its settlement order on Wednesday. “It is alleged that Utpal Sheth and Rakesh Jhunjhunwala were in possession of the UPSI and communicated it to the other applicants. The regulator alleged that on the basis of inside information, Rakesh Jhunjhunwala and his family members traded in the shares of Aptech during the UPSI period. A settlement does not mean that the case of SEBI was proved or there is any admission by Mr. Jhunjhunwala and others. It only means that the notices decided to not litigate and bought peace,” said Sumit Agrawal, founder of Regstreet Law Advisors and Rakesh Jhunjhunwala’s legal counsel. Separately, other Aptech board members, including investor Ramesh S Damani and independent director Madhu Jayakumar, paid Rs 6.2 crore and Rs 1.7 crore, respectively, to settle the matter. Aptech’s former director Chugh Yoginder Pal has also settled the case. Aptech’s current and former board members, in possession of insider information, were also alleged to have traded in the company’s shares during the UPSI period, SABI said in a separate order.

Rakesh Jhunjhunwala: Investments

As per a popular website money control, his net worth is approximately INR 29,644 crores and he also owns 35 company holdings.

His major investments are in;

- Construction and Contracting – 11%

- Miscellaneous- 9%

- Banks- Private Sector – 6%

- Finance- General- 6%

- Construction and Contracting Civil- 6%

- Pharmaceuticals- 6%

- Banks- Public Sector- 3%

Philanthropy

- Jhunjhunwala, whose net worth stands at $5.8 billion at the time of his death, had plans to donate a quarter of his wealth to charity. His philanthropic portfolio included health care as well as education-related initiatives, supporting organizations such as St Jude, Agastya International Foundation, Ashoka University, Friends of Tribals Society and Olympic Gold Quest. He was also active in efforts to construct an eye hospital in Navi Mumbai. He also supports Ashoka University, Friends of Tribals Society and Olympic Gold Quest.

Personal Life

- Rakesh Jhunjhunwala married Rekha Jhunjhunwala on 22 February 1987. The couple has three children together. Their daughter Nishtha was born on 30 June 2004. Their twin sons Aryaman and Aryaveer were born on 2 March 2009.

Death

- On 14 August 2022, Jhunjhunwala felt ill and was rushed to Breach Candy Hospital in Mumbai, and died at approximately 6:30 a.m. Doctors later reported that he suffered from kidney-related problems and acute multiple organ failure.

Popular Quotes By Rakesh Jhunjhunwala

“Nobody can predict the weather, death, market, and women. The market is like a woman, always commanding, mysterious, uncertain, and volatile. You can never really dominate a woman and likewise, you cannot dominate the market.”

“Prepare for losses. Losses are part and parcel of stock market investor life”.

“Buy when others sell and sell when others buy – the stock market mantra.”

“Respect the market. Have an open mind. Know what to stake. Know when to take a loss. Be responsible.”

“Stock markets are always right. Never time the market.”

Top 13 Facts About Rakesh Jhunjhunwala

Rakesh Jhunjhunwala was an Indian businessman who is popularly known as ‘ the Big Bull ‘ or ‘ the Phoenix ‘ of the Indian Stock Market. He started his journey with a meager Rs 5000 as capital and built an empire worth Rs 19000 crores (approx.).

Son of an income tax officer, Jhunjhunwala started dabbling in stocks while still in college.

He began investing with $100 in 1985 when the Bombay Stock Exchange Index was at 150; it now trades at over 50,000.

The most valuable listed holding in his portfolio at the time of his death was watch and jewelry maker Titan, part of the Tata conglomerate.

Jhunjhunwala’s early bets on Star Health and Allied Insurance and Metro Brands paid off when both companies were listed in 2021.

Rakesh’s first big profit was of Rs 5 lakhs in shares of Tata Tea at Rs. 43, which later rose to Rs. 143, giving him a 300 % profit.

He also invested in Sesa Goa in his early days. He bought the shares at Rs 28 because he was quick enough to realize the fall in the prices of iron ores and then sold them at Rs. 65. The future maestro of Dalal Street made a profit of 25 lakhs in the first couple of years of his trading business.

His major investments include buying 8 crore shares of Titan Ltd. in 2002-03 at around Rs 5 / share, which skyrocketed to Rs. 1500 as of 2020. He also bought the shares of Lupin Ltd. at Rs. 150. As of 2020, the price of Lupin stands at around Rs. 975. Such investments helped Rakesh generate immense wealth.

Jhunjhunwala also faced some hardship when his stocks fell by 30 % after the 2008 recession, but he recovered almost all of his losses by early 2012.

The King of Dalal Street co-owned the asset management company ‘ Rare Enterprises ‘ with his wife Rekha Jhunjhunwala. The name of the company is derived from the initials of the joint owners, ‘ Ra ‘ from Rakesh and ‘ Re ‘ from Rekha.

As of 2020, Rakesh was listed as the 54th richest Indian, and Mukesh Ambani topped the list. He made the headlines in 2017 when he earned more than Rs. 875 crores in a single day due to the surge in Titan’s share price.

Rakesh considered Radhakishan Damani. an Indian billionaire stock investor, as his business Guru. Rakesh and Damani made a lot of profit by short – selling the stocks during the time when Harshad Mehta was conceded as the Big Bull.

Rakesh Jhunjhunwala is also a movie producer. He has produced movies like ‘English-Vinglish’, ‘Shamitabh’, ‘Ki and Ka’. He is the chairman of Hungama Digital media entertainment Pvt Ltd.