Even as India’s Apple iPhone manufacturing capabilities are swiftly approaching China’s levels, the country’s contribution to Apple’s global revenue remains significantly lower, primarily due to consumer affordability constraints.

Indian manufacturing facilities produced 14-15% of Apple’s total iPhone output in FY24. Industry analysts project this share to expand to 26-30% by 2027. Currently, India stands as Apple’s sole iPhone manufacturing alternative to China, with Greater China encompassing Mainland China, Hong Kong, Macau and Taiwan.

Predictions indicate India’s iPhone production volumes could match China’s within five years. However, achieving comparable revenue contributions to Apple’s global operations could take 10-15 years.

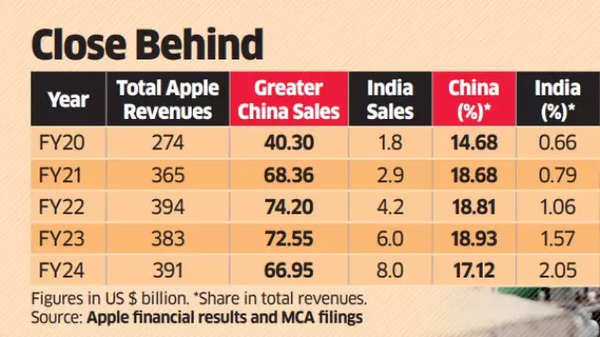

Apple achieved a record $8 billion in revenue from India in FY24, but this represented just above 2% of its global revenue of $391 billion. In contrast, Greater China generated $66.95 billion, accounting for more than 17%. Projections suggest Apple’s India revenue could reach $11 billion by FY26, following the company’s October-September fiscal calendar.

Apple India vs China

In FY20, China’s contribution to Apple’s total revenue stood at 14.68%, whilst India accounted for 0.66%. Apple’s India revenue includes sales across its product range, including iPhones, MacBooks, iPads and services, although local manufacturing figures are not included in Apple India‘s accounts.

Industry experts informed ET that Apple’s 2020 decision to establish manufacturing in India aimed to diversify production amidst US-China tensions and develop an export hub, despite awareness of limited domestic market potential due to lower per capita income.

Apple has emerged as the pioneering global value chain to establish India as its export centre. An official monitoring Apple’s progress under the government’s smartphone PLI scheme stated, “Currently, 70% of iPhones are exported and this figure would rise to 80-85% soon as capacity ramps up.”

Also Read | Fastest manufacturing growth in 50 years? Apple’s India business surpasses Rs 2 lakh crore; tech giant India’s largest global value chain

Whilst other international phone makers like Samsung from South Korea and Chinese companies Xiaomi, Oppo, and Realme focus mainly on domestic market production, Samsung stands as India’s second-largest smartphone exporter after Apple, exporting 30-35% of its local production.

Industry experts note that despite India’s substantial market potential, its lower per capita income affects Apple’s revenue growth.

For context, China’s per capita income is five times higher than India’s, making it Apple’s second-biggest iPhone market after the US. According to industry data, Apple’s production in India from April to October 2024 exceeded $9 billion, with exports reaching nearly $7 billion, setting a company record in India.

In India’s mobile phone market, which ranks second globally, iPhones maintain a modest 6-7% share of the total smartphone market. The remaining 94% consists of Android platform devices from competitors like Samsung, Oppo, Vivo and Xiaomi, alongside some domestic brands.

An analyst observed, “This gives Apple a long runway to increase the size of its domestic sales and market share.” India predominantly focuses on iPhones, although Apple’s MacBook laptops have performed well in FY24. Whilst iPhones constitute about 52% of Apple’s global revenue at $201.1 billion, industry specialists indicate that in India, iPhone sales make up 65-70% of Apple’s revenue.