- Umang Sagar

- Biography, Company / Organisation

Reserve Bank Of India (RBI)

A bank is a place that will lend you money if you can prove that you don’t need it – BOB HOPE

Introduction

- The Reserve Bank of India is India’s central bank and regulatory body and is responsible for the issue and supply of the Indian rupee and regulation of the Indian Banking System. It manages the country’s main payment systems and works to promote its economic development.

| Governor | Shaktikanta Das |

| Headquarter | Mumbai |

| Founded | 1st April 1935 |

| Founder | British Raj |

History Of Reserve Bank Of India

- The Reserve Bank of India is also known as the Nation’s Central Bank. According to the bank dossiers, it began operations on April 01, 1935. In 1926 the Royal Commission on Indian Currency and Finance recommended the creation of a central bank of India. In 1933 The White Paper on Indian Constitutional Reforms recommended the creation of a Reserve bank. RBI was originally set up as a private entity in 1935, but it was nationalized in 1949. It was set up on recommendations of the Hilton young commission. In 1921 it was set up as the Imperial bank of India by the British government.

Legal Framework

The Reserve Bank of India comes under the purview of the following acts:

- Reserve Bank of India Act 1934

- Public Debt Act 1944

- Government Securities Regulations 1949

- Banking Regulations Act 1949

- Foreign Exchange Management Act 1999

- Credit Information Companies (Regulations) Act 2005

- Payment and Settlement Systems Act 2007

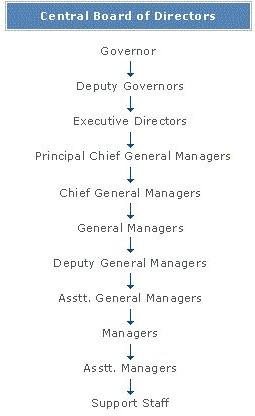

Organizational Structure

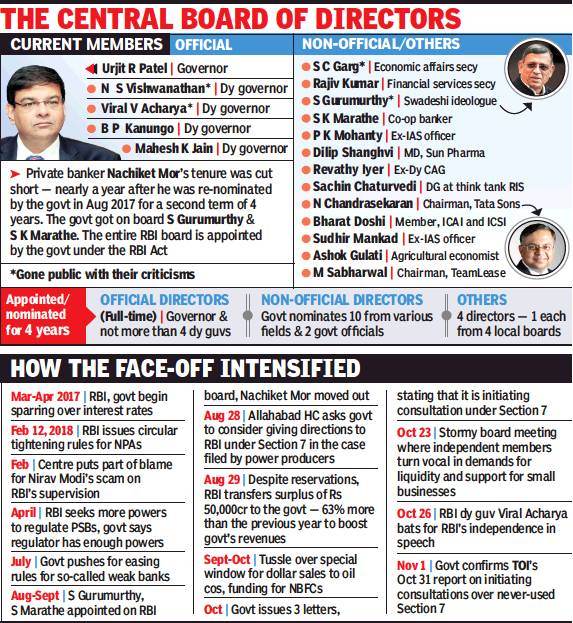

- Reserve Bank OF India is controlled by a central board of directors. The directors are appointed for a 4-year term by the government of India in keeping with the Reserve Bank of India Act.

The Central Board Consists of:

- Governor

- 4 Deputy Governors

- 2 finance ministry representative

- 10 governments nominated directors

- 4 directors who represent local boards

Reserve Bank Of India Governors

The Reserve Bank’s affairs are governed by the Central Board Of Directors(CBD). Members of the board are appointed by the Government Of India In accordance with section 8 of the Reserve Bank Of India Act.

The CBD as the administrative apex body of the RBI contains two sets of directors. First are the official directors and the second is nonofficial directors.

Qualifications And Terms Of Governors

The governors and Deputy Governors hold office for periods not exceeding five years. The term of the governor may be fixed by the government at the time of his appointment.

The RBI Act doesn’t mention any specific qualification for the governor. Qualification for governor is a matter of convention rather than a rule.

