What Is SEBI?

SEBI is the Security and Exchange Board of India.

SEBI is a regulatory body within the Ministry of Finance of the Government of India. It was established on 12 April 1988 as a non-statutory body to regulate India’s securities and commodity markets.

SEBI is a legal organization and a market regulator that controls the stock market in India.

The basic functions of the SEBI should protect the interests of value entrants and promote and regulate the stock exchange.

SEBI serves as an Interim administrative body to promote orderly and healthy growth of securities markets and for investor protection.

SEBI is aimed at his membership. The board consists of a chairperson and several other time and partial members.

SEBI’s headquarters are in Mumbai, with regional offices in Ahmedabad, Kolkata, Chennai, and Delhi.

History Of SEBI

Reason for Establishment of SEBI:-

Before SEBI, there were no regulatory bodies that controlled the activities of the stock market, so there were malpractitioners, which led to losses for investors.

There had been unofficial private placements, price rigging, and insider trading before SEBI.

There was a delay in the delivery of shares. The stock exchange violates its rules and regulations.

Capital issue controllers acted as the regulatory authorities before SEBI, this led to the creation of the Capital Affairs Act (Control), 1947.

SEBI was established in 1988 to regulate India’s capital markets.

Initially, SEBI was a non-legal body without legal power. After the passage of the SEBI Parliament Act in 1992, It received autonomous and legal powers.

The SEBI becomes a statutory organization on 30th January 1992, changing its status from a Nonstatutory organization to a statutory organization.

SEBI began regulating the commodity derivatives market on September 28, 2015, under the Securities Contract Regulation Act (SCRA) 1956, and the Forward Contracts Regulation Act, 1952 was repealed with effect on September 29, 2015.

- SEBI’s mission is to protect the interests of investors in securities, promote development, regulate the securities market, and deal with related issues.

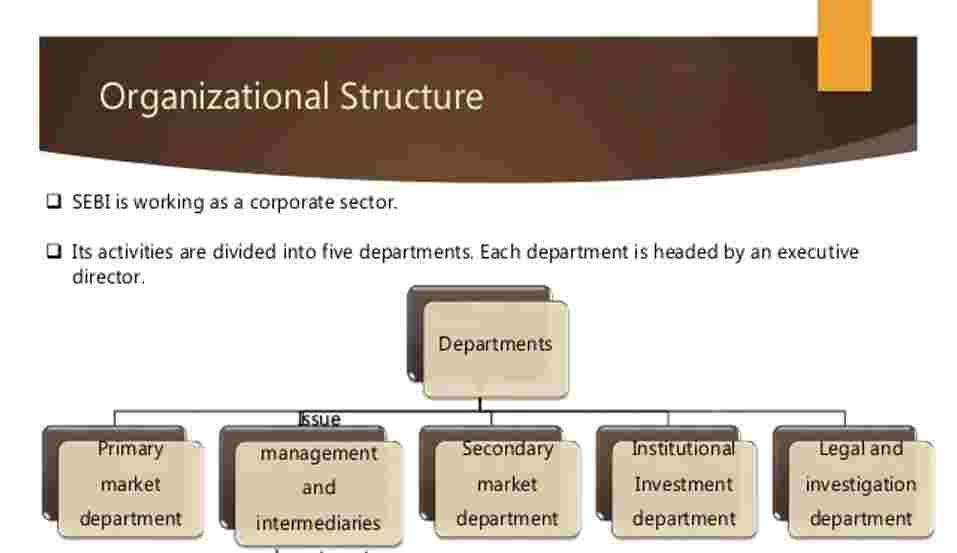

Structure Of SEBI

SEBI is a statutory body, which means that its activities have expanded.

To achieve its goals, SEBI must now pay more careful attention, closer coordination, and intensive monitoring to each of its activities.

SEBI has a corporate frame that includes multiple departments managed by a department head.

The SEBI has therefore been reorganized and rationalized to reflect its expanded scope.

