Introduction

A cryptocurrency is a digital currency that can be used to purchase goods and services but uses an online ledger with strong cryptography to secure online transactions. This makes it nearly impossible to counterfeit or spend double.

- The term “cryptocurrency” is derived from the word encryption techniques that are used to secure networks.

DO YOU KNOW

Encryption technique: It is the method by which information is converted into a secret code that hides the true meaning of the information.

It is a digital form of payment that can be exchanged for goods and services online.

Cryptocurrencies do not exist in physical form and are usually not issued by a central authority because their decentralized structure allows them to remain outside the control of governments and central authorities.

Cryptocurrencies have the ability to hold value and cannot be inflated by central banks that want to print money. It is also very difficult to counterfeit because of the blockchain ledger system that manages the currency.

The main interest behind these unregulated digital currencies is to trade for profit, with speculation about the future sometimes causing prices to skyrocket.

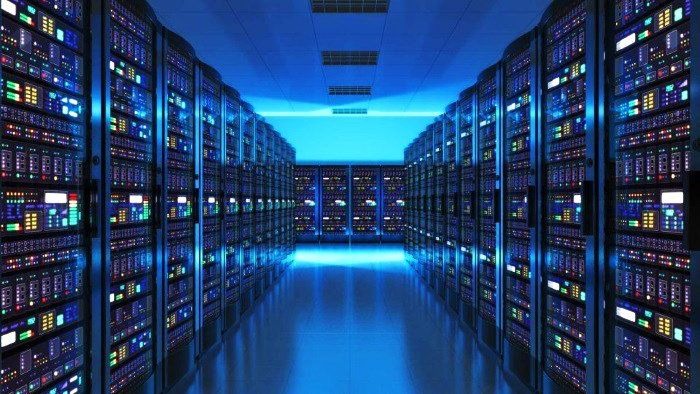

Cryptocurrencies work using a technology called a blockchain.

DO YOU KNOW

Blockchain: Blockchain is a system of recording information in a way that makes it difficult or impossible to alter, hack or spoof the system.

- Cryptocurrencies are easy to transfer money directly between two parties, without the need for a trusted third party such as a bank or credit card company. Instead, these transfers are secured using public keys and private keys, and a variety of incentive systems, such as proof of work or proof of stake.

DO YOU KNOW

- Public Key: User’s “wallet,” or account address.

- Private Key: Known only to the owner and used to sign the transactions.

- Cryptocurrencies can be easily converted into regular currencies like euros or dollars. One can also buy cryptocurrency through a payment app like PayPal or CashApp.

History

In the year 1983, American cryptographer David Chaum conceived an anonymous cryptographic electronic money called “eCash”.

In the year 1995, they implemented this through DigiCash, an early form of cryptographic electronic payment that required user software to withdraw notes from a bank and also specify a unique encrypted key before it was sent to the concerned recipient.

In the year 1996, the United States National Security Agency (NSA) published a paper titled How to Make a Mint: The Cryptography of Anonymous Electronic Cash, which described a cryptocurrency system. It first appeared on the MIT mailing list and later it was published in the Review of American Law in 1997.

In the year 1998, Wei Dai published a description of “B-Money”, which was described as an anonymous, distributed electronic cash system. Shortly thereafter, Nick Szabo described BitGold and other cryptocurrencies that would follow, describing BitGold as an electronic currency system requiring users to have a cryptographically secure solution.

Till that time, B-money was never deployed as a means of exchange.

The late 1990s and early 2000s saw the rise of more conventional digital finance intermediaries.

But no true cryptocurrency emerged until the late 2000s when Bitcoin came onto the scene.

In 2009, the so-called Satoshi Nakamoto, a man whose identity is still a secret, created the first decentralized cryptocurrency, bitcoin. Satoshi Nakamoto was not the first person who came up with the idea of making it. The intention behind this was to create a new method of payment that could be used internationally, decentralized, and without a financial institution behind it.

In April 2011, Namecoin was created as an attempt to create a decentralized DNS (Domain Name System) that would make Internet censorship very difficult.