List Of All RBI Governors With Their Tenure

| Name of Governors | Tenure |

| Osborne smith | 1935 |

| James Braid Taylor | 1937 |

| C.D.Deshmukh | 1943 |

| Benegal Rama Rao | 1949 |

| K.G.Ambegaonkar | 1957 |

| H.V.R.Iyengar | 1957 |

| P.C.Bhattacharya | 1962 |

| Lakshmikant Jha | 1967 |

| B.N.Adarkar | 1970 |

| Sarukkai Jagannathan | 1970 |

| N.C.Sen Gupta | 1975 |

| K.R.Puri | 1975 |

| M.Narasimham | 1977 |

| I.G.Patel | 1977 |

| Manmohan Singh | 1982 |

| Amitabh Ghosh | 1985 |

| R.N.Malhotra | 1985 |

| S.Venkata ramanan | 1990 |

| C.Rangrajan | 1992 |

| Bimal Jalan | 1997 |

| Y.Venugopal Reddy | 2003 |

| D.Subbarao | 2008 |

| Raghuram Rajan | 2013 |

| Urjit Patel | 2016 |

| Shaktikanta Das | 2018 |

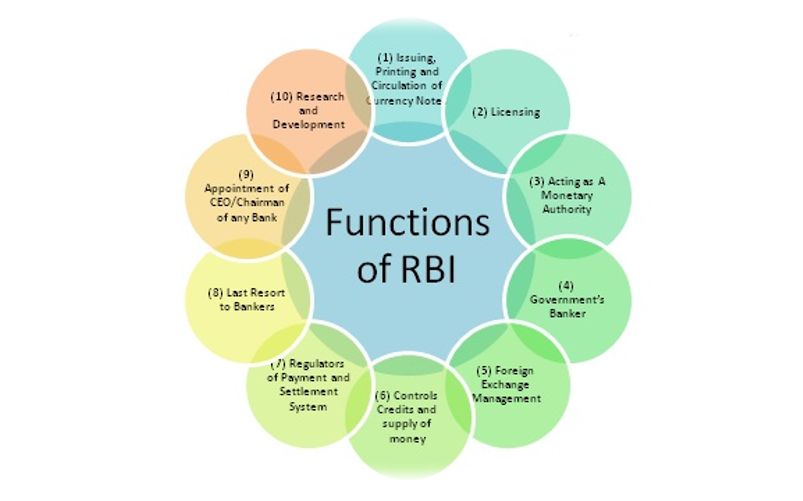

Functions Of Resreve Bank Of India

- In the Indian context, the basic functions of the Reserve Bank Of India as enunciated in the Preamble to the RBI Act 1934 are: “to regulate the issue of bank notes and the keeping of reserves with a view to securing monetary stability in India and generally to operate the currency and credit system of the country”.

Some of the basic functions of the RBI are:

The issuer of notes: The RBI is the only institution that has control overprinting of currency notes (except the one rupee note, which is printed by the finance ministry).

Banker to the government: The RBI performs banking functions for the state and central governments. It advises the government on monetary policy issues and also manages the government’s public debt.

Banker’s Bank: The central bank is also known as the banker’s bank because it performs functions similar to what commercial banks do for their customers.

Credit Regulation: The RBI regulates the flow of money in the country’s financial system. It controls inflation in the economy and takes necessary policy decisions from time to time to address systemic concerns.

Foreign reserves: The central bank buys and sells foreign currencies to keep the foreign exchange rates stable. It takes necessary steps as and when required.

Monetary Authority: It formulates and implements the national monetary policy.

Regulatory and supervisory: It sets parameters for banks and financial operations within which banking and financial systems function.

Developmental role: It promotes and performs promotional functions to support national banking and financial objectives.

Reserve Bank of India acts as a Lender of last resort.