It has organized its operations into five operational departments.

There is an executive director for each department.

Now there are about 20 departments under SEBI.

Some of these departments are financial corporations, economic analyzes and guidelines, debt and hybrid values, compliance, human resources, investment management, regulation of raw material derivatives, legal issues, and more.

SEBI’s headquarters are in Mumbai, and regional offices are in Ahmedabad, Kolkata, Chennai, and Delhi to handle investor complaints as well as issuers, intermediaries, and stock exchanges in the respective region.

Chairperson And Other Members

Who is the current chairperson of SEBI and SEBI Organization Structure:-

- As of 1st March 2022, Madhabi Puri Buch will replace Ajay Tyagi, who retired on 28th February.

- She becomes SEBI’s first female chairperson.

There are nine board members with the following structure:-

- Union Government of India nominates the Chairperson.

- There are two members from the Ministry of Finance of India.

- There is one member from the Reserve Bank of India.

- The Union Government of India nominates the remaining 5 board members out of a total of 9.

Madhabi Puri Buch

Chairperson, SEBI (She becomes SEBI’s first female chairperson)

March 01, 2022, to Present

Former Chairperson Of SEBI:-

Shri Ajay Tyagi

(March 01, 2017, to February 28, 2022)

Shri U. K. Sinha

(February 18, 2011, to March 01, 2017)

Shri C. B. Bhave

(February 19, 2008, to February 17, 2011)

Shri M. Damodaran

(February 18, 2005, to February 18, 2008)

Shri G. N. Bajpai

(February 20, 2002, to February 18, 2005)

Shri D. R. Mehta

(February 21, 1995, to February 20, 2002)

Shri S. S. Nadkarni

(January 17, 1994, to January 31, 1995)

Shri G. V. Ramakrishna

(August 24, 1990, to January 17, 1994)

Dr. S. A. Dave

(April 12, 1988, to August 23, 1990)

S.No | Name | From | To |

1. | Dr. S. A. Dave | 12 April 1988 | 23 August 1990 |

2. | G.V. Ramakrishna | 24 August 190 | 17 January 1994 |

3. | S.S. Nadkarni | 17 January 1994 | 31 January 1995 |

4. | D.R. Mehta | 21 February 1995 | 20 February 2002 |

5. | G.N. Bajpai | 20 February 2002 | 18 February 2005 |

6. | M. Damodar | 18 February 2005 | 18 February 2008 |

7. | C.B. Bhave | 18 February 2008 | 18 February 2011 |

8. | U K Sinha | 18 February 2011 | 10 February 2017 |

9. | Ajay Tyagi | 10 February 2017 | 28 February 2022 |

10. | Madhabi Puri Buch | 1 March 2022 | Present |

Organizational Structure

- SEBI formed two advisory committees. There are two of them: the primary Market Advisory Committee and the Secondary Market Advisory Committee.

1. Primary Markets Advisory:-

- The regulation of issuers’ access to the market.

- Regulation of information production at the time of issue.

- Processes and procedures relating to the issuance of securities are controlled.

2. Secondary Market Advisory:-

- Disclosure standards are not limited to accounting information but were extended to other issue-related communications such as advertisements.

- SEBI has been working relentlessly to improve corporate governance standards in India.

Dematerialization Of Securities

Institutionalization of Trading and ownership of securities:-

- To help in developing the capital market so that business activities do not get hampered.

- To protect investors’ interests, companies and organizations must be brought under its regulation

- To prohibit unethical trading that includes insider trading.

- A systemic mutual fund registration must be completed.

- SIPs (Systematic Investment Plans) and all other funds under this category are governed by the rules and regulations laid down by Mutual funds and SIPs.

