Exchange protectionism is reappearing as a disputable strategy among policymakers and market analysts in improving a country’s monetary prosperity. Exchange protectionism has been utilized with the aim of assisting a country with recuperating from a financial slump. Nonetheless, on many occasions, the contrary impact happened in which one, as well as numerous countries, experienced monetary misfortunes like a downturn or even a downturn. To comprehend exchange protectionism, it is important to know why it is done and what the impacts are on an economy.

New associations moreover will undoubtedly invest assets into creative effort (R&D), which is fundamental to aiding money-related advancement rates. Overall utilization of R&D as a degree of GDP stays at 2.29 percent, yet India spends under 0.63 percent.

- Advertisement -

New associations, whether in medications or development, have shown that they will place assets into R&D. In 1998 IBM set up an investigation lab in India and General Electric’s greatest assessment lab outside of the U.S. is in India.

India has long searched for autonomy in the monetary field, yet it has routinely come close to protectionism. Attempting to build your own brands and ensuring that your local associations are not gotten out by new competition is a decent goal. Hindering challenges inside the Indian market and using rules to help local associations isn’t the strategy for building an overall economy. Swapping scale controls that cause long haul expansion since the homegrown country has kept the worth of its money low. By having its money decline in esteem so it can sell its items and merchandise at less expensive costs in unfamiliar business sectors, any unfamiliar items sold in its market will really see costs increment. Customers will be compelled to follow through on greater expenses for merchandise, items, and wares they need to make due. The issue is that a country might have an honest goal of assisting its ventures with being serious abroad while its residents follow through on greater expenses at home.

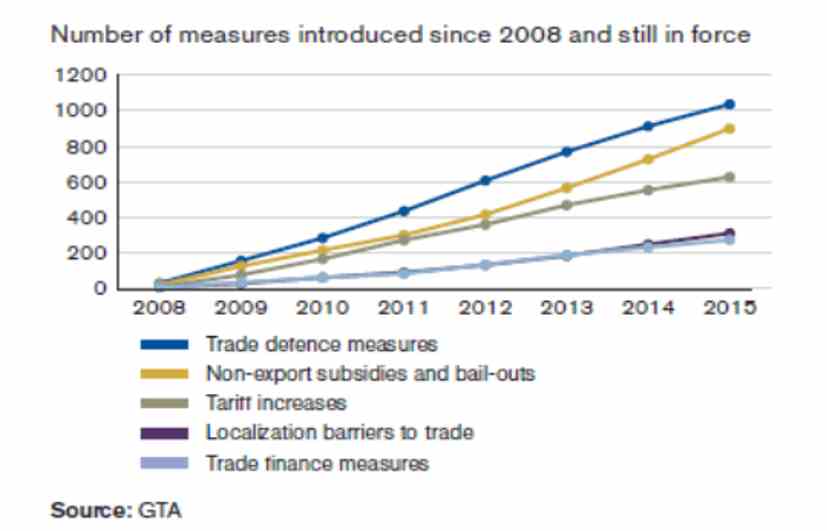

An exchange battle among countries. A difficult issue with exchange protectionism is that countries will make a proportional move assuming there are exchange insurance approaches put into impact. The issue here is that countries will fight back in the event that they can’t sell their merchandise and items in business sectors where they regularly could. Regardless on the off chance that those countries are political and military partners, countries will force balancing levies, amounts, appropriations, and conversion standard controls, to give some examples, to manage another country’s activities. For instance, the United States and Japan, long-term partners, both strategically and militarily since the finish of World War II, have conjured taxes and authoritative exchange arrangements against one another. This has wound up costing the buyers of the separate nations billions of dollars in inflated expenses and restricted purchaser decisions. An exchange war will eventually mean expanded import costs as makers and makers should pay something else for gear, items, and moderate items from unfamiliar business sectors. This will likewise influence a country’s genuine GDP development. As per a review by the International Monetary Fund (IMF), a long-lasting 10% increment in American duties on imports from all pieces of the globe will bring about a long-lasting 1% lessening in genuine GDP. The most popular exchange war response that happened throughout the entire existence of the United States was the Smoot-Hawley Act in June of 1931. Here, President Herbert Hoover marked a tax charge that increased government rates on numerous horticultural items and products causing counter by different countries. While the demonstration was expected to safeguard American organizations and enterprises, it expanded levies by a normal of 20% on in excess of 20,000 imported items and merchandise. This eventually made worldwide exchange drop by 67% and American commodities to fall as much as 75%. The primary impact of protectionism is a decrease in exchange, more exorbitant costs for certain merchandise, and a type of sponsorship for safeguarded businesses. A few positions in these enterprises might be saved, however, occupations in different ventures are probably going to be lost.

- Advertisement -