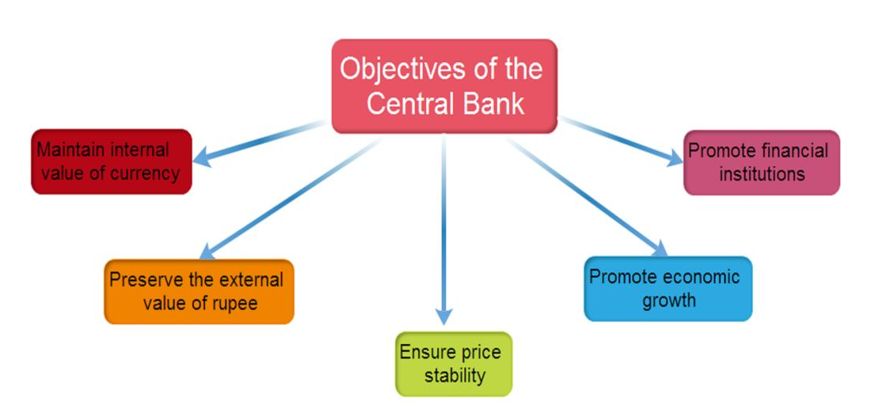

Objectives Of Reserve Bank Of India

To manage the monetary and credit system of the country.

To stabilize the internal and external value of the rupee.

For balanced and systematic development of banking in the country.

For the development of an organized money market in the country.

For the development of an organized money market in the country.

For the proper arrangement of industrial finance.

For proper management of public debts.

To maintain a balance between the demand and supply of currency.

To establish monetary relations with other countries of the world.

To establish monetary relations with International Financial Institutions.

For centralizations of cash reserves of commercial banks.

Reserve Bank Of India Policies

1. Bank Rate

- It is the rate of interest at which the central bank lends funds to commercial banks. During excess demand or inflationary gap, the central bank increases the bank rate. Borrowings become costly and commercial banks increases bank rate. During a deflationary gap, central banks decrease the bank rate. It is cheap to borrow from the central bank or the part of the commercial banks which in turn the commercial banks also decrease their lending rates.

2. Open Market Operations

- The open market operations mean buying and selling of bonds and shares by RBI is an open market. It is also called buying and selling of government security by the central bank from the public and commercial banks.

3. Repo Rate

- Repo or repurchase rate is the benchmark interest rate at which the RBI lends money to all other banks for a short term. When the repo rate increases, borrowing from RBI becomes more expensive, and hence customers or the public bear the outcome of high-interest rates.

4. Reverse Repo Rate

- Reverse Repo rate is the short-term borrowing rate at which RBI borrows money from other banks. The Reserve Bank of India uses this method to reduce inflation when there is excess money in the banking system.

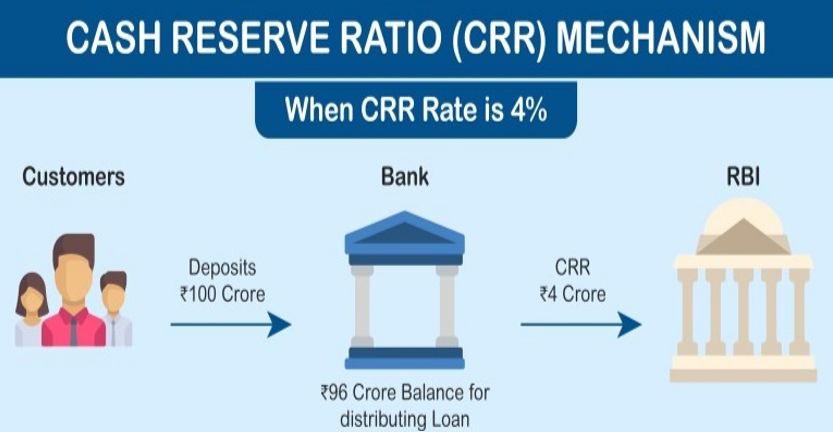

5. Cash Reserve Ratio

- Cash Reserve Ratio is the particular share of any banks’ total deposits that are mandatory and to be maintained with the Reserve Bank of India in the form of liquid cash.