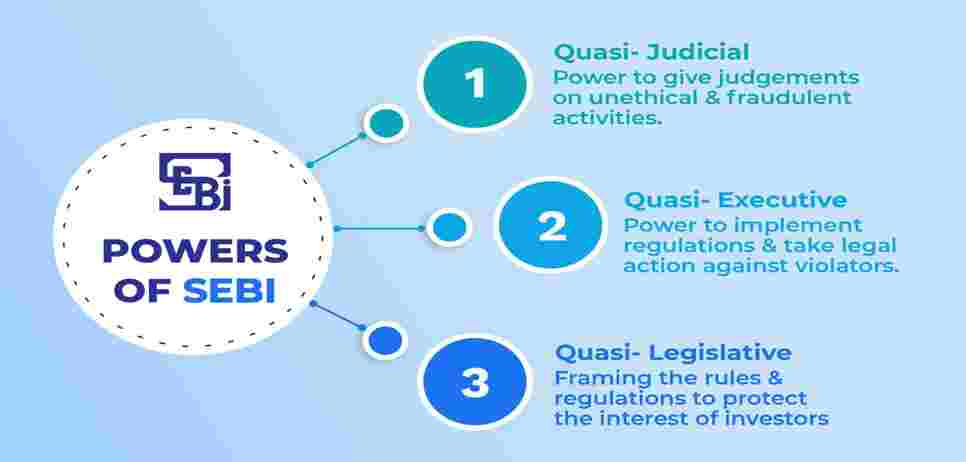

Powers Of SEBI

To regulate stock exchanges and approve their bylaws.

Examine the books of recognized stock exchanges and ask for periodic reports.

Examine the books of financial intermediaries.

Some companies must be listed on one or more stock exchanges

To register brokers.

Functions Of SEBI

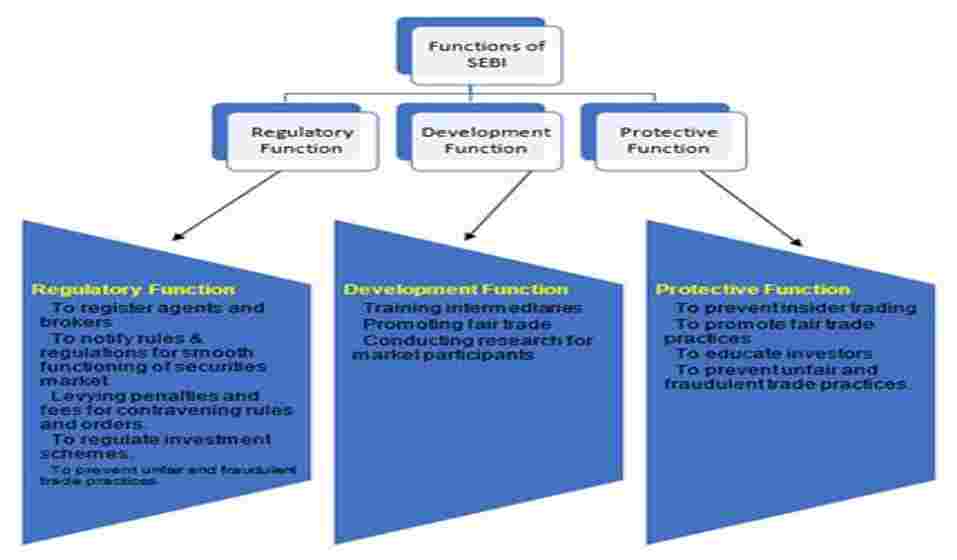

SEBI has Major three functions:-

- Protective Function

- Regulatory Function

- Development Function

1. Protective Function:-

SEBI protects investors and other financial participants through its regulatory role by the following function:

Prohibits insider trading:-

- An insider trade is any transaction in which employees, directors, or promoters of a company buy or sell securities.

- To prevent this kind of trading, SEBI prohibits companies from buying shares on the secondary market.

- Check price rigging:-

- Stock price rigging occurs when investors suffer unanticipated losses because of unnatural fluctuations in stock prices, either increasing or decreasing stock prices.

- SEBI maintains a strict watch on such malpractices.