In October 2011, Litecoin was released. It used the script instead of SHA-256 as its hash function. Another notable cryptocurrency, Peercoin, uses a proof-of-work hybrid.

On 6 August 2014, the UK announced that its Treasury had been appointed to study cryptocurrencies, and what role they could play in the UK economy. The study was also meant to report whether regulation should be considered.

In June 2021, El Salvador became the first country to accept bitcoin as legal tender, when the Legislative Assembly voted 62-22 to pass a bill by President Nayib Bukele classifying the cryptocurrency.

DO YOU KNOW

Tokens, cryptocurrencies, and other types of digital assets that are not bitcoin are known as alternative cryptocurrencies or Alt Coins.

Architecture

DO YOU KNOW

In centralized banking and economic systems such as the Federal Reserve System, corporate boards or governments control the money supply by printing units of fiat money or by creating additional demand in digital banking ledgers.

In decentralized cryptocurrency, companies or governments cannot produce new units and have not so far provided backing for other firms, banks, or corporate entities which hold asset value measured in it. The underlying technical system upon which decentralized cryptocurrencies are based was created by Satoshi Nakamoto (a man whose identity is still a secret).

As of May 2018, over 1,800 cryptocurrency specifications existed. In cryptocurrency systems, the safety, integrity, and balance of ledgers are maintained by a community of mutually distrustful parties known as miners.

DO YOU KNOW

Miners: Those who use their computers to help validate and timestamp transactions and add them to the ledger according to a special timestamping scheme.

- Most cryptocurrencies are designed to gradually reduce the production of currency, placing a cap on the total amount of currency that will ever be in circulation. Compared to normal currencies held by financial institutions or held as cash, cryptocurrencies can be more difficult to seize by law enforcement.

Block Chain :-

Blockchain is a system of recording information in a way that makes it difficult or impossible to alter, hack or spoof the system.

The validity of each cryptocurrency coin is provided by a blockchain. A blockchain is an ever-growing list of records, called blocks.

Blocks are connected and secured using cryptography.

Each block usually contains a hash pointer in the form of a link to the previous block, timestamps, and transaction data.

By design, blockchains are inherently resistant to modification of data. It is “an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent manner”. For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network that follows a protocol to collectively validate new blocks. Once recorded, the data in any block cannot be retroactively changed without the change of all subsequent blocks, which requires the collusion of the network majority.

Nodes :-

- In cryptocurrency, a node is a computer that connects to a cryptocurrency network. Node supports networks of relevant cryptocurrencies in two ways:

(a) Relaying transactions, verification,

(b) Hosting a copy of the blockchain.

In relaying transactions, each node has a copy of the cryptocurrency’s blockchain. When any transaction is created, the node creating the transaction sends a transaction using encryption to other nodes in the entire node network and transmits the details of the transaction so that the transaction is known.

Node owners are either volunteers or those who are tempted to host nodes in order to receive rewards from hosting the node network.

Timestamping :-

Various timestamping schemes are used by cryptocurrencies to “prove” the validity of transactions added to the blockchain ledger without the need for a trusted third party.

The first timestamping scheme invented was the proof-of-work scheme. The most widely used proof-of-work schemes are based on SHA-256 and scripts.

Some other hashing algorithms used for proof-of-work include Kryptonite, Blake, SHA-3, and X11.

Proof-of-Stake is another way to secure a cryptocurrency network and achieve distributed consensus by requesting users to show ownership of a certain amount of currency. The scheme is largely coin-dependent and currently does not have a standard form.

Some cryptocurrencies also use a combined proof-of-work and proof-of-stake scheme.

Mining :-

- Mining is the process by which transactions between users are verified and added to the blockchain public ledger. The mining process is responsible for introducing new coins into the existing circulating supply and is one of the key elements that allow cryptocurrencies to operate as a peer-to-peer decentralized network without the need for a third-party central authority.

Wallets :-

A cryptocurrency wallet stores the public and private “keys” which can be used to receive or spend the cryptocurrency.

A digital wallet is a computer with software hosting wallet information, using an exchange where cryptocurrency is traded or by storing wallet information on a digital medium such as plaintext.

Types Of Cryptocurrencies

Cryptocurrency is a digital currency that functions as real money but is not managed or governed by any central authority.