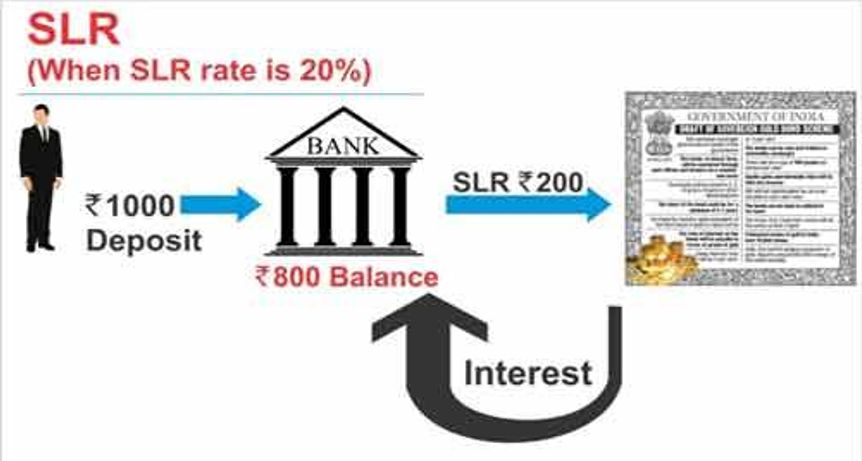

6. Statutory Liquidity Ratio

- Leaving aside the cash reserve ratio; banks are required to maintain liquid assets in the form of gold and approved securities. A higher SLR disables the banks to grant more loans.

Branches Of Reserve Bank Of India

- Reserve Bank of India is spread over 31 different locations in India. It is headquartered in Mumbai. There are four zonal offices of RBI at Mumbai, Kolkata, Delhi, and Chennai.

Controversies Of Reserve Bank Of India

- There were many incidents of conflicts between RBI and the central government in the past and as a result of which we witnessed so many ups and downs in the country citing the ongoing disputes. Sometimes it led to few resignations of governor in the past and indirectly affected our GDP and economy.

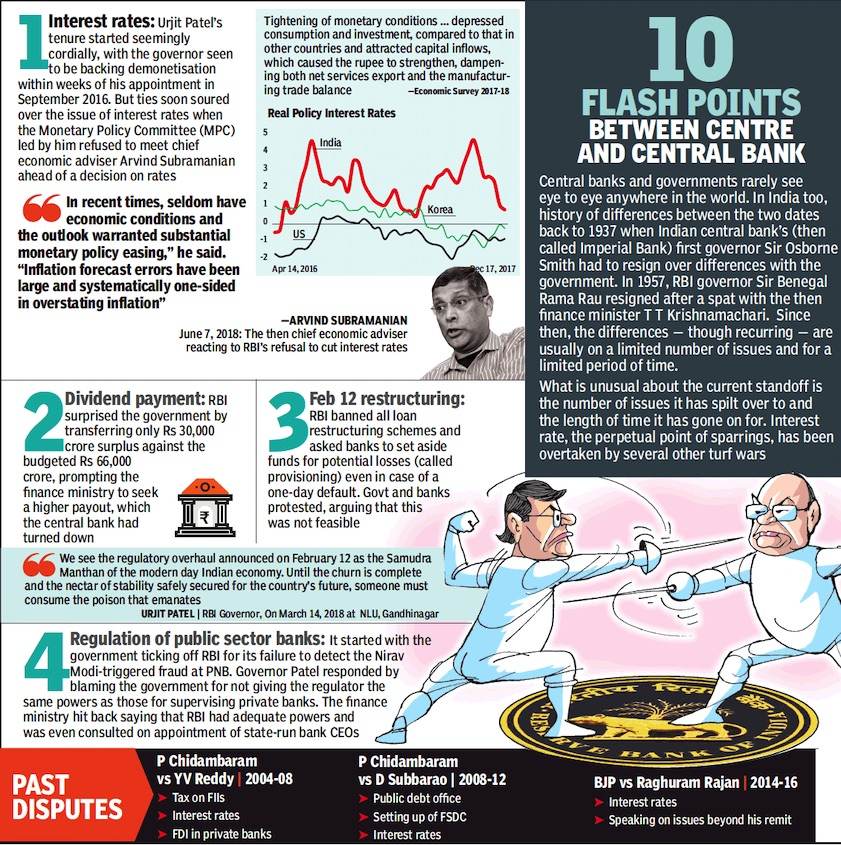

RBI Vs Central Government

These are some of the most debatable controversies between RBI and the central government:

1) Aadhaar Controversy

The Aadhaar controversy has not only become a sensitive topic for Indian citizens but also for the Reserve Bank of India and the government of India. From virtual ID to its data breach controversy, every issue affects us in our day-to-day life.