- Promoting fair trade practices:-

- The SEBI promotes fair trade practices and strives to prohibit fraudulent activities related to securities trading

- Financial education provider:-

- The SEBI educates investors through online and offline sessions that provide market insights and aspects of money management.

SEBI is responsible for responding to the following three groups:-

- Securities issuers.

- The investor.

- Intermediaries of the markets.

2. Regulatory Function:-

In regulatory functions, rules and regulations are established for financial intermediaries and corporates so that markets can be efficiently managed.

Some of the regulatory functions are:

- In addition to the rules and regulations, SEBI has developed guidelines and a code of conduct for corporations as well as financial intermediaries.

- Registration and regulation of brokers and sub-brokers.

- Examining stock exchanges and conducting audits of stock exchanges and intermediaries.

- To regulate the work of stockbrokers as well as merchant brokers.

- Apply penalties to the fraudulent practitioner.

3. Developmental Function:-

SEBI’s developmental function refers to the steps it takes to educate investors about the trading and market functions.

The following activities are included:

- Ensuring Training of intermediaries who are a part of the security market.

- Protect the interest of the investor.

- Facilitating flexibility in the working of the capital market.

Some Committees Formed By SEBI

Alternative Investment Policy Advisory Committee (AIPAC)

Risk Management Review Committee (RMRC)

Takeover Regulations Panel

Technical Advisory Committee (TAC)

Primary Market Advisory Committee (PMAC)

Depository System Review Committee (DSRC)

Corporate Bonds and Securitization Advisory Committee (CoBoSAC)

SEBI Committee on Disclosures and Accounting Standards (SCODA)

Qualified Audit Report Review Committee (QARC)

Controversies Of SEBI

- There are nine board members with the following structure: the Union Government of India nominates the Chairperson. There are two members from the Ministry of Finance of India. There is one member from the Reserve Bank of India. The Union Government of India nominates the remaining 5 board members out of the 3 (whole-time) Members. The Present Chairperson is Madhabi Puri Buch.

1. Controversies Of Chairperson CB Bhave;

Former IAS officer CB Bhave served as SEBI’s executive director in its early years. He then helped set up India’s first depository, NSDL, which holds shares and other securities in Demat or electronic form.

A SEBI investigation into the IPO fraud in 2005-06 found that NSDL failed to detect the opening of thousands of fictitious or benami Demat accounts by depository participants it oversees. Bhave, representing NSDL, appealed to the Securities and Exchange Commission against the order.

SEBI at Bhave, Bhave recused himself from the interview for the SEBI chief’s post in early 2008, claiming that the NSDL case was still pending and that there would be a conflict of interest.

Even though a search committee had previously recommended UK Sinha, the current chairperson, the government chose Bhave after shortlisting his name along with that of Jaimini Bhagwati, an IFS officer.

A decision was then made to exclude him from any NSDL-related proceedings, which required Bhave to recuse himself from any discussions about the depository.

However, a two-member SEBI board committee discovered several lapses on the part of the depository. SEBI board, on the other hand, declared them invalid, which drew criticism.

2. Dr. KM Abraham Controversy

In 2012, India Rejuvenation Initiative filed a PIL to challenge the government’s selections for SEBI, which resulted in a revision.

In another letter, Dr. KM Abraham complained about malice in the Board’s operation and how large firms intervened and duped the Board in high-profile cases like Sahara, Reliance, and MCX.

In 2016, however, the petitioner’s PIL was dismissed by the Supreme Court based on the grounds that most of the flaws raised in the document had already been corrected in subsequent revisions.

Current Controversy

According to sources, SEBI Chairperson Madhabi Puri Buch appeared before a parliamentary panel on Tuesday and was questioned about the NSE controversy, the Sahara case, and share offers made by Paytm and the Baba Ramdev-led Patanjali group’s Ruchi Soya.

Jayant Sinha, the former minister of state for finance, presided over the meeting of the parliamentary standing committee on finance that lasted over two and a half hours, according to panel sources.

