Introduction

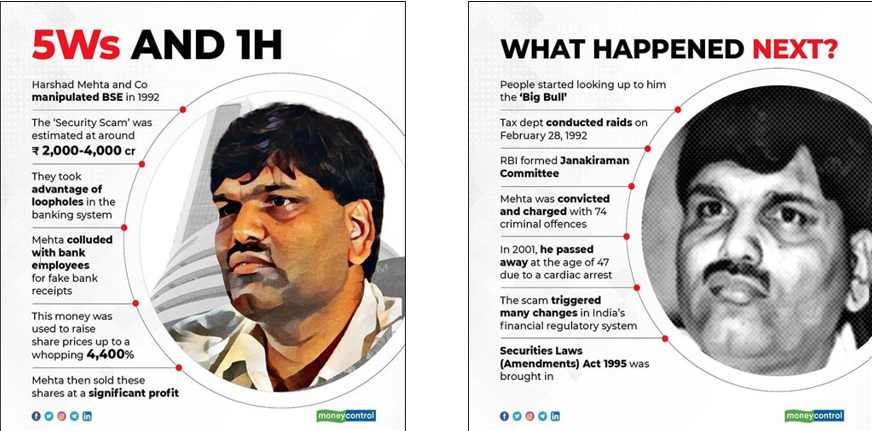

- The 1992 Indian stock market scam was a market abuse led by Harshad Shantilal Mehta with the help of politicians and bankers on the Bombay Stock Exchange. This scam is also known as the Harshad Mehta scam. The scam disturbed the Indian stock market. It was the biggest money market scam in the history of India, adding up to approximately 5000 crore INR. It defrauded investors of over ten million USD.

Who Was Harshad Shantilal Mehta?

Harshad Shantilal Mehta was born on 29 July 1954, in a Gujarati Jain family. He was born at Paneli Moti in Rajkot. His father worked as a small-time businessman. His early studies resided in Janta Public School. With no great achievement in school whatsoever, Mehta moved to Mumbai for further studies and work. He completed his B.Com in 1976 from Lala Lajpatrai College in Bombay. He then moved on to work in several jobs for the next few years of his life.

Some of the many jobs he took up included work related to sales, for example, hosiery, cement, and sorting diamonds. Mehta had a job as a salesperson in the Mumbai office of New India Assurance Company Limited (NIACL). Via this job opportunity, he was introduced to the Bombay Stock Market, which led him to resign and join a brokerage firm. In the 1980s, his job shifted to a lower position clerical job under the broker Prasann Harjivandas Nemidas Securities, who he had termed his “Guru”. Over the years his position as a worker went up along with his responsibilities in that position. By 1990 he had risen to a high position in the Indian securities industry. He was termed as “Amitabh Bachchan of the Stock Market”, by popular magazines like Business Today.

He started to trade in 1986 and by early 1990, many people started to invest in his firm and use his services. At this time he started to trade prominently in the shares of Associated Cement Company (ACC). The prices of shares increased rapidly due to a massive spate of buying from some particular brokers. Mehta stated that he had simply corrected the stock market by revaluing the company equivalent to the cost of building a similar enterprise. This is called the “replacement theory” that he introduced.

It was around this period he grew famous. The media called him “The Big Bull” and he was in a cover page article in Business Today. His several cars, a big penthouse, and rich lifestyle were brought to the eyes of the public via this article.

The Bombay Stock Exchange

The Bombay Exchange also known as the BSE Limited is located on Dalal Street in Mumbai. It was established in 1875 by a cotton merchant known as Premchand Roychand, who was a Rajasthani Jain businessman. It is the oldest stock market in Asia and the tenth oldest in the World. It is the ninth-largest stock exchange with an overall market capitalization of more than Rs. 276.713 lakh crore. It is the Fastest Stock Exchange in the world with a speed of 6 microseconds. In 2013 there was an update in the technology of the BSE, it was upgraded to Bolt Plus, which is based on the business architecture of global giant Deutsche Borse.

Its working is quite simple. Financial transactions are made online in the BSE through an electronic trading system. Market orders can be directly placed without the need for specialists through direct market access. Focus is mostly on the total value of transactions in a day. Trading in the BSE share market has to be done via a brokerage agency, against a stipulated charge. Direct investment access is given to certain investors who make large transactions in the BSE market. Security and Exchange Board of India (SEBI) is responsible for the regulation in the market, with constant rule updates.