- There are rumors of Aadhaar Data Breach in the public domain, which has created controversy and confusion among people. This Controversy pointed out serious privacy issues regarding Aadhaar.

- Over the Aadhaar controversy, RBI has certified neither the central bank nor its IDRBT was in any way connected to a study on security aspects of Aadhaar.

2) Narendra Modi’s Government Vs Central Bank

A conflict between Narendra Modi’s BJP led government and India’s central bank had been brewing for some time. The government reportedly wants the RBI to allow ailing state-owned banks, groaning under dud loans to industries, to resume lending to small businesses. It also wants the regulator to lower interest rates to inject much-needed liquidity into the economy.

The two have also differed over government plans to set up a separate regulator to look after digital payments. In the past few months, the government has appointed a controversial right-wing accountant to the central bank board and cut short the tenure of another board member, apparently on the grounds of conflict of interest.

3) Raghuram Rajan Vs. Central Government

Former RBI governor Raghuram Rajan’s abrupt decision to quit came as a shock to the nation after a continuous attack and clash of opinion between him and the central government. Rajan never hesitates to voice his opinion about government policies and this voicing of opinion intensified the rift between him and the government.

As a result of which we saw the Resignation of Raghuram Rajan and he became the first governor to not able to continue his 2nd term as RBI‘s Governor. He criticized the government decision of Demonetization and the poor rolling out of GST. He criticized the Modi govt. mostly for focusing more on fulfilling its political and social agenda rather than paying attention to economic growth.

4) RBI Vs Urjit Patel

Urjit Patel’s resignation is one of the most debated topics in the country.

He resigned from the post of RBI governor citing personal reasons but people speculated that the difference of opinion with the center over RBI’s decisions and its functions may have prompted his resignation. The government and RBI were not on the same page on issues like the use of RBI’s surplus reserves, handling of weak banks, funds for shadow banks, and interest rates.

- Let’s have a look at the history of the most debatable fights between RBI and the central government.

Conclusion

- RBI is a central bank and regulatory body which is responsible for the issue and supply of the Indian Rupee and regulation of the banking system. The frequent disputes between RBI and the Central government should be avoided and both should not interfere in each other’s domain. Freedom of working space and acceptance of criticism is vital for any organization to perform better.

Top 13 Interesting Facts About RBI

RBI is fully owned by the Government of India since nationalization in 1949.

The RBI also stores a contingency fund (CF), which is another provision for tackling unexpected emergencies coming to surplus funds. This surplus is basically RBI’s income which it earns through interest on securities it holds.

The RBI’s affairs are governed by a Central Board of Directors (CBD). The members of the board are appointed by the Government of India in accordance with Section 8 of the Reserve Bank of India Act.

Issuing, printing, and circulation of currency notes are the most significant functions performed by the Reserve Bank of India. It is the responsibility of RBI to print and circulate the denominations of India. The Reserve Bank is authorized to print currency notes between only Rupees 2 to 10,000, however for one rupee notes and coins; the ministry of finance (Government of India) is authorized.

The Reserve Bank of India is the Apex Body of different financial institutions in India. Therefore the licensing procedure of those financial institutions is under the RBI. It is the RBI that approves the license of these institutions.

The emblem of the Reserve Bank of India has a Royal Bengal tiger standing in front of a palm tree. The tiger was referred from the statue at the gate of belvedere Kolkata. These are enclosed by Bhartiya Reserve Bank on top and RESERVE BANK OF INDIA at the bottom. This has been completed by two concentric circles with thin and thick lines.

Udaya Kumar Dharmalingam is an Indian educationist and designer best known for his design of the Indian rupee symbol. His design was Selected among five designs. According to Kumar, the design is based on the Indian Tricolor.

The slogan of RBI is DEVELOPING BANKING.

The first Indian to hold the post of Governor of RBI, Mr. C.D. Deshmukh. He was the third governor of RBI.

The name of the first RBI governor was Sir Osborne Smith.

The RBI logo was inspired by the East India Company double stamp.

The first woman to become the deputy governor of RBI is KJ Udeshi. She was appointed in 2003.

Dr. Manmohan Singh is the only Prime Minister who has also served as the Governor of RBI.