According to a notice issued by the Lok Sabha Secretariat, the committee summoned Buch to discuss regulatory issues about initial public offerings, International Financial Services Centers, and alternative investment funds.

Earlier in the day, the newly appointed SEBI chief was also questioned by the parliamentary committee on petitions about the progress of the agency.

Earlier in the day, the newly appointed SEBI chief was grilled by the parliamentary committee on petitions about the progress made to date in refunding money to Pulse Agro Corporation Limited investors (PACL).

The Securities and Exchange Board of India (SEBI) ordered the attachment of all assets of PACL and its nine promoters and directors in December 2015 for their failure to refund money owed to investors.

Members questioned SEBI’s investigation into the NSE fiasco, in which several of the bourse’s top officials, including former CEOs Chitra Ramkrishna and Ravi Narain, are being investigated, according to sources.

Several members also asked about Ruchi Soya’s follow-on public offer (FPO), Paytm’s initial public offering (IPO), and the money in the Sahara case that is being held by the capital markets regulator.

On March 28, SEBI asked bankers of Baba Ramdev’s Patanjali group’s Ruchi Soya to give investors in its FPO the option to withdraw their bids. In the case of Paytm, its stock has plummeted following its massive initial public offering (IPO).

This was SEBI officials’ second meeting with the parliamentary panel since March 30, 2022.

SEBI Achievements

In 2006, Prime Minister Manmohan Singh stated that the price of market stability and growth is eternal vigilance. The regulator has maintained faith in its 25-year journey, during which it has steadily gained more authority to oversee India’s capital markets.

It has ensured a well-functioning market and fueled market development by, among other things, dematerializing shares, shortening settlement cycles, launching nationwide electronic trading, introducing risk management systems, establishing clearing corporations, and nurturing the mutual fund industry.

To be sure, the regulator has earned the respect of domestic and international investors for improving market efficiency. No broker defaults have occurred since 2001.

Initiating the process of consultation papers before the development of regulations has also increased its credibility with stakeholders.

The Indian capital market now compares favorably to mature markets.

SEBI has taken new initiatives in recent years to counter market volatility by improving analytical capabilities, strengthening surveillance and risk management, and promoting research.

Who Is Eligible For SEBI Exam?

In SEBI, officers are Graded from A to F: –

- Assistant Manager,

- Manager,

- Assistant General Manager,

- Deputy General Manager,

- General Manager,

- Chief General Manager.

When an officer in a particular Grade completes the required number of years of service in that Grade, he or she becomes eligible for promotion to the next higher Grade.

Promotions up to the position of Assistant General Manager are not based on vacancies, and subsequent promotions are. Officers in Grade F can advance to the position of Executive Director.

Positions above Executive Director (i.e., Whole Time Member and Chairman) are filled on a contract basis by the Government of India.

The SEBI Grade A exam is the exam you need to take to get a job with the SEBI (Securities and Exchange Board of India). SEBI Grade A is a national test for hiring qualified candidates for Assistant Manager positions within an organization.

It is a prestigious exam for candidates wishing to become Assistant Managers in streams such as General Stream, Legal Stream, Information Technology Stream, Research Stream, and Official Language Stream.

The SEBI Grade-A exam 2022 was held on February 20, 2022, and the phase-II online exam was held on March 20, 2022.

SEBI Grade A Recruitment 2022 | Details |

Name of the Examination | Securities and Exchange Board of India Grade A |

Conducting Body | Securities and Exchange Board of India (SEBI) |

Stage of Exam | Three: Phase 1(Online) Phase 2(Online) Phase 3(Interview) |

Education Qualification | Bachelor’s/ Master’s Degree |

Age Limit | The candidate must not exceed 30 years of age |

Official website | Sebi.gov.in |

Application Mode | online |

Salary and Position of Employees in SEBI: –

After passing the SEBI Grade A Selection Process and being selected, candidates can expect a salary range of INR 1,07,000/- without accommodation and INR 73,000/- with accommodation for the position of Assistant Manager in SEBI.

