- Umang Sagar

- Company / Organisation, Organisation, Recent article

International Monetary Fund (IMF)

Introduction

The International Money related Fund (IMF) is a worldwide monetary establishment, settled in Washington, D.C., comprising of 190 nations. Its expressed mission is “attempting to encourage worldwide money-related participation, secure monetary steadiness, work with global exchange, advance high business and maintainable financial development, and reduce poverty around the world.”Formed in 1944, began on 27 December 1945, at the Bretton Woods Conference primarily by the thoughts of Harry Dexter White and John Maynard Keynes, it came into formal presence in 1945 with 29 part nations and the objective of remaking the international financial framework. It presently assumes a focal part in the administration of balance of payments difficulties and global monetary crises.

Through the asset and different exercises like the social occasion of insights and examination, reconnaissance of its individuals’ economies, and the interest for specific policies, the IMF attempts to work on the economies of its part countries. The association’s goals expressed in the Articles of Understanding are: to advance worldwide money-related co-operation, international exchange, high business, swapping scale steadiness, maintainable monetary development, and making assets accessible to part nations in monetary difficulty.IMF supports come from two significant sources: amounts and loans. Standards, which are pooled assets of part countries, produce most IMF reserves. The size of a part’s standard relies upon its monetary and monetary significance on the planet. Countries with more prominent monetary importance have bigger amounts. The standards are expanded occasionally for the purpose of supporting the IMF’s assets in the structure of special drawing rights.

Functions

As per the actual IMF, it attempts to cultivate worldwide development and economic stability by giving approach guidance and financing the individuals by working with developing countries to assist them with accomplishing macroeconomic solidness and decrease poverty. The reasoning for this is that private global capital business sectors work incompletely and numerous nations have restricted admittance to monetary business sectors. Such market defects, along with balance-of-installments financing, give the avocation to true financing, without which numerous nations could address enormous outside installment irregular characteristics through measures with unfriendly monetary consequences. The IMF gives substitute wellsprings of financing, for example, the Poverty Decrease and Development Facility.

Upon the establishment of the IMF, its three essential capacities were: to direct the proper conversion standard plans between countries, accordingly assisting public state runs administrations with dealing with their trade rates and permitting these legislatures to focus on monetary growth and to give transient money to help the equilibrium of payments. This help was intended to forestall the spread of global financial emergencies. The IMF was likewise expected to assist with patching the bits of the global economy after the Economic crisis of the early 20s and Universal Conflict failed verification as well as to give capital ventures to financial development and activities, for example, infrastructure.

History

The IMF was initially spread out as a piece of the Bretton Woods system exchange understanding in 1944. During the Great Gloom, nations strongly brought obstructions to exchange up in an endeavor to work on their weak economies. This prompted the devaluation of public monetary forms and a decrease in world trade.

This breakdown in worldwide money-related participation made a requirement for oversight. The agents of 45 legislatures met at the Bretton Woods Conference in the Mount Washington Inn in Bretton Woods, New Hampshire, in the US, to examine a structure for postbellum global financial collaboration and how to remake Europe.

There were two perspectives on the job the IMF ought to accept as a worldwide monetary organization. Most of White’s arrangement was joined into the last ventures took on at Bretton Woods. English economist John Maynard Keynes, then again, envisioned that the IMF would be an agreeable asset whereupon part states could attract to keep up with monetary action and work through intermittent emergencies. This view proposed an IMF that helped legislatures and to go about as the US government had during the New Arrangement to the extraordinary downturn of the 1930s.

The IMF officially appeared on 27 December 1945, when the initial 29 countries ratified its Articles of Agreement. By the finish of 1946, the IMF had developed to 39 members. On 1 Walk 1947, the IMF started its monetary operations, and on 8 May France turned into the main country to get from it.

The IMF was one of the critical associations of the worldwide monetary framework; its plan permitted the framework to adjust the reconstructing of worldwide private enterprise with the augmentation of public financial sway and human government assistance, likewise known as embedded liberalism. The IMF’s impact on the worldwide economy consistently expanded as it gathered more individuals. The expansion reflected, specifically, the accomplishment of political freedom by numerous African nations and all the more as of late the 1991 dissolution of the Soviet Union because most nations in the Soviet range of prominence didn’t join the IMF.

Uses

A recent source uncovered that the normal by and large utilization of IMF credit each decade expanded, in genuine terms, by 21% between the 1970s and 1980s, and expanded again by more than 22% from the 1980s to the 1991-2005 period. Another review has recommended that beginning around 1950 the mainland of Africa alone has gotten $300 billion from the IMF, the World Bank, and associate institutions.