Cryptocurrencies work without the involvement of banks, governments, or any agents. However, in most cases, one needs to use digital currency to buy and sell their digital asset.

=> There are different types of cryptocurrencies but they generally fall into one of two categories such as:

- Coins which include Bitcoin and Altcoins.

- Tokens:- Tokens are created and given out through an Initial Coin Offering (ICO). They can be represented as:

=> As of May 2021, there are over 10,500 different types of cryptocurrency. Some of the most commonly used cryptocurrencies are as follows :-

1. Bitcoin

- Bitcoin is a type of digital currency. It is a decentralized digital currency without a central bank or single administrator, which can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. It is also known as “cash for the internet”. Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. Bitcoin has no central authority.

- There is no central server, the bitcoin network is peer-to-peer.

- There is no central storage, the bitcoin ledger is distributed.

- The ledger is public. Anyone can store it on their computer.

There is no single administrator. The ledger is maintained by a network of equally privileged miners.

Anyone can become a miner.

The issuance of bitcoins is decentralized. They are issued as a reward for building a new block. Anyone can create a new bitcoin address without any approval.

Any person can send transactions to the network without any approval and the network only confirms that the transaction is valid.

2. Bitcoin Cash :-

- Bitcoin Cash is a cryptocurrency that is a fork of Bitcoin. It was introduced in the year 2017. Bitcoin cash is one of the most popular cryptocurrencies on the market. The main difference with the original bitcoin is its block size which is 8MB.

3. Litecoin

- Litecoin uses Scrypt in its proof-of-work algorithm, a sequential memory-hard function that requires disproportionately more memory than an algorithm that is not memory-hard.

- Litecoin is a peer-to-peer cryptocurrency and open-source software project released under the MIT/X11 license. It is used in much the same way as bitcoin, and it functions in practically the same way. It was created in 2011 by former Google employee Charlie Lee. Litecoin is different from bitcoin in some ways. The Litecoin network aims to process one block every 2.5 minutes instead of 10 minutes for Bitcoin. This allows Litecoin to confirm transactions much faster than Bitcoin.

4. Ethereum

- Ethereum is a decentralized, open-source blockchain with smart contract functionality. After bitcoin, it is the largest cryptocurrency by market capitalization. Ethereum is the most actively used blockchain.

It has started implementing a series of upgrades called Ethereum 2.0, which includes a transition to proof of stake and aims to increase transaction throughput using sharding. In Ethereum, all smart contracts are publicly stored on each node of the blockchain, which has a cost. Having a blockchain means that it is secure by design and is an example of a distributed computing system with high Byzantine fault tolerance. The downside is that performance issues arise in that each node is computing all smart contracts in real time, resulting in low speed.

5. Ripple

Ripple is a real-time gross settlement system, currency exchange, and remittance network created by US-based technology company Ripple Labs Inc. It was released in the year 2012.

Ripple is built on a distributed open-source protocol and supports tokens representing fiat currency, cryptocurrencies, commodities, or other units of value such as frequent flyer miles or mobile minutes.

The main aim of Ripple is to enable “secure, instant and virtually free global financial transactions of any size with no chargebacks”.

It is more famous for its digital payment protocol than its XRP crypto. This is because the system allows the transfer of money in any form, be it dollars or bitcoin (or others). It claims to be capable of handling 1,500 transactions per second (TPS).

6. Stellar

Stellar focuses on money transfers, and its network is designed to make them faster and more efficient, even across national borders.

It was designed by Ripple co-founder Jed McCaleb in 2014 and is operated by a non-profit organization called Stellar.org.

It aims to help developing economies that may not have access to traditional banks and investment opportunities.

It does not charge users or institutions for using its Stellar network, and covers operating costs by accepting tax-deductible public donations.

7. Tether

Tether is called a Stablecoin because it was originally designed to have a value of $1.00, maintaining a reserve of $1.00 for each Tether issued.

This means that it is backed by fiat currencies such as the US dollar and the euro and hypothetically holds the equivalent value of one of those denominations.