SEBI Grade A Exam Pattern 2022:-

- The candidate will be chosen through two online examinations, followed by an interview round. Phase 1 is a screening test, and the results will not be considered for final selection. The final merit list for SEBI Grade A 2022 will be prepared based on the marks obtained in the main and the interview round. SEBI Grade A Syllabus consists of two online papers with the following exam pattern:

SEBI Grade A Phase-1 Exam Pattern:-

- An online examination consisting of two 100-point papers.

- Paper-1 will be 60 minutes (1 hour) long and will be the same for all streams.

- Paper-2 will be made up of multiple-choice questions, with each section lasting 40 minutes.

- The aggregate cut-off for scoring is 40%.

- For both Papers 1 and 2¼th marks will be deducted.

[wpdatatable id=59]

SEBI Grade A Phase-2 Exam Pattern:-

- An online examination consisting of two papers of 100 marks each.

- Paper-1 will be descriptive in nature and the duration will be 60 minutes (1 hour)

- Paper-2 will consist of Multiple-Choice Questions; the duration of each section is 40 minutes.

- The Aggregate Cut-off to be scored is 50%.

- There shall be negative marking (1/4th of marks assigned to the question) for Paper 2 in Phase II

[wpdatatable id=58]

Educational Initiatives Of SEBI

NISM (National Institute of Securities Markets):-

The Securities and Exchange Board of India (SEBI), India’s securities market regulator, established the National Institute of Securities Markets (NISM) in 2006. The institute conducts a wide range of capacity-building activities at various levels with the goal of improving the quality standards in the securities markets.

On December 24, 2016, Shri Narendra Modi, Present Prime Minister of India, inaugurated NISM’s sprawling 72-acre campus in Patal Ganga (near the Mumbai Pune Expressway). This campus offers a full-time residential academic program for postgraduate students, as well as short-term training programs and faculty development programs for market participants.

NISM has begun a rapid expansion of its activities both domestically and internationally, positioning the institute as a leading global player in knowledge dissemination and skill enhancement in the financial markets domain.

The institute’s six schools of excellence collaborate to create professionalized securities markets.

The campus features innovative design, a finance library, IT infrastructure, well-equipped classrooms, a seminar hall, a conference hall, and other amenities. It also has an amphitheater, a state-of-the-art auditorium, a multipurpose hall, and recreation facilities for a variety of activities. Wi-Fi is available throughout the campus.

What is Six School of Excellence?

- The National Institute of Securities Market, or NISM, has six schools of excellence that collaborate to create a more professionalized securities market and to improve or enhance the quality standards of the securities market.

These are as follows:-

- School for Securities Education (SSE)

- School for Certification of Intermediaries (SCI)

- School for Investor Education and Financial Literacy (SIEFL)

- School for Corporate Governance (SCG)

- School for Securities Information and Research (SSIR)

- School for Regulatory Studies and Supervision (SRSS)

NCFE (National Centre for Financial Education):-

- The Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), the Insurance Regulatory and Development Authority of India (IRDAI), and the Pension Fund Regulatory and Development Authority (PFRDA) jointly promote the National Centre for Financial Education (NCFE).

The Organization’s goal is:

To promote financial literacy throughout India for all segments of the population, following the Financial Stability and Development Council’s national financial education strategy.

To create financial awareness and empowerment through financial education campaigns across the country for all sections of the population through seminars, workshops, conclaves, training, programs, campaigns, and discussion forums with/without fees by themselves or with the assistance of institutions, organizations, and to provide training in financial education and to create financial education material in electronic or non-electronic formats, workbooks, worksheets, literature, pamphlets, and booklets.

- Recently, NCFE has launched an e-Learning course on basic financial education, which covers topics such as banking, securities markets, insurance, and pension products.

Some Important Facts About SEBI

The securities exchange board of India (SEBI) was Set up in 1988 to regulate the functions of securities markets.