A concentrate by Bumba Mukherjee found that developing democratic countries benefit more from IMF programs than developing autocratic countries because strategy making, and the most common way of concluding where credited cash is utilized, is more straightforward inside a democracy. One study done by Randall Stone found that albeit prior examinations observed little effect of IMF programs on the equilibrium of installments, later investigations utilizing more modern techniques and bigger examples “normally observed IMF programs worked on the equilibrium of payments”.

Impacts

Some exploration has observed that IMF credits can lessen the opportunity of a future banking crisis; while different examinations have observed that they can expand the gamble of political crises.IMF projects can diminish the impacts of a money crisis.

Some exploration has observed that IMF programs are less compelling in nations which have a created country benefactor (be it by an unfamiliar guide, participation of postcolonial organizations or UN casting ballot designs), apparently because of this supporter permitting nations to parade IMF program rules as these standards are not reliably enforced. Some research has observed that IMF advances decrease monetary development due to making an economic moral risk, lessening public venture, diminishing motivating forces to make powerful homegrown strategies, and diminishing private financial backer confidence. Other research has demonstrated that IMF credits can emphatically affect financial development and that their belongings are exceptionally nuanced.

Criticism

Abroad Improvement Institute (ODI) research embraced in 1980 included reactions of the IMF which support the examination that it is a mainstay of what extremist Titus Alexander calls global apartheid.

Created nations apparently had a more predominant job and control over less created countries (LDCs). The Asset chipped away at the wrong supposition that all payments disequilibria were caused locally. The Group of 24 (G-24), for LDC individuals, and the United Countries Gathering on Exchange and Development (UNCTAD) griped that the IMF didn’t recognize adequately between disequilibria with transcendently outer instead of inward causes. This analysis was voiced in the repercussions of the 1973 oil emergency. Then, at that point, LDCs wound up with installment shortages because of antagonistic changes in their terms of exchange, with the Asset recommending adjustment programs like those proposed for shortfalls brought about by government over-spending. Confronted with long haul, remotely created disequilibria, the G-24 contended for more opportunity for LDCs to change their economies. Some IMF arrangements might be against formative; the report said that deflationary effects of IMF programs immediately prompted misfortunes of result and work in economies where livelihoods were low and joblessness was high. Besides, the weight of the collapse is excessively borne by the poor. The IMF’s underlying approaches were situated in principle and affected by contrasting feelings and departmental contentions. Pundits propose that its goals to carry out these approaches in nations with generally shifting monetary conditions were deceived and needed financial reasoning.

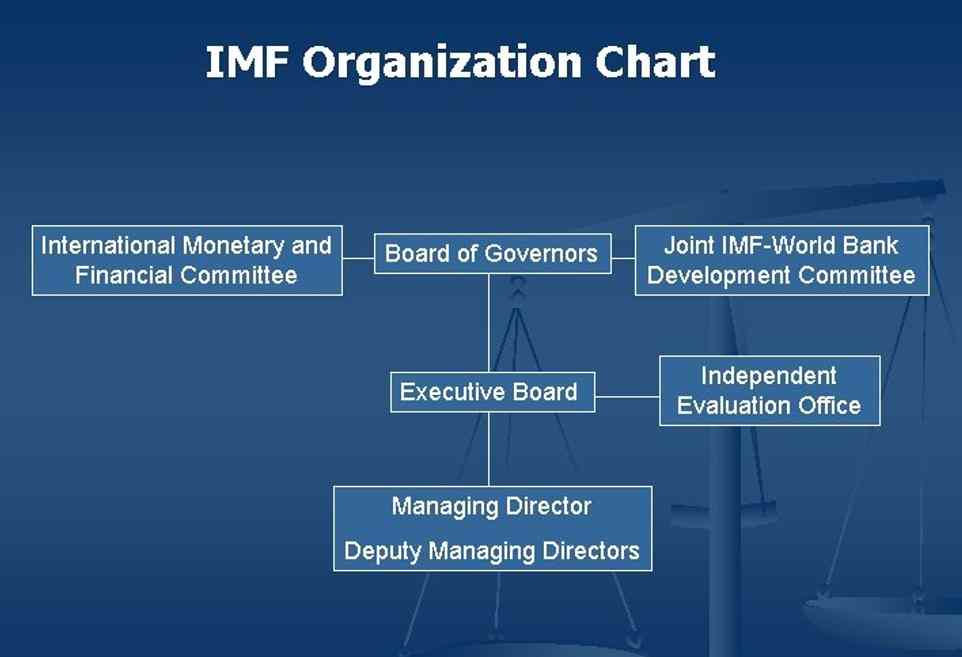

Organizational Heirarchy

The Leading group of Lead representatives is the most elevated dynamic body of the IMF. It comprises of one lead representative and one substitute lead representative for every part country. The lead representative is selected by the part country and is normally the clergyman of money or the top of the national bank.