The 1992 Scandal

- The scam was the biggest money market fraud ever committed in the history of India. It amounted up to 5000 crores. The mastermind behind the entire scandal was Harshad Mehta, who was an Indian stockbroker and market manipulator. It was a properly executed stock fraud using bank receipts and stamp paper, ultimately resulting in the crash of the Indian stock market. The scam, like most scams, exposed the loopholes of the stock market and Indian financial systems and completely reformed the stock market. It also added an introduction to online security systems.

This, unlike other frauds, was a security fraud. This means distracting funds from various banking systems to stockholders or brokers. The fraud resulted in the collapse of the security system of the Indian stock market. He committed a fraud of over 1 billion from the banking system to buy stocks on the Bombay Stock Exchange. This not only impacted the entire exchange system but also led to investors losing hundreds of thousands of rupees that they invested in the system. The net stocks were higher than the health and education budget of India. The scam’s basic overview was that Mehta secured securities from the State Bank of India against forged cheques signed by corrupt officials and failed to deliver the securities. He made the prices of the stocks rise high through practices and sold the stocks he owned in these companies.

The scam had so many impacts including losses in lakhs of families and the crash of the entire market. The index fell from 4500 to 2500 resulting in a loss of 1000 billion rupees in market capitalization. The scam raised many queries involving bank officials responsible for being in collusion with Mehta.

1. Stamp Paper Scam

- In the 1990s, banks were not allowed to invest in equity markets such as the BSE Limited. They were yet required to post profits and to keep a certain threshold of their assets in government fixed interest bonds. Harshad Mehta managed to extract capital from the banking system and transfer it into the share market. While asking them to put money in his account, he guaranteed banks higher rates of interest, under the guise of buying securities for them. Back then, banks had to go through a broker to buy securities and forward bonds from other banks. Mehta temporarily used this money in his account to buy shares, increase demand for those shares, sell them, and pass the proceeds to the bank while keeping generous amounts for himself. This resulted in huge increments in trades. For example, ACC which was trading for 200/share turned to 9000 in 3 months.

2. Bank Receipt Scam

- In a ready-forward deal, the borrower (seller of securities), gives the buyer of the securities a bank receipt (BR). There were no securities moved back and forth in reality. The BR is a receipt from the selling bank, and it guarantees that the buyer will receive the securities they have paid for at the end of the term. Mehta needed banks that would issue fake BRs or BRs that are not backed up by any government securities. Once these fake BRs were issued, they were passed on to other banks and the banks gave money to Mehta, on the assumption that they were lending against the government securities. He took the price of ACC from 200 to 9000, which was an increase of 4,400%. Since he had to book profits in the end, the day he had sold was the day the market collapsed.

3. Ready Forward Deal Scam

The ready-forward deal is a deal wherein the broker liaisons between two banks. When one bank wants to sell securities, it approaches the broker. The broker reaches out to another bank and tries to sell the securities and vice versa. As Mehta was a very well-known broker, cheques were issued in his name instead of the bank. When the bank demanded money for securities he reached out to another bank and repeated the process, he invested the bank money in the stock market. Mehta applied this system and deal with the Bank Receipt System of the Indian Financial systems. This was very flawed as the Janakiraman Committee was required to reform the entire BR system after the scandal in 1992.

Mehta used fake BR’s to gain unsecured loans and utilized several small banks to issue the BR’s on-demand. Since these banks were small, Mehta held on to the receipts for as long as he pleased. The cheques in favor of both banks were credited to the account of the broker, i.e., Mehta. This meant banks made heavy investments into BOK and MCB and showed positive signs of growth. Like the ACC several other stocks experienced drastic growth and when they were sold the market crashed.

As long as the stock prices increased, this kept going on. No one knew about the fraud Mehta was committing. Once the scam was brought to light, lots of banks held BRs of no value. The bank system had been at a loss of 4000 crores. They were aware that they would be accused if the public found out about their involvement with Mehta. Many assumptions were made as to who was involved. Some included Citibank brokers like Pallav Sheth, Ajay Kayan, industrialists like Aditya Birla, Hemendra Kothari, many politicians, RBI Governor S.Venkitaramanan.

4. Discovery Of The Market Scam

The scam was brought to light in April 1992, when it became evident that Mehta was an unusually large investor in government securities. Back then, Mehta was doing more than a third of the total securities business in India. When people realized that things did not add up his investments were illegitimate and that his stocks were worthless, it started to introduce a hurry of selling Mehta’s stocks. Banks that had loaned money via the BR’s were now holding hundreds of millions in unsecured loans. The hurry of selling his stocks and the fact that several banks had been defrauded crashed the market. Prices dropped 40%, stocks dropped 72% and a bear market lasted about 2 years.

