Meaning

- World global financial crisis is a period of extreme stress in the global financial market and banking system between the years 2007 to early 2009. The main cause of the global financial crisis Increase government spending, increase borrowing from banks and investors, the stress in the financial system, and excessive risk-taking by banks.

Background

The financial crisis brought about the great recession which at that time was severe. The financial crisis involves bank failure, a typical example is the three major banks of Iceland it was the largest economic collapse suffered by any country. It was among the five worst financial crises the world experience, it contributed to the loss of 2 trillion of the global economy.

Lack of investors’ confidence in bank solvency and decline in credit availability led to plummeting stock and commodity prices in 2008 and early 2009 .this crisis rapidly spread into global bank failures.

As part of national policy response to the recession, governments and central banks, including the Federal Reserve, the European Central Bank, and the Bank of England, provided trillions of dollars in bailouts and stimulus, including expansive fiscal policy and monetary policy to offset the decline in consumption and lending capacity, avoid a further collapse, encourage lending, restore faith in the integral commercial markets.

Economic Prediction Of The Crisis

A number of economists claim to have anticipated the crisis (Bezemer, 2009. Bezemer identified twelve individuals with a legitimate claim to having foreseen this crisis, on the basis of four selection criteria:

Only analysts were included who provide some account on how they arrived at their conclusions. Second, the analysts included went beyond predicting a real estate crisis, also making the link to real-sector recessionary implications, including an analytical account of those links. Third, the actual prediction must have been made by the analyst and available in the public domain, rather than being asserted by others. Finally, the prediction had to have some timing attached to it. (Bezemer, 2009.)

Table 1 Predictors of the Global Financial Crisis

Timeline

The financial crisis of 2007–2009 was the culmination of a credit crunch that began in the summer of 2006 and continued into 2007.

Analysis of post-crisis macroeconomic and financial sector performance for 58 advanced countries and emerging markets shows a differential impact of old and new factors. Factors common to other crises, like asset price bubbles and current account deficits, help to explain cross-country differences in the severity of real economic impacts. New factors, such as increased financial integration and dependence on wholesale funding, help to account for the amplification and global spread of the financial crisis.

Causes

The global financial crisis has been one of the most significant economic shocks in the post-war period. At its core, the crisis originated in credit markets in developed countries – centered particularly in the United States, the United Kingdom, and Europe – but the fallout has had a significant effect on activity in every country and region. As the crisis intensified, there was a large swing in the appetite of world financial markets for risk, and in their capacity to accept risk. The result was a shift from the easy credit conditions that had prevailed for some years to a situation of tight credit and in some cases dysfunctional markets. This was accompanied by a loss of consumer and business confidence, with significant effects on global activity.

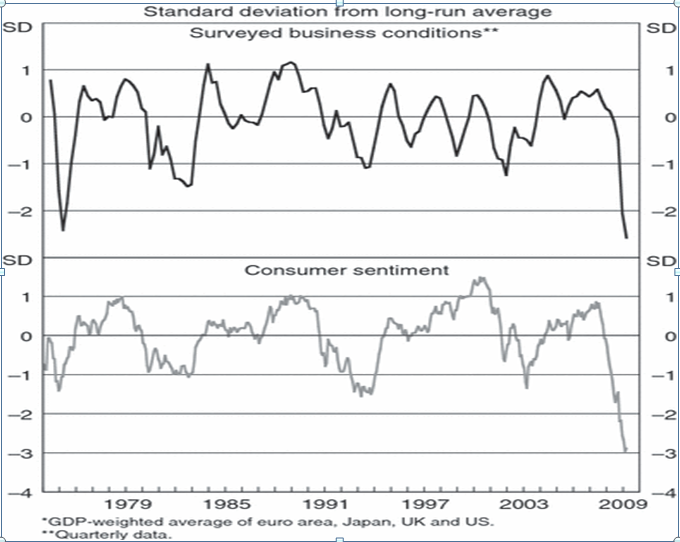

Several reasons have been proposed to explain this sudden and synchronized deterioration in global macroeconomic conditions. The first, which was already touched on above, was the widespread loss of confidence in the wake of the collapse of Lehman Brothers and the associated period of exceptional turmoil in global financial markets. This deterioration was clearly seen in survey-based measures of business and consumer confidence in the major economies. It is plausible that improvements in communication and the more rapid transmission of economic news contributed to making this swing in confidence more highly synchronized than in earlier major cycles. As a consequence of the deterioration in confidence, along with the decline in housing and equity wealth and rising unemployment, households around the world made a rapid re-evaluation of their spending plans, cutting back in particular on discretionary spending. Private consumption fell sharply in the industrialized and emerging market economies in late 2008. One very clear example was a sharp drop in the demand for cars, with sales in the major economies falling from their early 2008 levels by around 25 percent. Similarly, business investment contracted in a number of countries in late 2008/early 2009.

Boom In The Banking System

-

The financial crisis of 2007-2008 was created, in part, by several U.S. banks over-investing in subprime mortgages.

- Prior to 2000, there were laws that limited the number of subprime mortgages available, but deregulation efforts removed this limitation and permitted the crisis to happen. Questionable mortgages were not the only cause, but it was the tipping point that destroyed worldwide trust in the banking sector

-

The financial crisis of 2008 affected the banking sector by causing banks to lose money on mortgage defaults, interbank lending to freeze, and credit to consumers and businesses to dry up. In a June 2008 speech, President and CEO of the Federal Reserve Bank of New York Timothy Geithner who in 2009 became United States Secretary of the Treasury placed significant blame for the freezing of credit markets on a “run” on the entities in the “parallel” banking system, also called the shadow banking system. These entities became critical to the credit markets underpinning the financial system but were not subject to the same regulatory controls. Further, these entities were vulnerable because of Asset–liability mismatch, meaning that they borrowed short-term in liquid markets to purchase long-term, illiquid and risky assets.