- The value of Tether is considered to be more consistent than that of other cryptocurrencies and is preferred by investors who are wary of the extreme volatility of other coins.

8. Binance Coin

Binance Coin is a cryptocurrency issued by the Binance exchange and trades with the BNB symbol.

It works on the Ethereum blockchain with ERC20 standard but has become the core coin of the Binance series.

It holds a maximum of 200 million BNB tokens.

As of June 2021, Binance Exchange is the largest cryptocurrency exchange in the world, supporting over 1.4 million transactions per second.

9. Cardano ADA

Cardano is a public blockchain platform. It is open-source and decentralized, with consensus achieved using proof of stake.

It can facilitate peer-to-peer transactions with its internal cryptocurrency, ADA.

It also works like Ethereum to enable smart contracts and decentralized applications, which are powered by ADA, its native coin.

It was founded in 2015 by Charles Hoskinson, the co-founder of Ethereum.

It is named after Gerolamo Cardano and the cryptocurrency after Ada Lovelace.

10. Dogecoin (DOGE)

Dogecoin is a cryptocurrency created by software engineers Billy Marcus and Jackson Palmer, who decided to create a payment system as a joke, mocking the wild speculation in cryptocurrencies at the time.

Dogecoin rapidly became a prominent cryptocurrency option.

Dogecoin began with a supply limit of 100 billion coins, which would be far more coins than the top digital currencies of the time. By mid-2015 the 100 billionth Dogecoin had been minted and an additional 5 billion coins were in circulation every year thereafter.

Although there is no theoretical supply limit, at this rate, the number of Dogecoins in circulation will only double in 20 years.

Why are cryptocurrencies so popular?

- A cryptocurrency is a decentralized digital currency that is not issued by a central bank or government. They can be bought and sold through crypto exchanges, where price fluctuations are visible.

=> The reason why the cryptocurrency is so popular is because of some reasons:

- It is easy to transfer.

- It is a popular investment like investing in the stock market.

- It is highly secure.

- Its charges are comparatively low than others.

- Despite the market crash, cryptocurrencies will grow.

- Investing in crypto assets is risky but also potentially very profitable.

Is Investing in Cryptocurrencies a good deal?

Investing in cryptocurrencies is risky but at the same time, it is very profitable. Crypto is a good investment if you want to gain direct exposure to the demand for digital currency, whereas buying shares of companies exposed to cryptocurrency is a safer way.

It is also used for worldwide transactions without paying a large number of fees. Simultaneously, it could potentially revolutionize the banking and financial services industries.

How to buy cryptocurrencies?

Cryptocurrency is a new-age digital currency used to buy online services. Cryptocurrency is a revolution in the financial and banking sector all over the world.

Some cryptocurrencies such as bitcoin, are available to buy with dollars, others require that you pay with bitcoin or another cryptocurrency.

To buy cryptocurrency, you need to have a “digital wallet”, which is an online app that can hold your currency.

Normally, you create an account on an exchange, and then you can transfer real money to buy cryptocurrencies.

=> There are certain steps that are as follows:-

- Choose a Crypto Exchange: To buy any cryptocurrency, you’ll need a crypto exchange where buyers and sellers meet to exchange dollars for coins.

- Decide on a payment option: After choosing an exchange, you need to deposit funds into your account before you can start investing. Depending on the exchange, you can fund your account via bank transfer, you can use digital payment methods such as PayPal, wire transfer, a cryptocurrency wallet, or even a credit or debit card.

- Place an order: Once your account is funded, you can place your first order to buy cryptocurrency.

- Select storage location: The crypto exchange you use has an integrated bitcoin wallet or at least a preferred partner where you can keep your bitcoins or any cryptocurrency securely.

- If you want to sell your cryptocurrency, you can place a sell order through your exchange, just like the one you originally bought.

Are cryptocurrencies legal?

Cryptocurrencies are legal in the United States.

China has essentially banned their use.

Not illegal in India, but unregulated.

But El Salvador’s Congress on June 9 approved Bukele’s proposal to embrace the cryptocurrency, making El Salvador the first country in the world to adopt bitcoin as legal tender. In El Salvador, if someone receives payment in bitcoin, they can automatically choose to receive it in dollars,”

And ultimately whether they are legal or not is up to each individual country to consider cryptocurrencies.