National Housing Bank (NHB) lost the most money, i.e. 1199.39 crores. Followed by Standard Chartered Bank with 300 crores. Then State Bank of Saurashtra with 175.04 crores and lastly SBI Capital Markets Ltd with 121.23 crores.

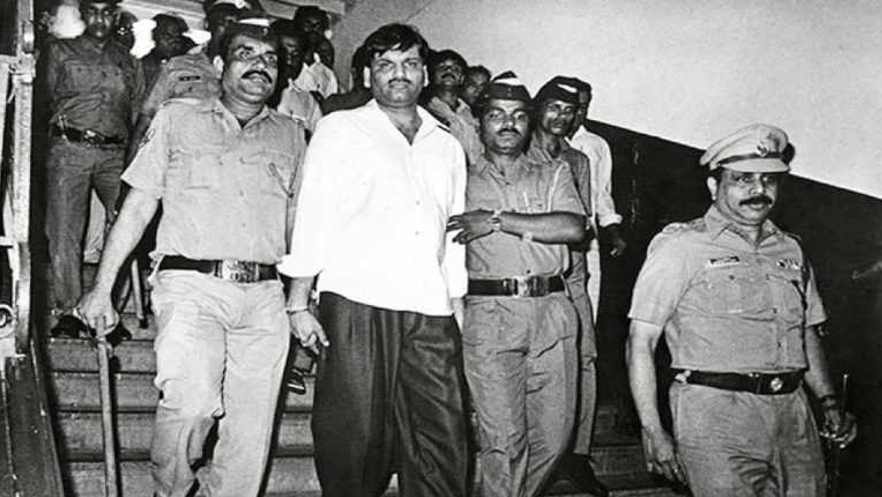

Exposure, Trial And Conviction

Exposing several loopholes of the system, Mehta and his associates triggered a rise in the BSE SENSEX. When the scheme came into the eyes of the public, banks started demanding their money back, this caused a collapse. He was then charged with 72 criminal offenses, and more than 600 civil action suits were filed against him. He was arrested and removed from the stock market with investors keeping him responsible for causing immense losses to various entities. Mehta and his associates were arrested by the CBI on 9 November 1992 for misappropriating more than a whopping 2.8 million shares of around 100 companies through forged share transfer forms. The total value of the shares misappropriation was placed at 250 crores. He made a comeback for a short period by giving out tips as a guru, on a website as well as a weekly newspaper column. In September 19999, Bombay High Court was convicted and sentenced to five years of rigorous imprisonment and a fine of 25,000. On January 14, 2003, The Supreme Court of India confirmed the High Court’s judgment in a 2-1 decision. While Justice B.N.Agarwal and Justice Arjit Pasayat upheld his conviction, Justice M.B Shah voted to acquit him.

Mehta caused huge controversy by announcing that he had paid 10 million to the Congress President and Prime Minister, P.V.Narasimha Rao, as a donation to the party for getting him off the scandal case.

Impacts

- The first most following impact was a drastic fall in the share and stock prices and market index. Causing a breakdown in securities control system operation with RBI and commercial banks. Around 35 million from the 2500 billion markets was taken back, causing the market to collapse. The Bombay Stock shares resulted in records tampering in the trading system. It caused widespread panic in the public and banks were impacted heavily. Banks like Standard Chartered and ANZ Grindlays were included in the scam for forging fake BR’s and transferring money into Mehta’s account. This scam helped the government realize that the main problem with the system was the lack of computerized systems. Various bank officers were looked into and were charged heavily. The five mainly accused officers were associated with the Financial Fairgrowth Services Limited (FFSL) and Andhra Bank Financial Services Ltd (ABFSL). The chairman of Vijaya Bank committed suicide following the news about the bank receipt scam. The scam led to the resignation of the accused of the person accused of owning shell companies to Mehta, P. Chidambaram. Mehta was convicted by the Bombay High Court and the Supreme Court of India for his role in the fraud which was valued at 49.99 billion. Various bank officials were arrested, leading to a complete breakdown of banking systems.

Reforms And Changes

The very first reform was the formation of the National Stock Exchange of India (NSE). It was followed by the development of the CC Code for Desirable Corporate Governance by Rahul Bajaj. It commanded the formation of two committees headed by Kumar Mangalam Birla and N.R.Murthy and reviewed by the Securities and Exchange Board of India (SEBI). The objective was to keep track of the NSE and the National Securities Depository. For the equity market, the government introduced ten acts of parliament and one amendment based on the principles of economic reform and legislative changes.

