- Advertisement -

Latest data available with global agency IWSR shows that nearly two-thirds of the spirits sales in India is accounted for by whiskey. Within that, 85% of the market is controlled by 10 home-grown brands at the lower end of the price spectrum.

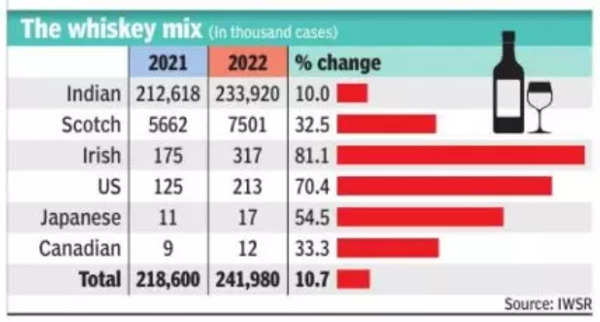

The share of imported whiskey is estimated at 3.3% of the pie and is projected to rise to 3.7% of the whiskey market in 2027. The numbers suggest that even with a projected 3.8% growth over the next five years, Indian-made whiskey will control over 96% of the market.

The latest numbers indicate that the business is back on track, having overcome the Covid-19 shock, with Vodka making a strong comeback with a 34% jump in sales, driven by flavours (see graphic).

India is the world’s fifth largest market for alcoholic beverages with overall size pegged at around $53 billion, and the consumption at home is expected to drive volumes over the next five years. Ready-to-drink beverages have emerged as the fastest growing segment, clocking near 40% surge last year, and expected to expand at double-digit rates even over the next five years. Wine — where nearly a fifth is made up through imports — will be the next fastest (6.6% projection), followed by spirits (3.7%) and beer (2.7%), according to IWSR.

While there are no estimates available, imported wine from countries such as Australia and the European Union may have a bigger share of the pie due to the free trade agreements. In whiskey — where the UK is seeking tariff cuts — the domestic industry will be the key driver.

This is despite some of the imported whiskeys seeing a rapid rise, although it has come over a small base.

“There is a growing trend of new whiskeys being explored by Indian consumers. While scotch leads, the new players on the table are Irish, US, Japanese and Canadian whiskies. And of course, Indian Single Malts too,” said Nita Kapoor, CEO, International Spirits & Wines Association of India.