While the Leading body of Lead representatives has designated the majority of its abilities to the IMF’s Chief Board, it holds the option to endorse quantity expands, exceptional drawing right (SDR) distributions, the permission of new individuals, mandatory withdrawal of individuals, and revisions to the Articles of Understanding and By-Regulations.

The Leading body of Lead representatives likewise chooses or designates chief and is a definitive judge on issues connected with the understanding of the IMF’s Articles of Arrangement. Casting a ballot by the Leading body of Lead representatives generally happens via the early voting form.

The Sheets of Legislative leaders of the IMF and the World Bank Gathering regularly meet one time each year, during the IMF-World Bank Spring and Yearly Gatherings, to examine crafted by their separate establishments. The Gatherings, which occur in September or October, have generally been held in Washington for two sequential years and in one more part country in the third year.

The Yearly Gatherings are led by a Legislative head of the World Bank and the IMF, with the chairmanship turning among the participants every year. At regular intervals, at the hour of the Yearly Gatherings, the Legislative heads of the Bank and the Asset choose Leader Chiefs for their separate Chief Sheets.

Capacity Development

- The IMF gives specialized help and preparation to states, including national banks, financial services, income organizations, and monetary area administrative offices. These limit improvement endeavors are focused on the IMF’s center subject matters going from tax assessment through national bank activities to the detailing of macroeconomic information. Such preparation likewise assists nations with handling cross-cutting issues, like pay disparity, orientation correspondence, defilement, and environmental change.

Conclusion

- As this paper has proposed, these two associations are actually the off track focus for the genuine worries individuals of all philosophical stripes have had about the quick speed of globalization in the past 50 years. It is logical this globalization would have happened whether or not there had been a Bretton Woods gathering, and it is everything except specific it will go on in the future no matter what the approaches sought after by the IMF and World Bank. While it is actually the case that they have frequently been excessively determined by U.S. international strategy worries, in the end, the impact of the two organizations has been broadly exaggerated. Furthermore regardless of their mix-ups during the past 50 years, they have seldom been given credit for a significant number of the seemingly insignificant details they progress admirably. For instance, the two establishments perform financial observation over the majority of the world’s economy, a significant assignment that no other worldwide or private association could perform with such expertise. The two offices likewise fill in as a store of master information and insight for nations all through the world that need prepared trained professionals. While neither the IMF nor the World Bank has met the grand objectives of their authors or employed the loathsome impact charged by their faultfinders, they have and should keep on assuming a little yet significant part in advancing flourishing and financial dependability around the world.

Top 13 Interesting Facts About IMF

Establishing and mission: The IMF was considered in July 1944 at the Unified Countries Bretton Woods Meeting in New Hampshire, US.

Surveillance: In a request to keep up with dependability and forestall emergencies in the worldwide money-related framework, the IMF screens part country strategies as well as public, territorial, and worldwide monetary and monetary improvements through a proper framework known as surveillance.

The IMF gives counsel to part nations and elevates approaches intended to encourage monetary solidness, diminish weakness to financial and monetary emergencies, and increase living expectations.

IMF Providing loans to member nations that are encountering real or likely equilibrium of-installments issues is a center liability of the IMF.

Advance assets accessible to low-pay nations were strongly expanded in 2009, while normal cutoff points under the IMF’s concessional advance offices were multiplied.

The IMF provides technical help and training to assist part nations with building better monetary organizations and reinforce related human limits.

The IMF gives a global save resource known as Special Drawing Rights or SDRs, that can enhance the authority stores of part nations.

IMF Member shares are the essential wellspring of IMF monetary assets. A part’s share extensively mirrors its size and position on the planet’s economy.

The IMF is responsible to its part country legislatures. At the highest point of its organizational structure is the Board of Governors, comprising of one lead representative and one substitute lead representative from every part country, normally the high ranking representatives from the national bank or money service.

The biggest preparatory advances: Mexico, Chile, Colombia

Primary aims: Promote global financial cooperation.

Facilitate the development and adjusted development of worldwide trade; Promote trade stability; Assist in the foundation of a multilateral arrangement of installments.

Make assets accessible (with satisfactory protections) to individuals encountering balance-of-installments challenges.