Many changes in the financial structure of India took place after the scandal. The authorities reconsidered and restricted the entire financial structure of India. Its main purpose was to record the payments made for purchasing investments in reconciled bank receipts and subsidiary general ledgers to prevent fraud. With the advice of the Janakiraman Committee, a committee was established to look over the Securities and Exchange Board of India. The first recommendation of the committee was to limit the ready forward and double ready forward deals to government securities only. All banks were required to make custodians rather than principals in transactions. Banks were to have a separate audit system for portfolios and it was to be overseen by the RBI.

Harshad Mehta- Hero Or Villain?

Was Harshad Mehta a hero or a villain? Since always, we aware that India is a country which when making progress, will be brought to its knees and taken ten steps back by some devil. In this case, Harshad Mehta was the devil and Dhirubhai Ambani was the hero. Motabhai introduced the idea of the stock market wherein both public and the companies could benefit. Due to these big companies like LIC, TATA, etc, dominated the stock market and caused great advantages to the country. Ordinary people like rickshaw wallahs, auto wallahs, etc, could afford the shares and earn a profit of a lakh in five years.

Harshad Mehta took advantage of Ambani’s progress to bring the stock market to smaller investors. He manipulated share prices and created worthless equipment in the process. In this way, he eventually started earning highly, quickly. He drove the common people away from the stock market and back to initial methods of financial transactions. So in conclusion, Harshad Mehta was not the hero, in fact, a villain.

Today's Stock Market

- Ever since the Indian stock market scam of 1992, many changes and reforms have taken place to build the stock market as it is today. There are several things done differently now than they used to back then. Here are some things to compare:-

1. Settlement Cycle: The settlement cycle is a term used to refer to the time within which brokers have to pay full money and take delivery of stocks and deliver stocks if sold. Currently, the settlement cycle is of two days. Although, it used to last 14 days.

2. Minimum Balance: In 1992, there were no provisions on maintenance of minimum balance that a customer needs to ensure to buy stocks. But now, no customer is permitted to purchase stocks without the required minimum balance. This helps prevent systemic risks from aggressive brokers who initially compromised risks for the business.

3. Electronic transactions: When dated back, settlement trades were made via paper and counterparty risk was prominent. Now, all settlement trades occur through clearing operations and all transactions are electronic.

4. Broker’s approval: Today, now that the risk of the customer is practically negligible due to margin requirements and CC, we do not require approval from a broker to start an account, unlike what used to be followed back in 1992.

5. Brokerage firms’ role: In 1992 brokerage firms dealt as advisory. But now, they work more on the execution role rather than advisory.

6. Trading process: In 1992, all trades were made via dealers and hence there was a very prominently high execution risk. Now, most trades are conducted by the customers themselves.

7. Brokerage fee: In 1992 customers were required at least 1% as a brokerage for equity delivery trades, but now no such charges have to be paid.

8. Price difference: One of the last differences is that back then dealers used to pocket a cut by stating different prices to customers rather than the actual trade price. However, nowadays the process is completely and utterly transparent.

List Of Movies Made On 1992 Stock Market Scam

Top 13 Interesting Facts About Scam 1992

There are many films based on this scandal. Gafia is a 2006 Indian Bollywood movie directed by Sameer Hanchate based on the events of this incident.

The scam was dramatized in the series Scam 1992 by Hansal Mehta. The series was inspired by the book The Scam: Who Won, Who Lost, And Who Got Away.

The scam was projected in the 2020 Indian web series, The Bull Of Dalal Street on Ullu.

The Big Bull is a 2021 Indian film directed by Kookie Gulati, which is loosely based on Mehta’s life and the 1992 scam.

A total of 1795.66 crore rupees was lost, summing the amounts each bank lost.

Mehta’s life and the entire scam are vividly depicted in Sucheta Dalal’s and Debashis Basu’s book The Scam: From Harshad Mehta to Ketan Parekh.

The character Natwar Shah in the movie Aankhein, placed under a scanner for a multi-crore scandal was adapted from Harshad Mehta.

Harshad Mehta was mentioned in the 2018 TV show Yeh Un Dinon Ki Baat Hai based in Ahmedabad in 1990.

In 2001, he passed away at the age of 47 due to a cardiac arrest.

BSE Limited is the oldest stock market in Asia and the tenth oldest in the World. It is the ninth-largest stock exchange with an overall market capitalization of more than Rs. 276.713 lakh crore.

BSE Limited is the Fastest Stock Exchange in the world with a speed of 6 microseconds.

Harshad Mehta was termed as “Amitabh Bachchan of the Stock Market”, by popular magazines like Business Today.

Mehta caused huge controversy by announcing that he had paid 10 million to the Congress President and Prime Minister, P.V.Narasimha Rao, as a donation to the party for getting him off the scandal case.