Inflation

According to the National Bureau of Economic Research (NBER), the U.S. economy was in a recession for 18 months from December 2007 to June 2009. It was the longest and deepest recession of the post-World War II era. The recession can be separated into two distinct phases. During the first phase, which lasted for the first half of 2008, the recession was not deep as measured by the decline in the gross domestic product (GDP) or the rise in unemployment. It then deepened from the third quarter of 2008 to the first quarter of 2009. The economy continued to contract slightly in the second quarter of 2009, before returning to expansion in the third quarter. The recent recession features the largest decline in output, consumption, and investment, and the largest increase in unemployment, of any post-war recession.

One unique characteristic of the recent recession was the severe disruption to financial markets. Financial conditions began to deteriorate in August 2007 but became more severe in September 2008. While financial downturns commonly accompany economic downturns, financial markets have continued to function smoothly in previous recessions. This difference has led some commentators to instead compare the recent recession to the Great Depression. While the onset of both crises bears some similarities, the effects on the broader economy have little in common.

The Great Recession

The recent recession has also featured the largest decrease in consumption and private fixed investment spending of any post-war recession. There are a few commonalities found across all previous post-war recessions. First, in all cases, consumption spending did not weaken as much as GDP’ First, in all cases, consumption spending did not weaken as much as GDP, as shown In fact, in five out of 11 recessions, consumption continued to grow while GDP fell. To the extent that households can adjust their saving and borrowing levels, they are thought to generally prefer to “smooth” consumption over time, avoiding sudden increases and decreases. In the recent recession, consumption declined relatively rapidly in the third and fourth quarters of 2008, with small positive and negative changes in the other quarters. Consistent with the historical pattern, consumption has fallen by proportionately less than output cumulatively.

A primary reason the recession was longer and deeper than normal is the severity of the financial downturn that began in August 2007 and worsened dramatically in September 2008. As noted above, the recession was initially mild, and the decline in GDP accelerated markedly after the financial downturn worsened. Although a diminished investor appetite for risk and a stock market decline before or during a recession is common, the recent recession has featured a breakdown in activity in certain financial markets, such as the markets for asset-backed securities, commercial paper, and interbank lending, and the failure (or government rescue to avoid failure) of several large, established financial firms. Since then, financial conditions have improved but have not completely returned to normal.

Top 13 Interesting Facts Of Global Financial Crisis

Foreign and Domestic Debt Crises-Theories on foreign debt crises and default are closely linked to those explaining sovereign lending. Absent “gun-boat” diplomacy, lenders cannot seize collateral from another country, or at least from a sovereign, when it refuses to honor its debt obligations.

Banking Crises-Banking crises are quite common, but perhaps the least understood type of crisis. Banks are inherently fragile, making them subject to runs by depositors. Moreover, problems of individual banks can quickly spread to the whole banking system.

REAL AND FINANCIAL IMPLICATIONS OF CRISES-Macroeconomic and financial consequences of crises are typically severe and share many commonalities across various types. While there are obviously differences between crises, there are many similarities in terms of the patterns macroeconomic variables follow during these episodes.

Financial Effects of Crises-Crises are associated with large downward corrections in financial variables. A large research program has analyzed the evolution of financial variables around crises. Some of the studies in this literature focus on crises episodes using the dates identified in other work, others consider the behavior of the financial variables during periods of disruptions, including credit crunches, house, and equity price busts.

Response to crisis-In the wealthy countries the discussion on how to deal with the global financial and economic crisis marginalized the developing countries and their needs. At all events, the impact of the crisis on the poor countries did not hit the headlines the way bank bailouts and toxic securities did.

International Initiatives- The same ever-recurring themes run like a red thread through the international initiatives to deal with financial and economic crises, although they may be weighted differently or even run in the opposing direction.

Currency crisis-A currency crisis, also called a devaluation crisis, is normally considered as part of a financial crisis. For instance, define currency crises as occurring when a weighted average of monthly percentage depreciations in the exchange rate and monthly percentage declines in exchange reserves exceeds its mean by more than three standard deviations.

International financial crisis-When a country that maintains a fixed exchange rate is suddenly forced to devalue its currency due to accruing an unsustainable current account deficit, this is called a currency crisis or balance of payments crisis. When a country fails to pay back its sovereign debt, this is called a sovereign default.

Increased government spending-Governments increased its spending to stimulate demand and support employees throughout the economy; guaranteed deposits and bank bonds to shore up confidence in financial firms; and purchased ownership stakes in some banks and other financial firms to prevent bankruptcies that could have exacerbated the panic in financial markets.

World Bank policies and measures-The World Bank rapidly became an important advocate for the developing countries in overcoming the financial crisis. It was soon patent that the poorest countries, already depleted by the food and energy crisis, had few possibilities of providing the necessary responses from their own resources.

Response to crisis-In the wealthy countries the discussion on how to deal with the global financial and economic crisis marginalized the developing countries and their needs. At all events, the impact of the crisis on the poor countries did not hit the headlines the way bank bailouts and toxic securities did.

Oil Sector-The global financial crisis occasioned a credit freeze which led to declining consumer and industrial demand in Nigeria. As a result demand for crude oil, as well as crude oil price, fell drastically.

Industrial sector-Another Sector that was hit by the crisis is the industry. The devastating impact of the global financial crisis hit the country in the second half of 2008.