SEBI promotes orderly and healthy development in the stock market but initially, SEBI was not able to exercise complete control over the stock market transactions.

It was left as a watchdog to observe the activities but was found ineffective in regulating and controlling them.

As a result, on 30 January 1992, SEBI was granted legal status. SEBI is a body corporate having a separate legal existence and perpetual succession.

SEBI was constituted on 12th April 1988 as an interim administrative body under the finance ministry.

Four years later, on 30 January 1992, a notification awarding statutory powers to SEBI was issued SEBI act, 1992.

SEBI in its short journey of 25 years has made a remarkable impression on the investor as well as capital markets.

SEBI exists to meet the needs of the three categories listed below:-

- Issuers – By providing a marketplace, it helps issuers increase their financing.

- Investors – Ensures the safety and accuracy of information.

- Intermediaries – It enables a competitive professional intermediary market.

Structure Of SEBI:-

- The SEBI is managed by its members,

- The chairperson who is nominated by the Union Government of India

- Two members from Finance Ministry,

- One member from the reserve bank of India,

- The remaining five-member are nominated by the Union Government of India, out of the three shall be whole-time members.

Objective of SEBI:-

- To regulate the activities of the stock exchange.

- To protect the right of investors and ensure the safety of their investments.

- To prevent fraud and malpractices by having a balance between the self-regulation of business and its statutory regulation.

- To regulate and develop a code of conduct for intermediaries such as brokers, underwriters, etc.

Power of SEBI:-

- Approve by-laws of the stock exchange.

- To require the stock exchange to amend its by-laws.

- Inspect the books of accounts and call for potential returns from recognized stock exchanges.

- Inspect the books of account of financial intermediaries.

- Compel certain companies to list their share in one or more stock exchanges.

- Registration of brokers.

The function of SEBI:-

- It oversees the security markets in India.

- It examines stock trading and protects the security market from fraud.

- It has control over stockbrokers and sub-stockbrokers.

- It educates investors about the market to increase their knowledge.

Top 13 Interesting Fact About SEBI

SEBI was set up in1988 to regulate the functioning of Securities Markets. The SEBI becomes a statutory organization on 30th January 1992, changing its status from a non-statutory organization to a statutory organization. SEBI has left an indelible imprint on investors and capital markets in its brief 25-year existence.

SEBI is governed by a board of members appointed by various government departments, and its chairperson is appointed by the Union Government of India. In addition to the Chairperson, there are two full-time members and four part-time members.

Madhabi Puri Buch is the first woman to be appointed as the chairperson of SEBI. She takes charge on 1 March 2022.

SEBI is responsible for responding to the three groups: -Securities issuers, The investor, and Intermediaries of the markets.

SEBI launches the “Saarthi” Mobile Application to empower investors with knowledge about the securities markets. The App is available in two languages- Hindi and English.

The Securities and Exchange Board of India (SEBI) has permitted Indian companies to increase their shareholding by 25% by issuing rights and bonus shares to their existing clients.

SEBI’s main objectives are to regulate the activities of the stock exchange, protect the right of investors and ensure the safety of their investments, and prevent fraud and malpractices by having a balance between self-regulation of business and its statutory regulation.

SEBI develops a code of conduct for intermediaries such as brokers, underwriters, etc.

SEBI archives a well-functioning market and fueled market development by, among other things, dematerializing shares, shortening settlement cycles, launching nationwide electronic trading, introducing risk management systems, establishing clearing corporations, and nurturing the mutual fund industry.

Through clause 49, SEBI institutes corporate governance in India. The compensation paid to non-executive directors shall be fixed by the board of directors and approved by the shareholders.

SEBI Initiate NISM and NCFE Educational programs for learners.

SEBI regulates Indian financial markets through its 20 Departments and Regional offices.

SEBI Grade A is a national test for hiring qualified candidates for Assistant Manager positions within an organization.