Are cryptocurrencies real?

Cryptocurrency is software-based digital money. Your token represents a specific amount of cryptocurrency owned by you based on the current market value.

You can sell that token, or you can redeem it at market value.

Cryptocurrency is decentralized in nature.

You exchange cryptocurrency with anyone online, usually with your phone or computer, without using an agent or a middleman such as a bank.

Bitcoin and Ether are well-known cryptocurrencies, but there are many different cryptocurrency brands, and new ones are constantly being created.

As of May 2021, there are over 10500 cryptocurrencies.

Which cryptocurrencies are best to invest in 2021?

=> According to market cap, the top 10 best cryptocurrencies to invest in the year 2021 are as follows:-

| Name of the cryptocurrencies | Its market capitalization |

| Bitcoin (BTC) | Over $641 billion |

| Ethereum (ETH) | Over $307 billion |

| Tether (USDT) | Over $62 billion |

| Binance Coin (BNB) | Over $56 billion |

| Cardano (ADA) | Over $51 billion |

| Dogecoin (DOGE) | Over $44 billion |

| XRP | Over $40 billion |

| USD Coin | Over $23 billion |

| Polkadot (DOT) | Over $21 billion |

| Uniswap (UNI) | Over $13 billion |

Advantages and Disadvantages of Cryptocurrency?

| Advantages Of Cryptocurrencies | Disadvantages Of Cryptocurrencies |

| A faster way to transfer funds. | Some coins are not available in other fiat currencies. |

| Cost-effective mode of transaction. | Susceptible to hacks |

| Currency exchanges can be done easily. | No refund or cancellation policy |

| Highly secure and private. | Data losses can cause financial losses. |

| Protection from inflation. | Used for illegal transactions. |

| Self-governed and manageable. | Decentralized but still operated by some organizations. |

| Potential for high returns | High volatility and potential for large losses |

| Protection From Payment Fraud | Black market activity |

| Immediate Settlement, International Transactions. | Unbacked, Cyber hacking |

Cryptocurrencies in India?

Cryptocurrency is not illegal in India. India does not yet have any regulatory framework to govern cryptocurrencies. The government had constituted an Inter-Ministerial Committee (IMC) on 2 November 2017, to study cryptocurrencies. The Group’s report along with the draft bill marked the positive side of distributed-ledger technology and suggested various applications for its use in India, particularly in financial services, including by banks and other financial firms.

However, the Center had objected to its misuse and wanted a complete ban in India. According to the latest reports, cryptocurrencies may not face a complete ban in India. The Center may soon set up a panel to regulate cryptocurrency. The decision was taken after several cryptocurrency exchanges urged the Center to ban virtual coins rather than regulate them.

The Government of India has decided to introduce the Cryptocurrency and Regulation of Official Digital Currency Bill in Parliament. Information about this bill is not yet public.

This bill will legally control the use of cryptocurrency in India.

The world is watching every move of India on cryptocurrency. If this bill is introduced in the next session of Parliament, it will be closely watched by investors.

Union Finance Minister Nirmala Sitharaman has made it clear that the government does not plan to ban cryptocurrency completely. In fact, the government wants to protect blockchain technology based on cryptocurrency.

Top 13 Interesting Facts About Cryptocurrency

Cryptocurrency can’t be physically banned.

China is the biggest cryptocurrency miner.

Cryptocurrency is taxable.

As of April 2021, there are around 10,000 cryptocurrencies.

The person or organization that created the ‘bitcoin’ is still unknown.

Cryptocurrencies have no fundamental backing.

If you lose your bitcoin address, also known as your private key, it not only means losing your unique identity, but it also means losing all the bitcoins in your wallet.

Ethereum is the second most popular and valuable cryptocurrency after bitcoin.

StormGain is not only the most effective crypto trading tool on the market.

Cryptocurrencies are not expensive.

The value of cryptocurrency is real as rupees.

Cryptocurrencies are easy to transfer money between two parties directly, without the need for a trusted third party.

Cryptocurrencies work using a technology called a blockchain