Teenage users of the Facebook app in the US had declined by 13% since 2019 and were projected to drop 45% over the next two years, driving an overall decline in daily users in the company’s most lucrative ad market. Young adults between the ages of 20 and 30 were expected to decline by 4% during the same timeframe. Making matters worse, the younger a user was, the less on average they regularly engaged with the app. The message was clear: Facebook was losing traction with younger generations fast.

The “aging up issue is real,” the researcher wrote in an internal memo. They predicted that, if “increasingly fewer teens are choosing Facebook as they grow older,” the company would face a more “severe” decline in young users than it already projected.

- Advertisement -

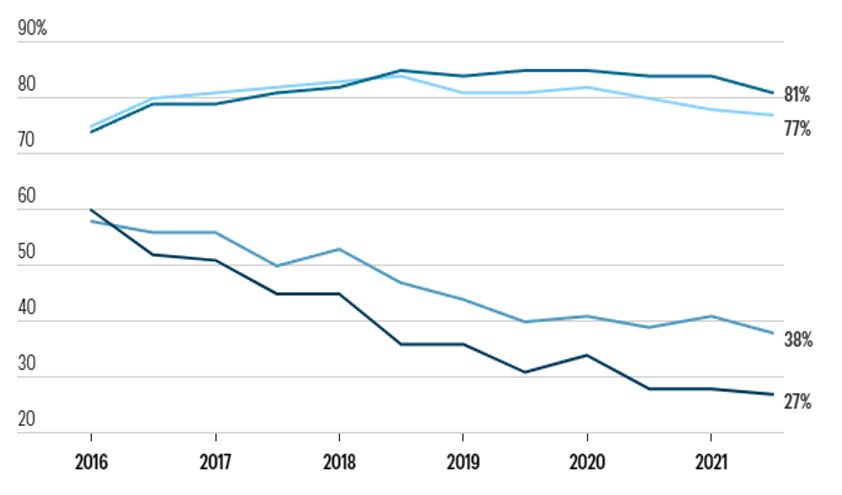

Yet only 2% of teens rate Facebook as their favorite social media platform, according to the latest Taking Stock With Teens survey released earlier this month. In fact, Facebook’s reign continues to decline. Facebook usage among teens has dropped from about 60% using it at least once a month in spring of 2016 to 27% of those surveyed using it monthly in fall 2021. Overall, Piper Sandler found that teens spend an average of 4.2 hours per day on social media.

Facebook’s own research, based on the leaked documents, seems to confirm this: The time U.S. teens spend on Facebook was down 16% year over year, and fewer young adults are signing up for the platform.

Instagram and Snapchat are posing a threat to Facebook’s stronghold. As Facebook recedes, Instagram and Snapchat popularity are creeping up. For example, while Instagram was the most used social media brand by just 7% of respondents in 2015, that percentage has more than doubled to 16% this year.

- Advertisement -

To start, Facebook has started converging its various products and its messaging functionality. This will unify their underlying infrastructure as well as institute end-to-end encryption across all these apps – but for marketers wondering how this will affect their plans, change is unlikely to come until next year.

Turning back to the usage stats, last year’s Infinite Dial report showed that the decline in Facebook usage was due to lower use in the 12-34 age bracket. The same holds true this year. Facebook usage among this bracket decreased another 5% points to 62%. Among Americans ages 35-54 Facebook usage has flattened out at 69% and, interestingly, usage amongst the age group 55 and older actually increased from 49% in 2018 to 53% in 2019Furthering the evidence that Facebook is losing ground with 12-34-year-olds, the survey revealed that 29% of this age group use Facebook most often compared to the other social media brands — half the percentage (58%) from 2015. Instagram’s popularity, on the other hand, is growing: this year 26% of 12-34-year-olds count the image-focused platform as their most-used, up from 15% in 2015.

For deep details, you can read the full article. Click the link below :